First Solar Inc (NASDAQ:FSLR) Shows Strong Technical Rating and High Setup Quality for Potential Breakout

Technical analysis often relies on identifying stocks with strong underlying momentum that are simultaneously forming consolidation patterns, suggesting potential breakouts. One method for spotting such opportunities involves screening for securities with high technical ratings, indicating good trend health, coupled with high setup quality scores, which signal consolidation and favorable entry points. This approach helps investors focus on names that are not only trending positively but also offering defined risk-reward setups, aligning with disciplined technical strategies.

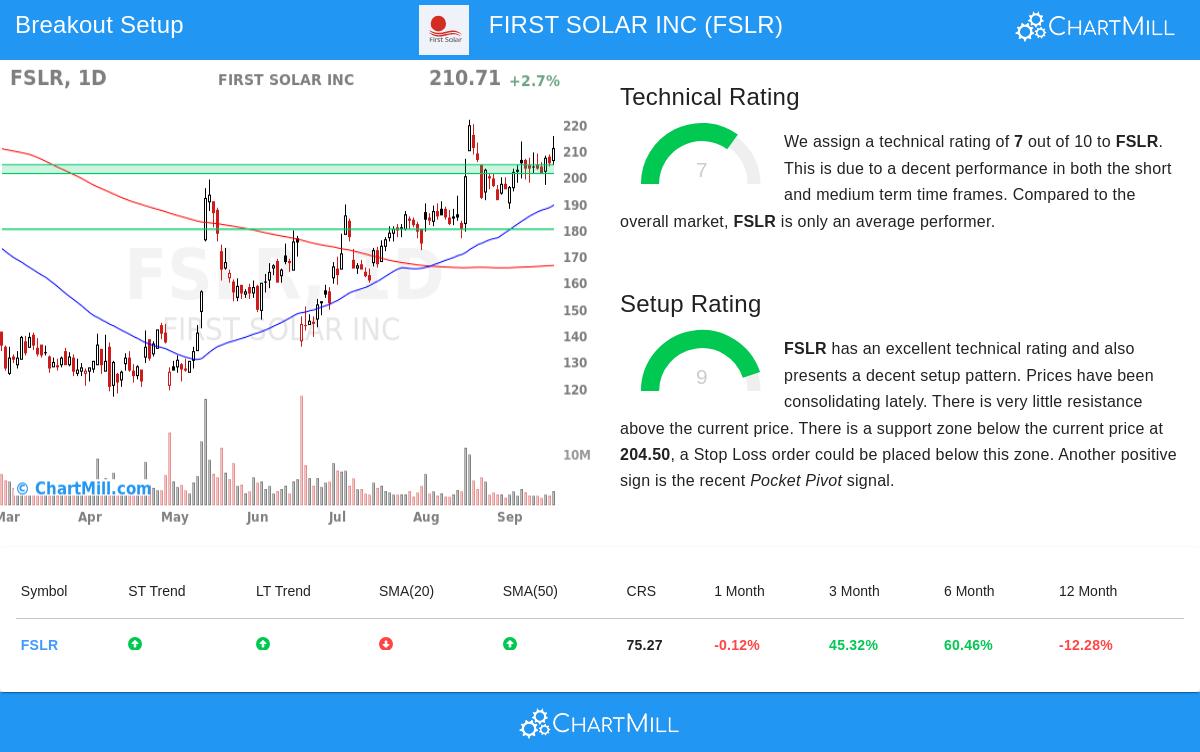

FIRST SOLAR INC (NASDAQ:FSLR) recently surfaced in such a breakout screen, displaying a blend of solid technical foundations and a promising short-term pattern. With the broader S&P500 exhibiting positive trends in both the short and long term, the environment remains supportive for equities demonstrating technical strength.

Technical Rating Strength

The technical rating, which evaluates the overall health and trend quality of a stock, is a cornerstone of this screening methodology. A higher score suggests stronger momentum, better relative performance, and alignment across multiple timeframes, key traits for reducing downside risk and improving the probability of continuation.

First Solar earns a technical rating of 7, reflecting several supportive factors:

- Both its short-term and long-term trends are positive, indicating consistency in buyer interest.

- The stock is trading above key moving averages, including the 50-day, 100-day, and 200-day SMAs, which often act as dynamic support levels.

- It has outperformed 75% of all stocks over the past year, though much of this strength has been concentrated in recent months.

These elements contribute to a profile that suggests the stock is in a healthy uptrend, making it a candidate for further price appreciation if broader conditions remain favorable. For a deeper look into these metrics, readers can review the full technical report.

Setup Quality and Consolidation

While technical strength identifies which stocks to consider, the setup quality score addresses when to consider them. A high setup rating implies the stock is consolidating within a narrow range, decreasing volatility and forming a base from which it can break upward. This allows for precise entry points and well-defined stop-loss levels, improving risk management.

First Solar’s setup rating of 9 highlights exceptional consolidation characteristics:

- Prices have been trading recently between $187.64 and $215.25, with the current price near the upper bound of this range.

- Multiple support zones exist below, notably around $204.50, providing a logical area for stop placement.

- A recent pocket pivot signal, where price advances on higher volume, suggests accumulation, adding conviction to the setup.

This combination implies that the stock is not only technically sound but also poised for a potential breakout above the recent high, offering a clear signal for entry.

Risk and Reward Considerations

Every technical setup must be evaluated in terms of its potential payoff relative to risk. Based on the automated analysis, a breakout above $215.26 could serve as an entry point, with a stop-loss placed below support at $201.12. This defines a risk of approximately 6.57% on the trade, which is reasonable given the stock’s volatility and the overall bullish structure.

It is worth noting, however, that while the technical and setup ratings are good, external factors such as earnings announcements or sector rotation could influence price action. Investors should always incorporate fundamental context and market sentiment into their decisions.

Finding Similar Opportunities

For those interested in exploring other stocks exhibiting similar technical breakout patterns, additional screening results are available through the Technical Breakout Setups screener. This tool is updated daily and can help identify fresh opportunities aligned with current market conditions.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The analysis is based on technical metrics and historical data, which are not guarantees of future performance. Investors should conduct their own research and consider their risk tolerance before making any trading decisions.