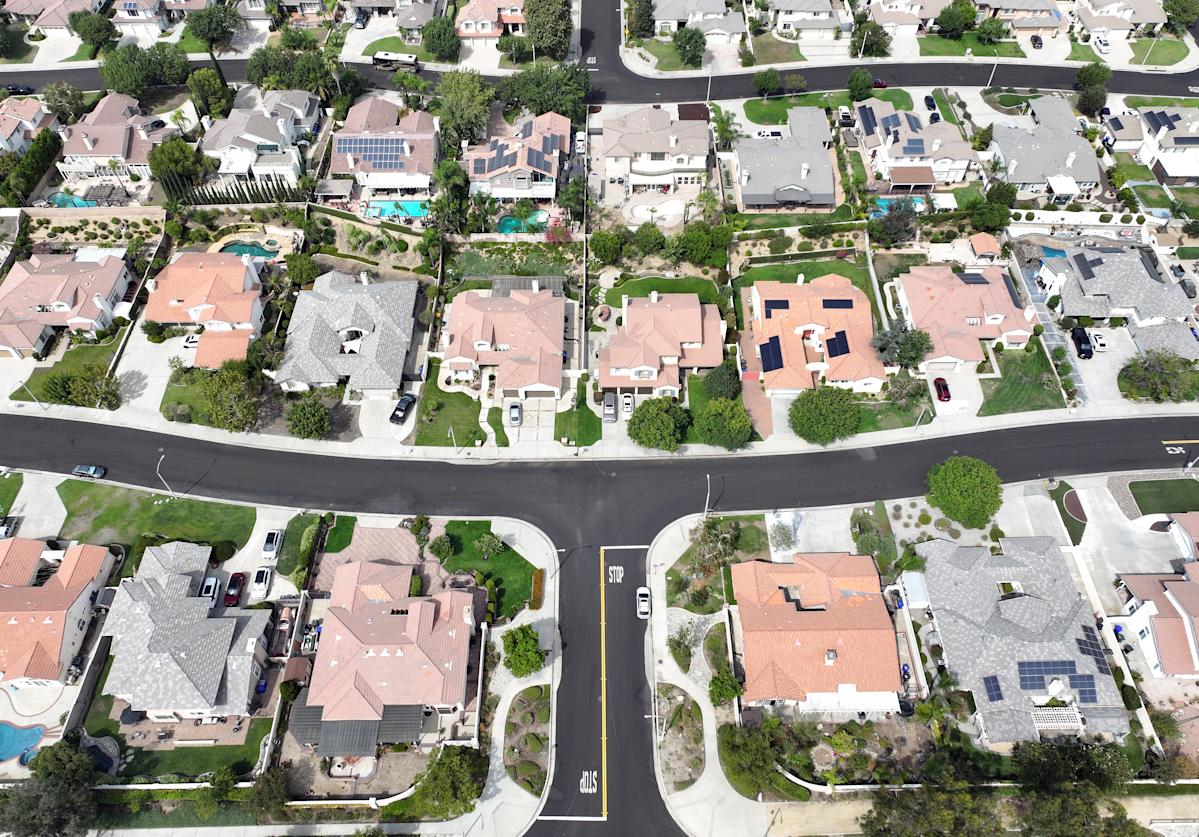

More housing markets are shifting toward buyers. It’s not enough to make them want to buy.

As the year draws to a close, homebuyers are gaining ground. Mortgage rates are hovering near year-to-date lows, and in a growing number of metro areas, market conditions now outright favor buyers.

The only problem? Many of these newfound buyer’s markets lack buyers.

As of October, sellers outnumbered buyers nationwide by 37%, according to Redfin, creating the strongest buyer’s market since at least 2013. Buyers are in control when they have more inventory to choose from, which, in turn, helps limit home price appreciation. But despite these conditions, buyers, feeling stymied by high costs and economic worries, are exiting the market faster than sellers.

The shift underscores how small affordability gains aren’t enough to unfreeze a housing market where prices are more than 50% higher than pre-pandemic levels and mortgage rates are above 6%. At these levels, many aspiring buyers, especially first-timers, remain effectively shut out. As a result, home sales this year are on track to spend their third straight year near 30-year lows.

“Buyers are just feeling the pain of many years of home price increases, on top of interest rates still in the 6% range,” said Molly Boesel, senior principal economist at property data provider Cotality.

Read more: Is it a buyer’s market or a seller’s market? How to tell the difference.

Even though buyers stay hesitant, they’re gaining leverage in more parts of the country. Buyers have long enjoyed the biggest upper hand in southern cities like Houston, San Antonio, Nashville, and Jacksonville, Fla., which have prioritized new building and seen their population growth slow since the pandemic. As of October, cities like Cincinnati and Milwaukee have also transitioned to become buyer’s markets, according to Zillow data.

The listings giant now considers 19 major metro areas to be tilted toward buyers, up from nine a year ago.

Buyers are usually considered to have more power when it would take six months or more to sell all active listings on the market, while markets tilt toward sellers when there’s under four months of supply.

Greg Langhaim, a real estate agent and owner of Go Idaho Group in Meridian, Idaho, said buyers in the Boise area have turned hesitant this year, even though the region’s inventory remains constrained enough to be considered a seller’s market.

“We have all these buyers who are sitting because they’re doing the math, and it’s just not adding up,” Langhaim said. “There’s a lot of uncertainty, and our wages aren’t matching up with the prices.”

Leave a Comment

Your email address will not be published. Required fields are marked *