Intel Stock Surges After $5B Nvidia Deal – Breakthrough In AI Chips Or Bubble In The Making?

Image Source: Pexels

Intel (Nasdaq: INTC) is back in the spotlight after striking a major partnership with Nvidia, sending shares soaring to levels not seen in decades.

The deal makes Nvidia a top Intel shareholder and includes plans to co-develop multiple generations of custom CPUs and SoCs with Nvidia GPU chiplets – a move many hail as Intel’s long-awaited lifeline in the AI era.

Alongside additional backing from the U.S. government and SoftBank, Intel now carries both financial support and strategic importance as a national asset.

Still, the rally has left Wall Street divided. On one side, bulls see the partnership as the spark that could restore Intel’s competitiveness in data centers and PCs. On the other, skeptics highlight execution risks where Intel must fix manufacturing delays, improve efficiency, and prove it can deliver chips at scale. Its foundry business continues to struggle, and long-term profitability remains uncertain.

https://www.youtube.com/watch?v=UOvcVbzX6CU

At the same time, investor enthusiasm has pushed the stock well beyond historical valuation norms. Analysts have raised their expectations slightly, but many caution that the current surge may have already priced in too much optimism too soon.

That disconnect between renewed excitement and lingering challenges brings us back to the central debate: is Intel’s Nvidia-backed surge truly the beginning of an AI breakthrough, or simply a bubble in the making? Until Intel proves it can execute on its bold promises, investors face the risk of chasing hype rather than sustainable growth.

Let’s map it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Intel, ask yourself:

Do you want exposure to a company aligned with the U.S. government and Nvidia, positioned as a strategic semiconductor asset?

Are you comfortable with dilution and overvaluation, where much of the AI turnaround story is already priced in?

Do you believe Intel can overcome execution missteps and deliver competitive chips that claw back share from AMD and Arm?

Intel’s core business remains under pressure, with its foundry still losing money and product timelines not clearly defined. Despite this, sentiment has turned positive as investors view the Nvidia partnership as a possible turning point and the government stake as added long-term support. On the charts, the stock has jumped into the $30 range, breaking through major resistance. Still, many analysts warn that a pullback is likely as traders take profits and the initial excitement fades.

For long-term investors, Intel may be appealing if the Nvidia partnership expands into foundry work and execution improves, but it suits only those with higher risk tolerance. In the short term, stretched valuations and execution challenges make Intel a battleground stock where the risks equal the potential rewards.

IDDA Point 3: Fundamentals

Intel has secured major backing through high-profile deals with Nvidia, SoftBank, and the U.S. government, strengthening its balance sheet and national importance. However, these moves dilute shareholders and may make foreign customers cautious, while doing little to fix Intel’s core operational issues.

The Nvidia partnership is strategically significant, with plans to co-develop custom CPUs and SoCs that integrate Nvidia GPU chiplets. This could open up a $50B market across data centers and PCs and help Intel slow share losses to AMD. For Nvidia, it adds diversification and deeper access to x86 workloads, though the agreement is focused on products, not manufacturing, leaving TSMC as Nvidia’s main foundry partner.

Execution risk is Intel’s biggest challenge. It must deliver competitive products on schedule, improve yields, and control costs – areas where it has consistently stumbled. With vague timelines, it could take more than a year before the partnership shows meaningful results, and Nvidia carries far less risk thanks to its dominant AI position.

Intel’s foundry business remains a drag on profitability, with forecasts for earnings and cash flow still trending downward. While the Nvidia collaboration boosts credibility, it doesn’t solve the core cash flow problem. A true breakthrough would require Nvidia to shift GPU production to Intel’s advanced nodes, but this is unlikely given Nvidia’s reliance on TSMC.

Valuation also looks stretched after a sharp stock surge. Analysts have nudged fair value estimates higher, but many caution the rally has gone too far too fast. The Nvidia deal is a positive step, yet not a seismic shift, and until Intel executes and proves its foundry can turn profitable, the stock looks more like a long-term turnaround story than a near-term winner.

Fundamental Risk: High

IDDA Point 4: Sentimental

Strengths

Strategic Nvidia Partnership – Co-developing CPUs and SoCs with Nvidia could restore Intel’s relevance in AI and PCs, open a $50B market opportunity, and help slow CPU share losses to AMD.

