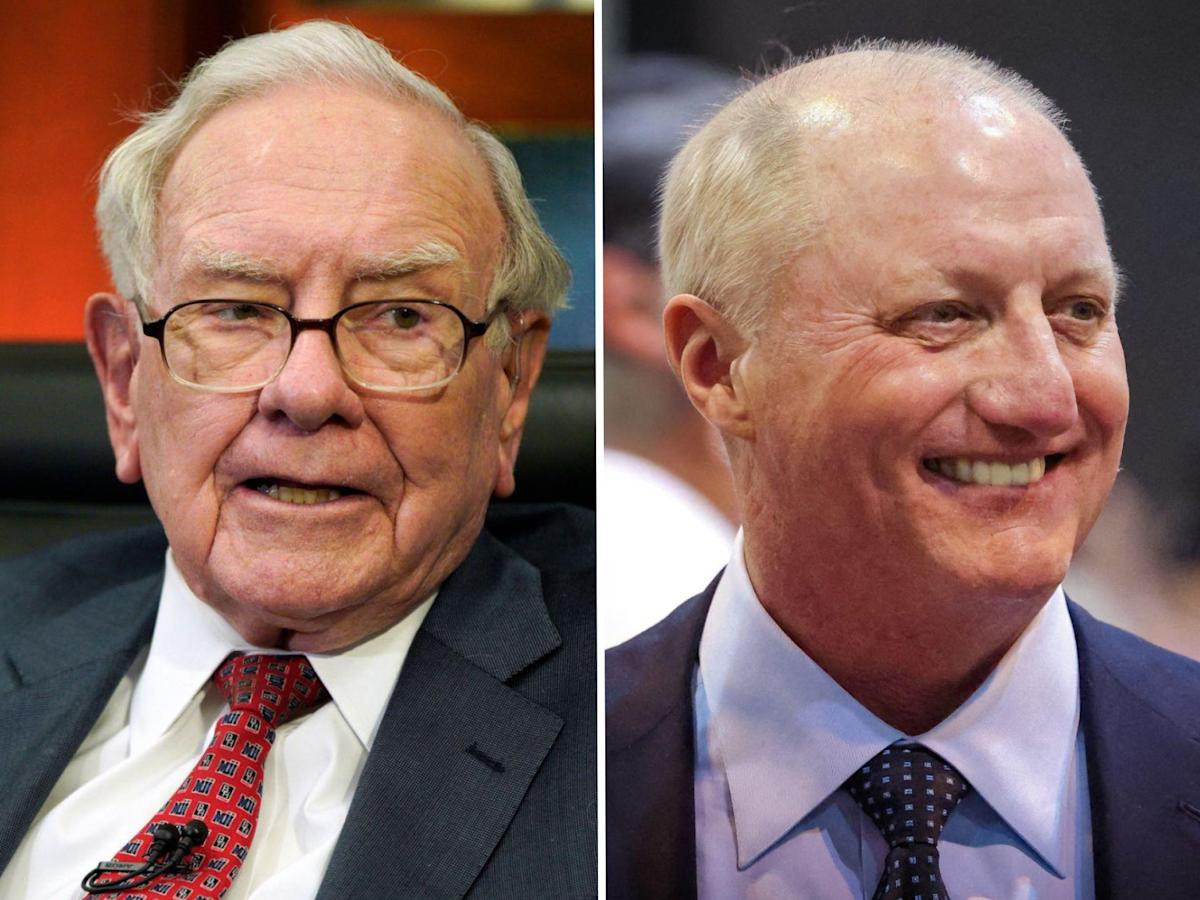

Warren Buffett is famous while Greg Abel is virtually unknown. Here’s what Berkshire’s new CEO has shared about himself.

-

Warren Buffett is famous, while Berkshire Hathaway’s new CEO, Greg Abel, is barely known.

-

Business Insider reviewed Abel’s past comments to better understand who he is and how he leads.

-

Abel reads a lot, coaches sports, and hews closely to Buffett’s investing approach.

Warren Buffett is a world-renowned investor and business icon, famous for everything from his folksy wisdom and vast fortune to his frugal habits and love of junk food.

Greg Abel, who took over as Berkshire Hathaway’s CEO on January 1, has virtually zero public profile by contrast. Whereas Buffett has partied with Jay-Z, stumped for Hillary Clinton, and appeared on “The Office,” few people outside the financial world have even heard of Abel.

Buffett’s successor has reserved his commentary in recent years for Berkshire’s annual shareholder meetings. Business Insider reviewed those Q&A sessions to gain a better sense of who Abel is and how he plans to lead — and found a private person who fully embraces Buffett’s teachings and seems unlikely to rock the boat.

Abel joined Berkshire in 2000 when Buffett acquired MidAmerican Energy, and rose from the subsidiary’s CEO to become vice-chairman of Berkshire’s non-insurance businesses in 2018. He began appearing on stage with Buffett starting in 2020.

Prior to last year’s meeting, Abel largely limited his input to discussing subsidiaries such as Berkshire Hathaway Energy and the BNSF Railway, and weighing in on hot topics such as the clean-energy transition.

Abel has frequently echoed Buffett, emulated the investor by praising his employees and lieutenants, championed Berkshire’s culture, and talked up its businesses.

He’s described Berkshire as a “very special company” because it treats its shareholders as partners and its business managers act as owners, saying “that’s never going to change.”

Abel has said he’ll invest like Buffett by staying within his “circle of competence,” treating every stock purchase as if he’s buying a piece of a business for the long term, valuing companies based on what they’re likely to be worth in 10 or 20 years and relative to the risks they face, and having patience and discipline at all times.

“It’s important to know that the capital allocation principles that Berkshire lives by today will continue to survive, Warren,” he said during the 2024 meeting.

Abel has underscored that, like Buffett, he’ll be ready to pounce during periods of turmoil. He said last year that onlookers should “never underestimate the amount of reading and work that’s being done to be prepared to act quickly,” adding that a “large part of being patient” is “using the time to be prepared.”

Leave a Comment

Your email address will not be published. Required fields are marked *