Festive Offers, GST Cuts Fail To Lift Tata Motors Stock; Analyst Flags Bearish Outlook

The spotlight is back on the auto sector this week as the revised GST rates come into effect today. Tata Motors has been one of the biggest beneficiaries of the government’s GST rationalisation drive.

Tata Motors stock has witnessed a good rally from the lows of ₹628 on August 11, driven by the two-rate slab announcement.

Infact, Tata Motors has launched significant festive offers across its passenger vehicle range – over and above the GST-related price reductions. Customers can now enjoy total benefits of up to ₹2 lakh, depending on the model, making this one of Tata Motors’ most competitive promotional campaigns in recent times.

Post the GST announcements, it was the first auto company to announce that they will be passing on the benefits to the customers. In early September, they reduced prices up to ₹1.5 lakh for certain models.

But technical charts show that it has been in a downtrend over the past week. This after the company extended its production shutdown at its British unit, Jaguar Land Rover (JLR) until September 24 following a major cyberattack earlier this month. The company’s three UK plants, which typically produce around 1,000 cars per day, have now been idle for more than three weeks, with 33,000 employees impacted, according to reports.

Technical Outlook

SEBI-registered analyst Kush Ghodasara flagged a bearish outlook for the stock. He noted that on the technical charts, Tata Motors was driving between two parallel lines, which had been breached on Monday.

Going ahead, Ghodasara identified ₹705 as a strong resistance for Tata Motors. He added that the stock has breached 5-day and 13-day averages at ₹712, which could now act as a stop loss.

Since the short-term moving average is just crossing over the long-term moving average, it could confirm further selling pressure.

Trading Strategy

Ghodasara suggested a short-term call to sell at the current market price in futures with positional targets of ₹686 and ₹662. He advised maintaining a stop loss at ₹713 on a closing basis.

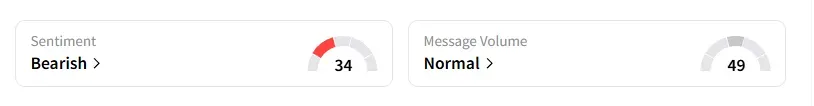

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bearish’ for over a week now. It was ‘bullish’ a month ago.

Tata Motors shares have declined 6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

The most relevant Indian markets intel delivered to you everyday.