Hecla Mining Co (NYSE:HL) Emerges as a Top Technical and Fundamental Growth Candidate

HECLA MINING CO (NYSE:HL) has recently appeared as an interesting candidate for investors using a combined technical and fundamental growth strategy. The stock was found through a screening process that joins Mark Minervini’s Trend Template, a methodical way to find stocks in strong uptrends, with a High Growth Momentum (HGM) filter, which looks at a company’s fundamental growth path. This two-part method seeks to find equities that not only show solid price momentum but also display speeding up earnings, revenue increases, and better operational efficiency, signs of companies set for continued strong performance.

Technical Strength and Trend Compliance

Hecla Mining meets all main technical conditions described in Minervini’s Trend Template, which is made to filter for stocks showing clear upward momentum and relative strength. The template focuses on agreement across several moving averages, nearness to new highs, and solid relative performance compared to the wider market.

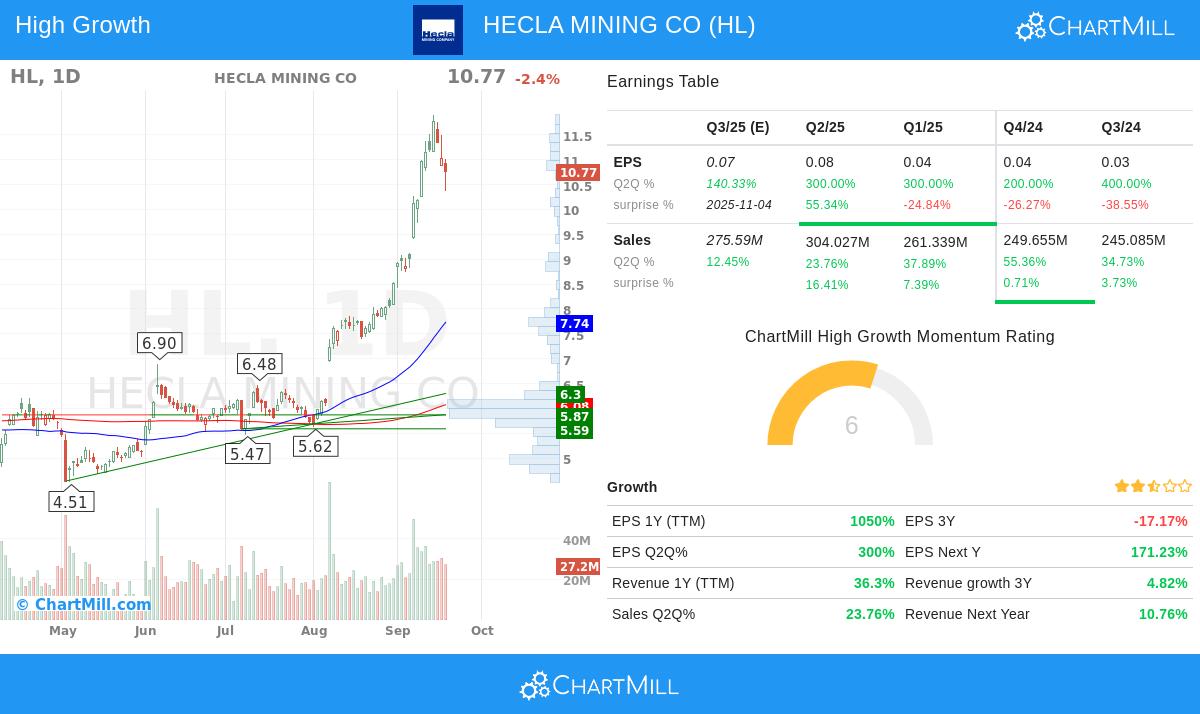

- Price vs. Moving Averages: The current price of $10.77 trades well above the rising 50-day SMA ($7.74), 150-day SMA ($6.28), and 200-day SMA ($6.08). Each of these averages is moving upward, confirming continued positive momentum across short, medium, and long-term timeframes.

- 52-Week High and Low Performance: HL is trading within 9.5% of its 52-week high of $11.90 and has increased more than 141% from its 52-week low of $4.46. This points to strong recovery momentum and implies the stock is a leader.

- Relative Strength: With a ChartMill Relative Strength (CRS) score of 94.13, HL is doing better than 94% of all stocks in our database, showing superior market momentum. This is a key part of Minervini’s strategy, as high relative strength often comes before more price gains.

These technical features are important because they help separate stocks that are not just going up, but are doing so with steadiness and institutional backing, factors that lower volatility and raise the chance of the trend continuing.

Fundamental Growth Drivers

Beyond its technical strength, Hecla Mining shows several fundamental traits that fit with high-growth investing. The HGM rating included in the screen focuses on earnings speeding up, revenue growth, margin increases, and positive analyst changes.

- Earnings Momentum: HL’s EPS growth on a trailing twelve-month (TTM) basis is at a notable 1,050%, with recent quarterly growth rates between 200% and 400% year-over-year. This speeding up shows that operational gains and market conditions are positively affecting profitability.

- Revenue Expansion: Revenue growth has also been solid, with TTM revenue up 36.3% and recent quarterly sales growth between 23.8% and 55.4%. This steadiness implies strong demand for the company’s silver, gold, lead, and zinc production.

- Margin Improvement: Maybe most importantly, Hecla’s profit margin has grown significantly, from 0.66% three quarters ago to 18.93% in the most recent quarter. This gain reflects better pricing power, cost control, and operational effectiveness.

- Analyst Revisions: Positive feeling is further supported by upward changes in earnings estimates; analysts have increased their EPS expectations for the next year by 17.7% over the past three months, showing rising belief in the company’s future.

These fundamental measures are key because they give the basic reason for technical breakouts. Minervini’s method emphasizes that the top-performing stocks usually show strong earnings surprises and upward estimate changes, which draw institutional interest and drive extended gains.

Sector and Market Context

Hecla works in the metals and mining industry, a sector that has often been cyclical but is now gaining from macroeconomic trends like inflationary pressures and industrial demand. The stock’s strength is especially noticeable given its outperformance compared to industry peers, it ranks in the top group based on relative strength within its sector. This implies that HL is not just following a sector-wide trend but is also a top performer due to company-specific advantages.

Technical Analysis Summary

According to ChartMill’s own technical report, HL gets a high technical rating of 9 out of 10, showing excellent trend condition, strong momentum, and notable relative performance. The report notes, however, that the setup rating is currently a 3, meaning that while the stock is technically good, it may not be in a perfect consolidation stage for new entries. The analysis points out key support levels near $10.76 and $6.30, which could act as possible areas for risk management if the stock has a pullback.

For a detailed breakdown of the technical indicators, readers can look at the full technical analysis report.

Conclusion

Hecla Mining shows an interesting case of a stock that fits with both the technical discipline of Mark Minervini’s trend-following system and the fundamental strictness of high-growth investing. Its strong mix of rising moving averages, high relative strength, speeding up earnings, and growing margins makes it a notable candidate for investors looking for exposure to a momentum-driven, fundamentally good opportunity in the natural resources area.

For those interested in finding similar high-growth, technically solid stocks, more screening results can be found using the High Growth Momentum + Trend Template screen.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.