Crypto Firms Buoyed by Trump Get Rocked as US Bill Delayed

(Bloomberg) — The unbridled optimism that permeated the crypto industry during Donald Trump’s first year back in power is giving way to angst, after a much-awaited digital-asset bill was delayed in the Senate amid frenzied debate over the treatment of stablecoins.

The Senate Banking Committee on Wednesday delayed its discussion of the bill, hours after Coinbase Global Inc. pulled its support for the latest version. Among elements of the bill Coinbase and other firms are lashing out against are limits on their ability to offer yield or rewards on customers’ stablecoin holdings.

Most Read from Bloomberg

Stablecoins are a key pillar of the cryptoasset universe, and usage is booming after the US passed legislation governing them in July. After their success helping get Trump elected and the stablecoin bill passed, crypto executives now fear the impasse over tokens pegged to the dollar could prevent the US regulatory framework from catching up with other markets.

“This delay is concerning as it creates a probability for the US to be one of the only major digital assets hubs without a clear capital markets rulebook in 2026,” said Dea Markova, director of policy at Fireblocks, a crypto custody services provider.

Shares of Coinbase fell as much as 4%, while Circle Internet Group Inc. and Gemini Space Station Inc. each slipped around 5%.

The latest proposal suggests paying stablecoin yield will be banned, although some types of rewards may be allowed. But the language around exactly what kind of rewards would be permitted isn’t straightforward, according to Nana Murugesan, a former senior executive at Coinbase.

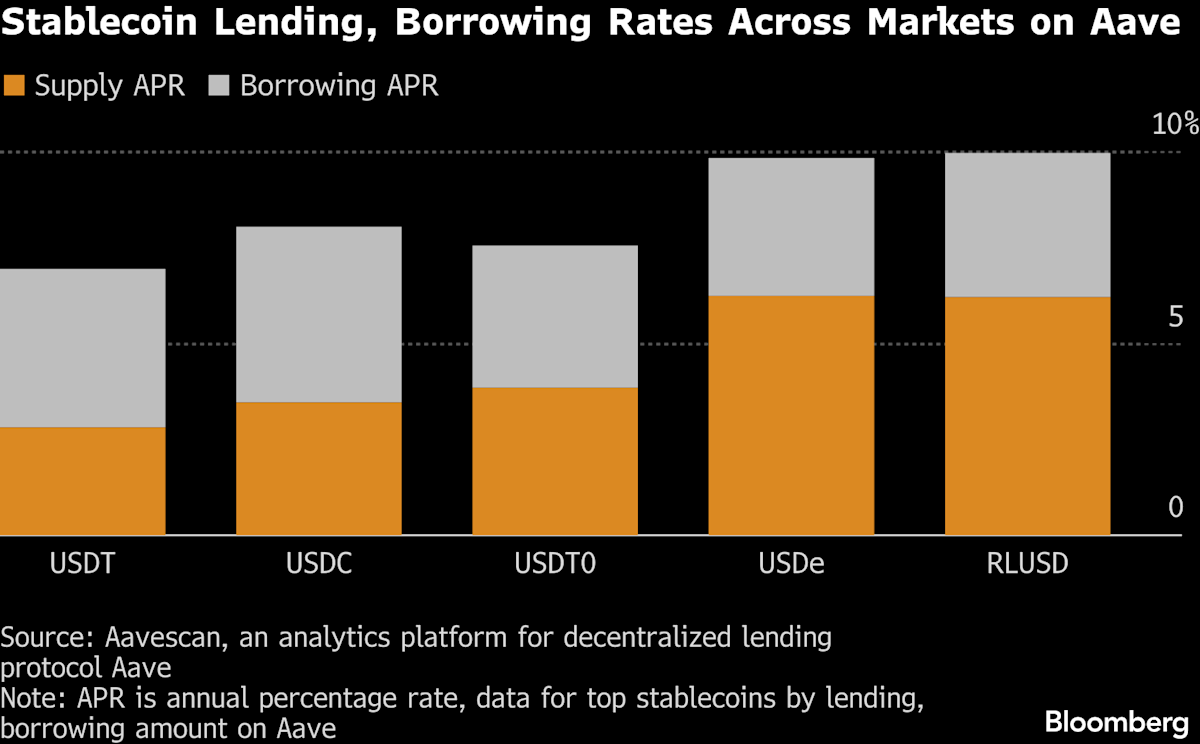

Crypto companies have long enticed users with yield and rewards as a way to motivate them to hold their digital assets for longer, rather than converting them back into fiat currencies. Some tokens, like Ethena’s dollar-pegged USDe, offers yield as a built-in part of their structure.

Coinbase offers rewards to users who hold Circle’s USDC stablecoin in their accounts, akin to the returns traditional savings accounts feature.

“Stablecoin rewards sit at the intersection of payments, savings-like behavior, and market incentives,” said Ari Redbord, global head of policy and government affairs at TRM Labs. That explains why “a narrow technical issue has become a central policy question as the bill moves through markup.”

Leave a Comment

Your email address will not be published. Required fields are marked *