Neurocrine Biosciences Inc (NASDAQ:NBIX) Screened as a Strong Growth Stock with Bullish Technical Setup

Neurocrine Biosciences Inc (NASDAQ:NBIX) has recently appeared as a candidate through a screening method that mixes technical and fundamental analysis. This process finds stocks showing solid growth features, such as accelerating revenue and earnings, while also showing positive technical patterns that indicate possible breakout momentum. The method stresses the value of both quantitative financial wellness and chart activity, trying to find equities that are not only sound in their foundation but also set for near-term price gains. By merging these fields, investors try to match basic business health with market timing, possibly bettering the chances of good growth-focused investments.

Fundamental Strength and Growth Metrics

Neurocrine’s fundamental profile shows why it qualifies as an interesting growth stock. The company works in the biotechnology field, concentrating on neurological and neuropsychiatric disorders, a specialized but growing market with major unmet needs. According to its fundamental analysis report, Neurocrine scores well across several important areas:

-

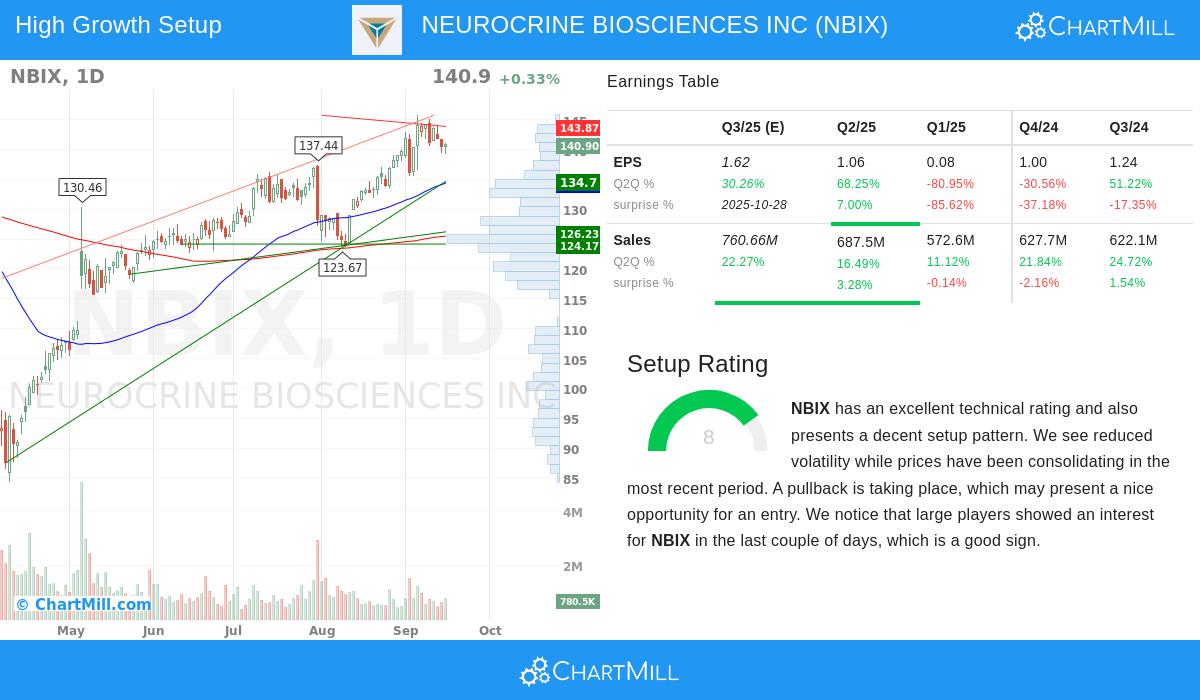

Growth Rating of 8/10: The company has shown solid historical performance, with revenue growing at an average of 24.48% over recent years and expected future EPS growth projected at 36.54% yearly. This speeding up matches the central idea of growth investing, which focuses on companies moving faster than their industry and the wider market.

-

Profitability Rating of 8/10: Neurocrine keeps up good margins, including a profit margin of 13.88% and an operating margin of 19.89%, each ranking above 93% of industry peers. High profitability points to efficient operations and the ability to put money back into more growth, a sign of successful growth equities.

-

Financial Health Rating of 7/10: The company carries no debt, supported by a good current ratio and solid liquidity. This financial steadiness lowers risk and gives room to fund research, development, and commercial growth without taking on too much leverage.

These measures are vital within the growth investing model because they show a company’s ability to maintain expansion, create new things within its market, and keep competitive benefits, factors that add to long-term outperformance.

Technical Setup and Breakout Potential

From a technical view, Neurocrine is showing patterns that often come before major price moves. The technical analysis report points out several positive signals:

- The stock is now in a bull flag pattern, which usually forms after a solid upward move and hints at consolidation before a possible continuation of the trend.

- Both short-term and long-term trends are positive, with price action holding above important moving averages (including the 50-day and 200-day SMAs), showing continued investor confidence.

- Important resistance levels are found near $141.66,$143.87, with a breakout above this zone possibly starting more upward momentum.

This technical position is significant because it matches price behavior with basic fundamental strength. For growth investors, timing entries during consolidations or breakouts can improve returns by using momentum phases while depending on fundamental quality to back the investment thesis.

Alignment with Growth and Momentum Strategy

Neurocrine’s mix of solid fundamentals and positive technicals makes it a notable example of the strategy’s goals. The company’s focus on neuroscience therapeutics places it in a growth industry where new ideas push expansion, and its lack of debt shows careful financial management. At the same time, the technical setup suggests that market players are starting to see this potential, as seen in recent price action and volume patterns.

Investors using this merged approach search for such alignments: fundamental measures that indicate future growth, along with technical signs that point to growing market recognition. This double check can help filter out companies with strong stories but poor price momentum, or the opposite.

Explore Similar Opportunities

For readers interested in examining other stocks that meet these conditions, more results can be found using the Strong Growth Stocks with Good Technical Setup Ratings screen. This tool actively finds companies showing good growth, profitability, and technical patterns, providing a useful resource for more research.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation, risk tolerance, and investment objectives before making any decisions.