EXELIXIS INC (NASDAQ:EXEL) Represents an Affordable Growth Opportunity

Investors looking for growth chances at fair prices often use screening methods that find companies with good expansion possibilities without high prices. The Affordable Growth method looks for equities with strong growth features, good profitability, sound financial positions, and appealing prices. This system tries to find companies set for future growth while reducing the chance of paying too much for that growth possibility.

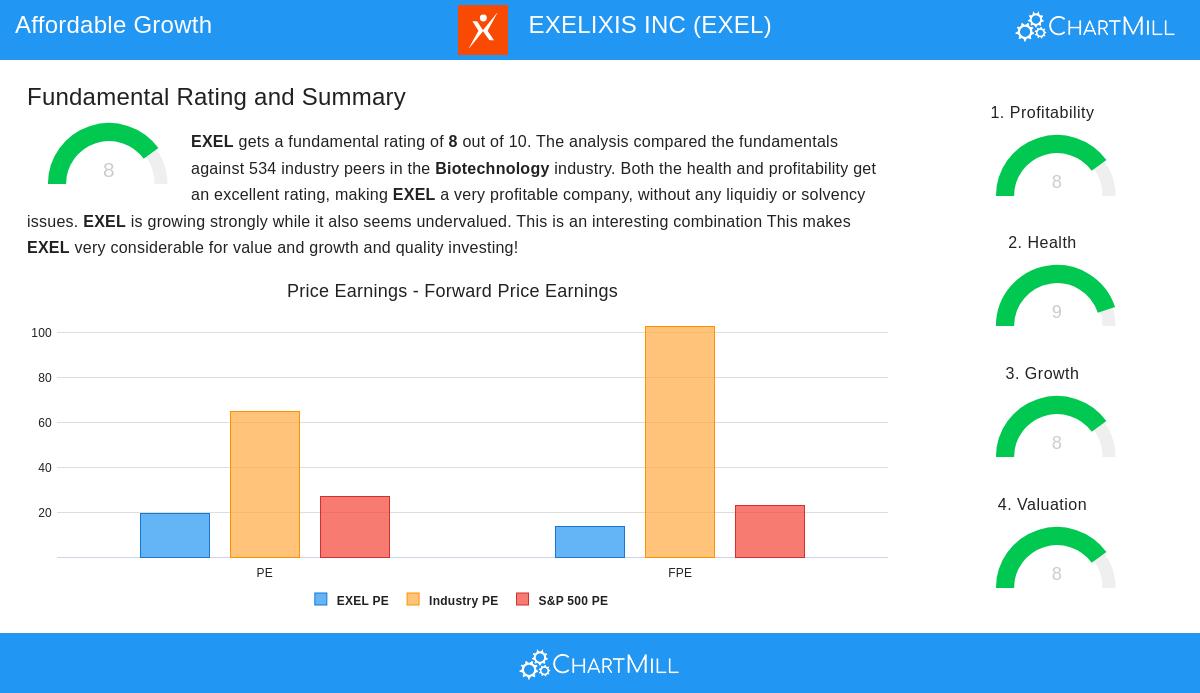

EXELIXIS INC (NASDAQ:EXEL) presents an interesting example within this investment structure. The biotechnology company, which works on creating cancer treatments, shows several traits that match affordable growth standards based on its detailed fundamental analysis report.

Growth Path

Exelixis shows notable expansion numbers that support its high growth score of 8 out of 10. The company’s recent results and future outlook show a good upward path:

- Earnings Per Share rose 67.74% over the last year, with an average yearly growth rate of 12.65% over recent years

- Revenue grew 10.73% in the past year, keeping a good 17.51% average yearly growth rate in the past

- Future EPS growth forecasts are 22.20% per year, pointing to increasing profitability growth

- Revenue growth expectations stay good at 10.31% per year going forward

This steady and increasing growth profile provides the basic expansion possibility that growth investors look for, while the fair price stops investors from paying too much for this growth.

Valuation Check

Exelixis gets a valuation score of 8, showing appealing pricing compared to its growth outlook and industry place:

- The P/E ratio of 19.23 seems high alone but becomes interesting when measured against industry averages

- The company trades at a lower price than 95.32% of biotechnology industry companies based on P/E ratios

- Forward P/E of 13.76 places Exelixis as more reasonably priced than 95.69% of industry rivals

- Enterprise Value to EBITDA and Price/Free Cash Flow ratios both show lower valuation than over 95% of industry companies

- The PEG ratio, which changes P/E for growth rates, suggests the stock is fairly priced considering its expansion path

These valuation numbers show how Exelixis provides growth exposure without the high premiums often seen in the biotechnology sector, fitting well with the affordable growth plan’s main idea of looking for value in growth chances.

Profitability and Financial Condition

The company’s operational strength and financial steadiness provide the base for lasting growth:

- Profitability score of 8 shows very good operational efficiency with Return on Assets of 22.49% and Return on Equity of 29.62%

- Profit margins of 27.01% and operating margins of 33.71% do better than about 97% of industry competitors

- Financial condition rating of 9 shows very good stability with no current debt and strong liquidity ratios

- Current ratio of 3.51 and quick ratio of 3.44 show plenty of short-term financial flexibility

- Altman-Z score of 12.04 points to very low bankruptcy danger, doing better than 84% of industry companies

These traits make sure the company’s growth is built on a sound financial base, lowering investment risk while helping continued expansion.

The detailed fundamental analysis found in the full EXEL report gives more understanding of these numbers and what they mean for long-term investment possibility. For investors wanting to find similar chances, more affordable growth options can be found using our specific stock screener, which finds companies meeting these particular growth, valuation, profitability, and condition requirements.

Disclaimer: This analysis is for information only and does not make up investment advice, suggestion, or support of any security. Investors should do their own research and talk with financial advisors before making investment choices. Past results do not ensure future outcomes.