Capital & Government Backing – Major investments from Nvidia, SoftBank, and the U.S. government provide financial stability and reinforce Intel’s role as a national strategic asset.

Ecosystem Boost – Pairing Intel CPUs with Nvidia GPU chiplets could create competitive products across data centers, laptops, and consumer PCs, strengthening Intel’s long-term positioning.

Risks

Execution Risk – Intel must show it can deliver advanced chips on time and at scale, but its history of delays and yield issues raises doubts.

Foundry Weakness – The Nvidia deal doesn’t fix Intel’s unprofitable foundry business, which remains a drag on cash flow and margins.

Valuation Concerns – After a sharp rally, Intel trades well above historical norms, with optimism already priced in and limited room for near-term upside.

Market sentiment toward Intel has turned sharply bullish, with the stock soaring over 50% in its strongest rally since the 1980s. Investors see the Nvidia partnership and U.S. government backing as a lifeline in AI and a sign of Intel’s renewed strategic importance.

Yet much of this enthusiasm appears already priced in, with valuations stretched and expectations running ahead of fundamentals. While the deal has sparked excitement about a potential turnaround, analysts warn that the surge is driven more by hype than by actual financial improvements, leaving the risk/reward outlook unfavorable until Intel proves it can execute.

Sentimental Risk: High

IDDA Point 5: Technical

On the weekly chart:

The recent candlestick was a strong bullish move, signaling a shift to positive sentiment.

The bearish cloud has thinned and closed, pointing to a potential end of downward momentum.

The current candlestick is inside the cloud, testing its upper boundary as a resistance zone.

On the weekly chart, the price surge is now testing the bearish Ichimoku cloud as resistance but has not yet broken above it. The cloud is thinning, suggesting weakening downward momentum and a possible trend reversal ahead.

(Click on image to enlarge)

