Victory Capital (NASDAQ:VCTR) Embodies the Affordable Growth Investment Strategy

Investors seeking growth opportunities often face the challenge of balancing expansion potential with reasonable valuations. The “Affordable Growth” strategy addresses this by identifying companies demonstrating strong growth characteristics while maintaining sound profitability, healthy financials, and attractive valuations. This approach, often referred to as Growth at a Reasonable Price (GARP), helps investors avoid overpaying for growth while still capturing companies with solid expansion prospects.

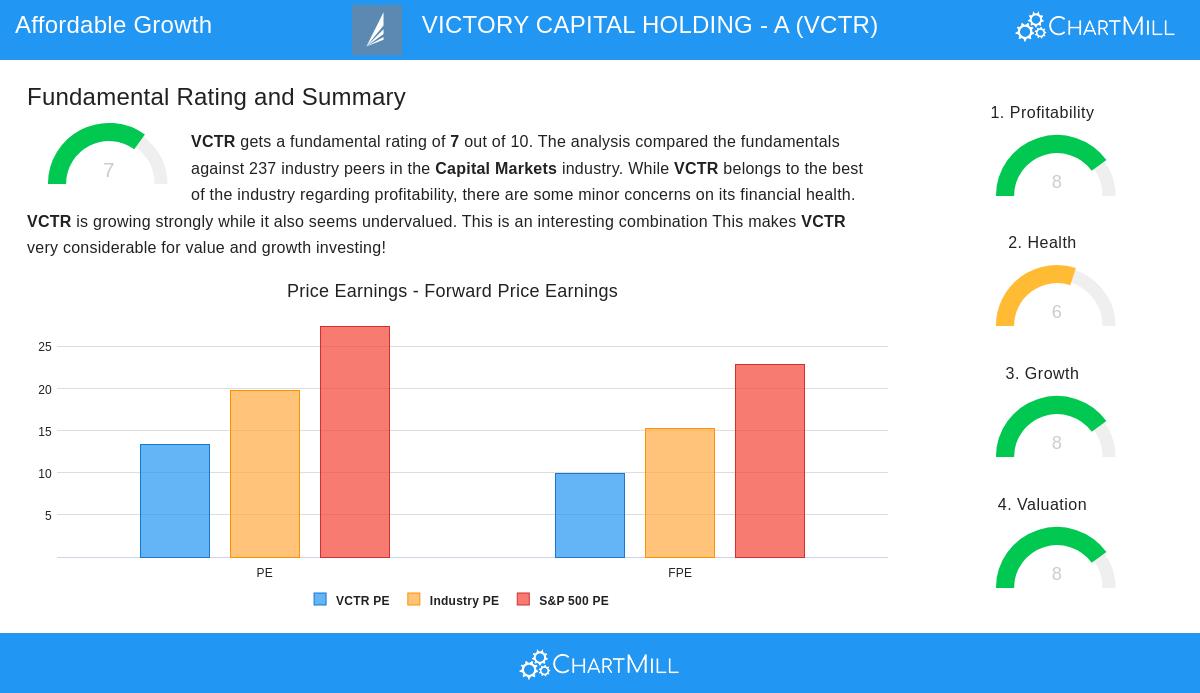

VICTORY CAPITAL HOLDING – A (NASDAQ:VCTR) presents a strong case study in affordable growth investing, earning an overall fundamental rating of 7/10 according to ChartMill’s detailed analysis system. The company’s fundamental profile shows particular strength in growth and valuation metrics, which form the core of the affordable growth screening methodology.

Growth Trajectory and Momentum

Victory Capital demonstrates solid growth characteristics that align well with the affordable growth strategy. The company’s growth rating of 8/10 reflects strong historical performance and promising future prospects:

- Revenue increased by 20.90% over the past year, significantly outpacing industry averages

- Earnings per share grew by 15.51% annually, with a five-year average growth rate of 12.55%

- Forward-looking estimates project 16.06% annual EPS growth and 21.43% revenue growth

- Both EPS and revenue growth rates are accelerating compared to historical trends

This combination of strong historical growth and accelerating future projections indicates a company successfully expanding its market position while maintaining operational efficiency.

Attractive Valuation Metrics

The company’s valuation rating of 8/10 suggests the market may be undervaluing its growth potential, a key characteristic sought by affordable growth investors:

- P/E ratio of 13.37 compares favorably to the industry average of 19.82

- Forward P/E of 9.89 sits well below the S&P 500 average of 22.88

- Enterprise Value to EBITDA ratio places it cheaper than 87.76% of industry peers

- Price/Free Cash Flow ratio is more attractive than 62.03% of competitors

These valuation metrics suggest investors can access Victory Capital’s growth story without paying premium prices typically associated with high-growth companies.

Profitability and Financial Health

While the affordable growth screen prioritizes valuation and growth, it also requires decent profitability and financial health, areas where Victory Capital shows mixed but generally positive results:

Profitability Strengths (Rating: 8/10):

- Return on Invested Capital of 9.26% outperforms 84.39% of industry peers

- Operating margin of 46.16% exceeds 79.75% of competitors

- Consistent profitability over the past five years with positive cash flows

- Gross margin of 83.35% ranks in the top tier of the industry

Financial Health Considerations (Rating: 6/10):

- Debt-to-equity ratio of 0.39 indicates balanced leverage

- Altman-Z score of 2.49 shows adequate but not exceptional financial stability

- Current and quick ratios around 1.14 suggest sufficient short-term liquidity

- Share count reduction through buybacks demonstrates capital allocation discipline

Investment Considerations

The combination of strong growth metrics, reasonable valuation, solid profitability, and adequate financial health makes Victory Capital an interesting candidate for investors employing the affordable growth strategy. The company’s position in the capital markets industry provides exposure to financial services while maintaining asset-light characteristics that typically command premium valuations.

While the financial health score shows some areas for monitoring, particularly regarding solvency metrics, the overall fundamental picture suggests a company executing well on both growth and profitability fronts without demanding excessive valuation multiples. This balance is precisely what affordable growth investors seek—companies growing faster than the market while trading at reasonable multiples.

For investors interested in exploring similar opportunities, additional affordable growth candidates can be found through our specialized stock screener that identifies companies meeting these specific criteria. Readers can also examine Victory Capital’s complete fundamental analysis report for more detailed information on the metrics discussed.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. All investment decisions should be based on individual research and consultation with qualified financial professionals. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.