Oklo Stock Set To Pop Again? Wall Street Tech Bull Hikes Price Target By 90% On Trump’s Nuclear Thrust As Retail Traders Pile In

The analyst believes that Oklo remained one of the primary beneficiaries of the significantly increased US government support for nuclear energy.

Shares of Oklo, Inc. (OKLO), a nuclear fission plant company, jumped nearly 29% on Friday, and the buoyancy will likely linger as they rose in overnight trading.

Oklo stock is up a whopping 537% year-to-date, riding on the market opportunity provided by the increased power needs of AI data centers, especially for clean and reliable power.

The stock broke out of a consolidation phase in early September and has gone parabolic after the company announced plans to build and operate a fuel recycling facility in Tennessee as the first phase of an advanced fuel center with an investment outlay of $1.68 billion.

Chart courtesy of Koyfin

Chart courtesy of Koyfin

In a note released late Sunday, Wedbush analyst Daniel Ives raised the price target for Oklo stock to $150 from $80, a whopping 90% hike, citing incremental confidence in the company’s nuclear growth strategy as the artificial intelligence (AI) revolution hits its next stride of growth. Ives has an ‘Outperform’ rating for the company’s stock. Oklo has a 2.5% weighting in the Dan Ives Wedbush AI Revolution ETF (IVES) that was launched in June.

“Our time spent in the Beltway last week with meetings on the Hill gave us incremental confidence that the push for nuclear energy in the US is now underway and positions OKLO very well for this wave of spending/growth/regulatory approval,” Ives said in the note.

The analyst believes that Oklo remained one of the primary beneficiaries of the significantly increased US government support for nuclear energy, with the company being announced as an initial selection for two projects and one project for Atomic Alchemy in the Trump administration’s new Nuclear Reactor Pilot Program.

He also sees Oklo benefiting from the major U.S. companies increasing investments into building data centers within the U.K., including Google, OpenAI, and CoreWeave. According to Ives, the U.K.’s decision to slash the licensing timeline to two years represents a massive acceleration for companies deploying small modular reactors (SMRs), including Oklo.

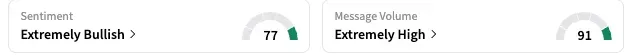

Oklo stock was among the top five trending equity tickers on Stockwits late Sunday. The seven-day message volume change leading up to late Sunday was about 750%. Retail sentiment toward the stock stayed ‘extremely bullish (76/100), with the buoyancy accompanied by ‘extremely high’ message volume.

A bullish user has set a lofty target of $500 for the stock before the end of the year.

Another watcher said everyone is bought into the AI-powered narrative that has been communicated clearly.

That said, Wall Street isn’t equally enthusiastic. According to Koyfin, the average analyst’s price target is $73.75, implying over 45% downside from Friday’s closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Snap Stock’s Retail Traders On High Alert For Meme Rally As Buyout Speculation Resurfaces

High Relative Strength, Low Social Following