Quanta Services Inc (NYSE:PWR) Presents a Strong Growth and Technical Breakout Case

As infrastructure demands continue to grow across North America, companies providing essential construction and engineering services are attracting significant investor attention. One such company, Quanta Services Inc (NYSE:PWR), has recently appeared on screens that combine detailed fundamental and technical analysis. The strategy behind this method is to identify companies demonstrating strong underlying business growth, supported by healthy financials and profitability, while also showing promising technical chart patterns that indicate a potential upward price movement. This two-part method aims to align a company’s operational strength with favorable market timing.

Strong Growth Fundamentals

At its center, a noteworthy growth stock must show an ability to increase its earnings and revenue at an above-average rate. Quanta Services performs well in this area, which is a main reason it was chosen. The company’s fundamental report shows positive growth metrics that are important for this investment strategy, as sustained growth is a key sign of a company’s potential to do better than the market.

- Earnings Per Share (EPS) Growth: Over the past year, PWR’s EPS grew by a solid 30.70%. Even more positive is its 5-year average annual EPS growth of 18.25%, indicating consistent and good profitability increase.

- Revenue Expansion: The company’s top-line growth is also good, with revenue increasing by 18.26% in the last year and by an average of 14.34% each year over the past several years.

- Future Outlook: Analysts expect this momentum to continue, with estimated EPS growth of nearly 17% and revenue growth of 13% each year in the coming years. This consistency between past and expected growth rates lowers uncertainty for investors.

You can review the full details of these growth metrics in the fundamental analysis report for PWR.

Supporting Financial Health and Profitability

While growth is very important, it must be supported by a stable financial foundation and the ability to generate profits. A company growing quickly but using cash rapidly or building up unsustainable debt is a risky situation. Quanta Services presents a balanced profile here, meeting the strategy’s need for “decent profitability and health.”

- Profitability Rating: The company receives a profitability score of 6 out of 10. It has kept profitability and positive operating cash flow for the past five years. Its Return on Invested Capital (ROIC) of 7.94% is better than a majority of its industry peers.

- Financial Health Rating: With a health score of 5 out of 10, PWR shows both positive points and areas of neutrality. Its Altman-Z score of 5.05 points to a low near-term risk of bankruptcy and is better than 75% of its competitors. The company’s debt levels are acceptable and similar to industry averages.

Technical Breakout Pattern

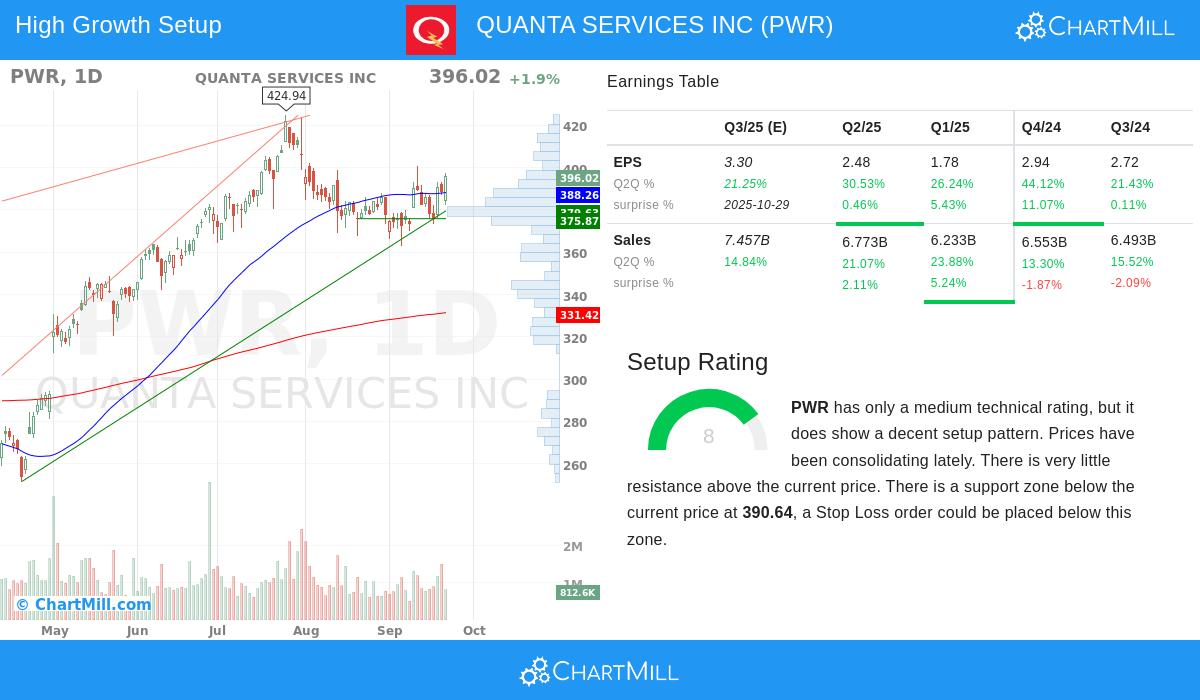

A strong fundamental story is most effective when the market’s sentiment aligns, often seen through technical analysis. Quanta Services is currently displaying a positive technical setup, which is exactly what this screening method looks to find. The technical analysis indicates that the stock may be getting ready for its next important move.

- Consolidation and Breakout: After a good upward move over the past six months, the stock’s price action has recently come together into a tighter range. This consolidation often comes before a new directional move.

- Strong Trend Foundation: The long-term trend for PWR is positive, and it is trading above its key moving averages (20, 50, 100, and 200-day SMAs), showing underlying strength.

- Low Overhead Resistance: A key aspect of the current setup is the absence of important resistance above the current price level. This means that if the stock moves above its recent consolidation high, there is a clear path for upward movement. The technical analysis report for PWR notes a positive setup rating of 8 out of 10, suggesting the technical conditions are good for a potential breakout.

Valuation Considerations

It is important to note that growth often comes at a price. Quanta Services trades at a high valuation, with a P/E ratio of nearly 40, which is above the S&P 500 average. This high valuation is the main factor moderating its overall fundamental rating. However, for growth investors, a higher valuation can sometimes be acceptable if the company’s growth path is expected to continue, effectively growing into its valuation over time. This is a key point for investors to watch closely.

Conclusion

Quanta Services presents a noteworthy case for investors following a growth-with-momentum strategy. The company shows very good revenue and earnings growth, supported by adequate financial health and profitability. This strong fundamental story is combined with a technical chart pattern that indicates a potential breakout from a recent consolidation phase. While its valuation requires careful thought, the combination of these factors makes PWR a stock deserving of more examination for those looking for exposure to the infrastructure sector.

If this method matches your investment approach, you can find more potential opportunities by exploring the Strong Growth Stocks with good Technical Setup Ratings screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. All investments involve risk, including the possible loss of capital. Always conduct your own research and consider your individual financial situation before making any investment decisions.