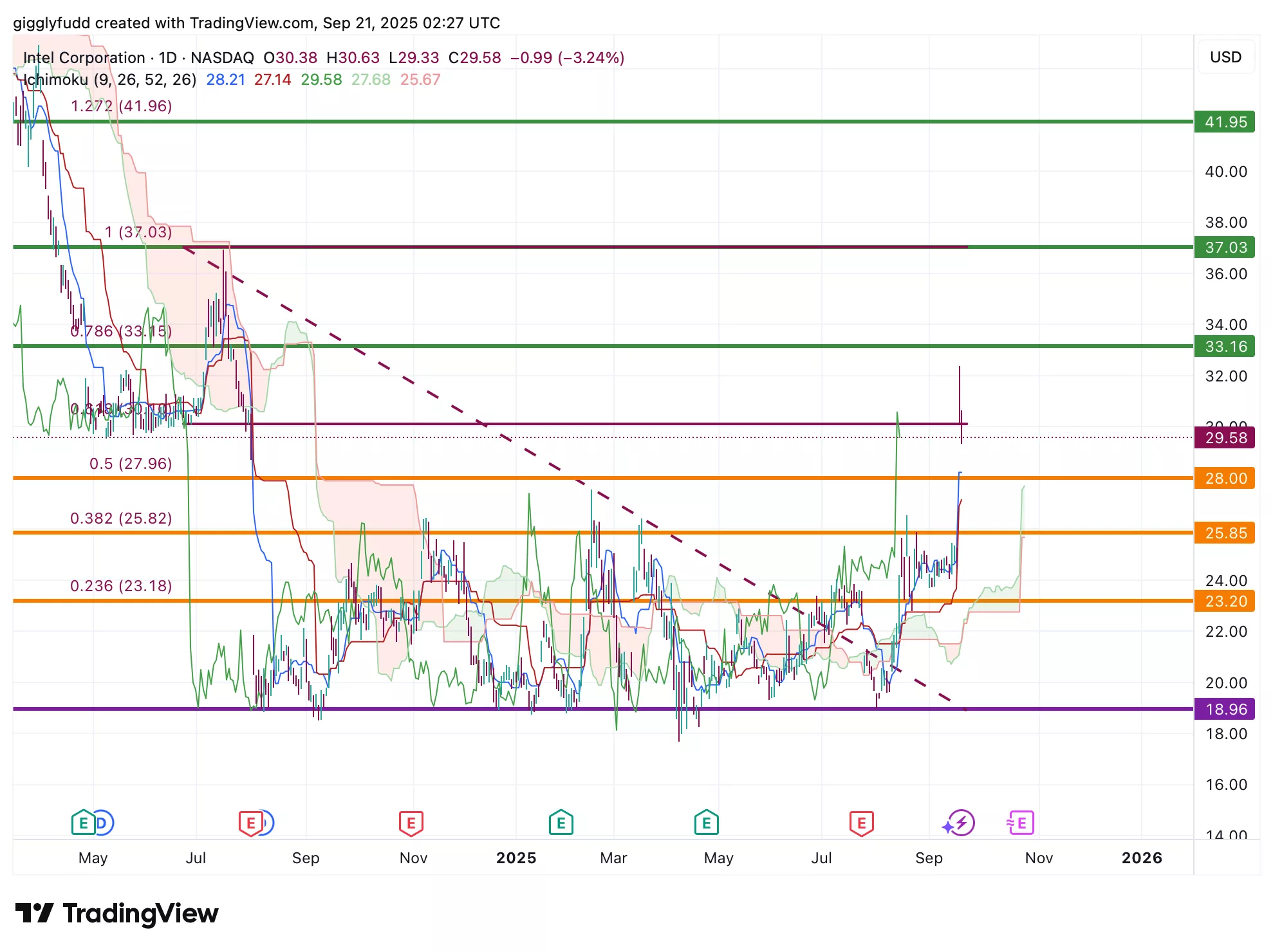

On the daily chart

Price has surged to 32, breaking above the 26 resistance from the consolidation phase.

The future cloud is bullish, signaling continued upward momentum.

Candlesticks sit well above the cloud, which now acts as support—this height also suggests a potential pullback.

On the daily chart, Intel’s price has broken out strongly, surging to 32 and moving beyond the 26 level that marked the upper boundary of its recent consolidation phase. The future Ichimoku cloud is turning bullish, signaling momentum may continue to the upside. However, candlesticks are currently trading well above the cloud, which now acts as a strong support zone, suggesting that while the broader trend remains positive, the stretched distance from support could invite a near-term pullback before any further sustained rally.

(Click on image to enlarge)

Investors looking to get in INTC can consider these Buy Limit Entries:

Current market price 29.58 (High Risk – FOMO entry)

28.00 (High Risk)

25.85 (Medium Risk)

23.20 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

33.16 (Short term)

37.03 (Medium term)

41.95 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on Intel (INTC)

Intel has surged back into the spotlight after its $5B partnership with Nvidia, which reignited investor excitement and positioned the company as a strategic national asset alongside backing from the U.S. government and SoftBank. The deal offers Intel a foothold in AI and a chance to regain relevance against rivals like AMD and Arm, but challenges remain – its foundry business is still unprofitable, profitability forecasts are weak, and execution risks are high.

While the partnership is promising, Nvidia still relies on TSMC, limiting near-term impact, and Intel’s valuation has already run ahead of fundamentals. Technically, momentum is bullish with the stock breaking resistance, but charts suggest a pullback may be near, leaving investors to weigh hype against Intel’s ability to deliver.

Key Takeaways:

The debate over Intel comes down to whether this is a real AI breakthrough or simply a bubble forming. Bulls believe the Nvidia partnership, government support, and new product roadmap could give Intel the chance to mount a historic comeback. Bears counter that the stock looks overvalued and still faces major execution risks, with profitability uncertain and foundry problems unresolved. For long term investors, Intel offers potential if the partnership deepens into manufacturing and the company can prove it can deliver. For short term investors, momentum remains strong, but high valuations and volatility mean timing is critical.

Overall Stock Risk: High

More By This Author:

Baidu Stock: Is This Rally Set To Last?

Wall Street Says Tesla Stock Is 70% Overvalued – But Are Investors Missing The Real Story?

B2Gold Just Turned On Its Goose Mine – So Why Is Wall Street Still Sleeping On This Stock?