MACOM TECHNOLOGY SOLUTIONS H (NASDAQ:MTSI) Shows Strong Technical and Fundamental Momentum

Investors looking for high-growth chances often mix strict technical screening with fundamental momentum study to find stocks set for continued strong performance. One method attracting interest from traders focused on growth is the combination of Mark Minervini’s Trend Template with high-growth momentum filters. This two-part plan confirms a security is both in a strong technical uptrend and supported by improving financial results. MACOM TECHNOLOGY SOLUTIONS HOLDINGS INC (NASDAQ:MTSI) recently appeared from this type of screening process, offering a solid case for more review.

Fitting the Minervini Trend Template

The Minervini Trend Template is a structured way to find stocks in a confirmed and strong uptrend. It focuses on price trading above important moving averages with upward slopes, closeness to new highs, and better relative strength. A stock needs to meet all conditions to be viewed as having the traits of a market leader. MACOM TECHNOLOGY SOLUTIONS HOLDINGS INC shows a good fit with these technical requirements.

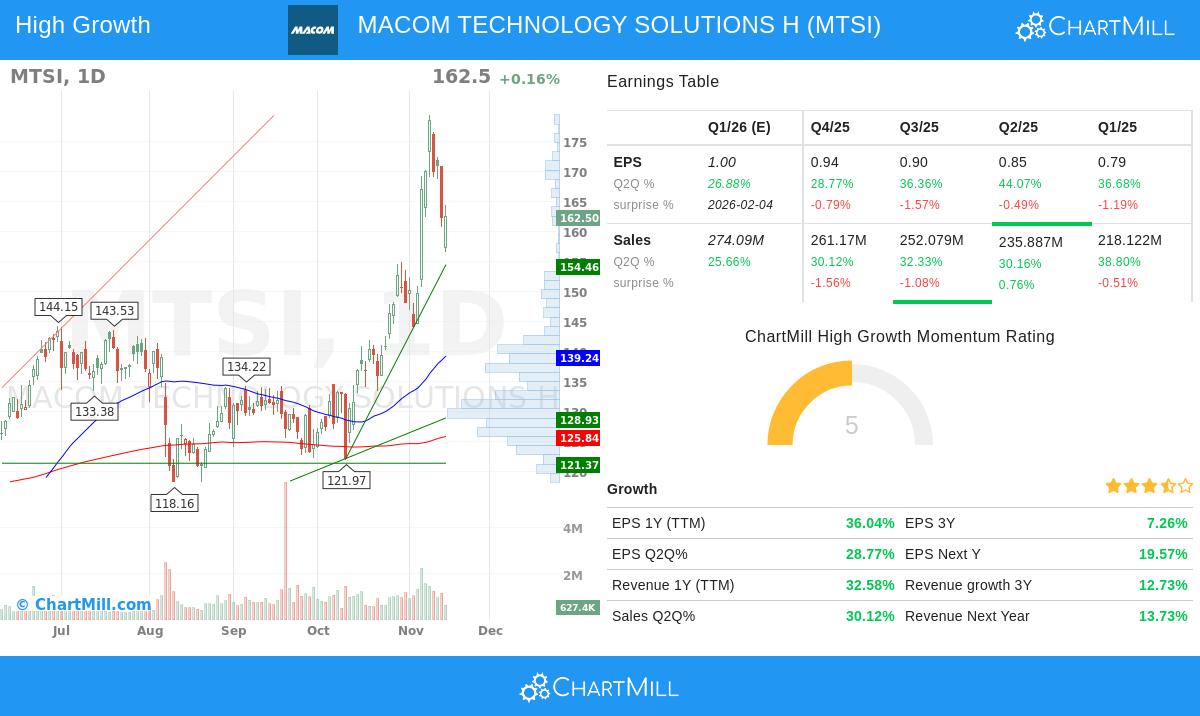

- Price Above Key Moving Averages: The stock’s present price of $162.50 trades significantly above its increasing 50-day ($139.24), 150-day ($130.62), and 200-day ($125.84) simple moving averages. This arrangement confirms a positive trend across short, intermediate, and long-term periods.

- Moving Average Arrangement: The 50-day SMA is located above the 150-day SMA, which is also above the 200-day SMA. This ordered positive arrangement is a fundamental part of the Trend Template, showing continued buying interest and a sound stage 2 advance.

- Closeness to Highs: MTSI is trading within 25% of its 52-week high of $179.38, an important Minervini filter that directs an investor’s focus to strength instead of weakness. Stocks close to their highs frequently have the momentum to keep rising.

- Strong Relative Strength: With a ChartMill Relative Strength rating of 89.01, MTSI is doing better than almost 90% of all stocks in the market. Minervini states that the top performers usually have RS ratings above 70, preferably in the 80s or 90s, showing institutional interest and leadership.

Fundamentals for High-Growth Momentum

While the Trend Template creates a solid technical base, the High Growth Momentum (HGM) rating aims to find companies with improving business fundamentals. This is important because, as Minervini’s SEPA method notes, the largest stock market winners are nearly always supported by strong earnings and sales growth. MTSI’s fundamental picture shows several reasons for its momentum.

- Notable Earnings Growth: The company has shown strong bottom-line growth, with EPS growth of 36.04% over the trailing twelve months. This increase is even more clear on a quarterly basis, with recent quarters showing year-over-year growth of 28.77%, 36.36%, and 44.07%. Such steady and increasing growth is a sign of companies seeing strong operational leverage and market need.

- Strong Revenue Growth: Top-line growth is similarly solid, with revenue rising 32.58% over the past year. Recent quarterly sales growth numbers of 30.12% and 32.33% confirm this is not a single occurrence but a continuing pattern. Good sales growth provides a reliable base for earnings and lessens dependence on cost reduction or financial methods.

- Gaining Profitability: The company’s profit margin has shown steady gain, increasing from 13.42% two quarters ago to 17.28% in the latest quarter. Growing margins indicate pricing ability, operational effectiveness, and a scalable business plan, all valued by growth investors.

- Positive Analyst Outlook: Upward changes in analyst estimates give a forward-looking sign of strength. MTSI has seen its next-year EPS estimates raised by 0.11% and, more significantly, its next-year revenue estimates raised by 0.92% over the last three months. This shows increasing belief in the company’s future potential.

Technical Health Summary

A look at the detailed technical report for MTSI gives the stock a high score of 9 out of 10, reflecting its very good technical condition. The report states that both short-term and long-term trends are positive, a highly optimistic sign. While the stock is trading in the higher part of its 52-week range, the study also mentions that the recent trading range has been large, indicating that while the trend is firm, the present situation may need waiting for a good, lower-risk entry point as market swings lessen.

Finding Comparable Chances

The mix of a Minervini-aligned trend and high-growth fundamentals forms a strong screen for possible market leaders. MTSI is one of the stocks that currently meets this strict filter. Investors searching for other companies displaying these features can use the predefined screen that found MTSI. You can review more high-growth momentum stocks fitting the Trend Template conditions by using this screen.

Disclaimer: This is not investment advice. The content is intended to be used for information and education purposes only. It is crucial to conduct your own research and consider your personal financial situation before making any investment decisions. Please read our full disclaimer and terms of use to understand our obligations.