Leslie Smith is among millions of Americans scrambling to meet a fast-approaching deadline to lock in health insurance coverage for 2026.

Smith, a 64-year-old Arizona resident with diabetes, faces the daunting prospect of juggling more-expensive Affordable Care Act premiums with everyday living expenses. Smith delayed selecting her plan for 2026 coverage as Congress debated whether to extend maintain COVID-era subsidies that made Obamacare health insurance cheaper for 22 million Americans.

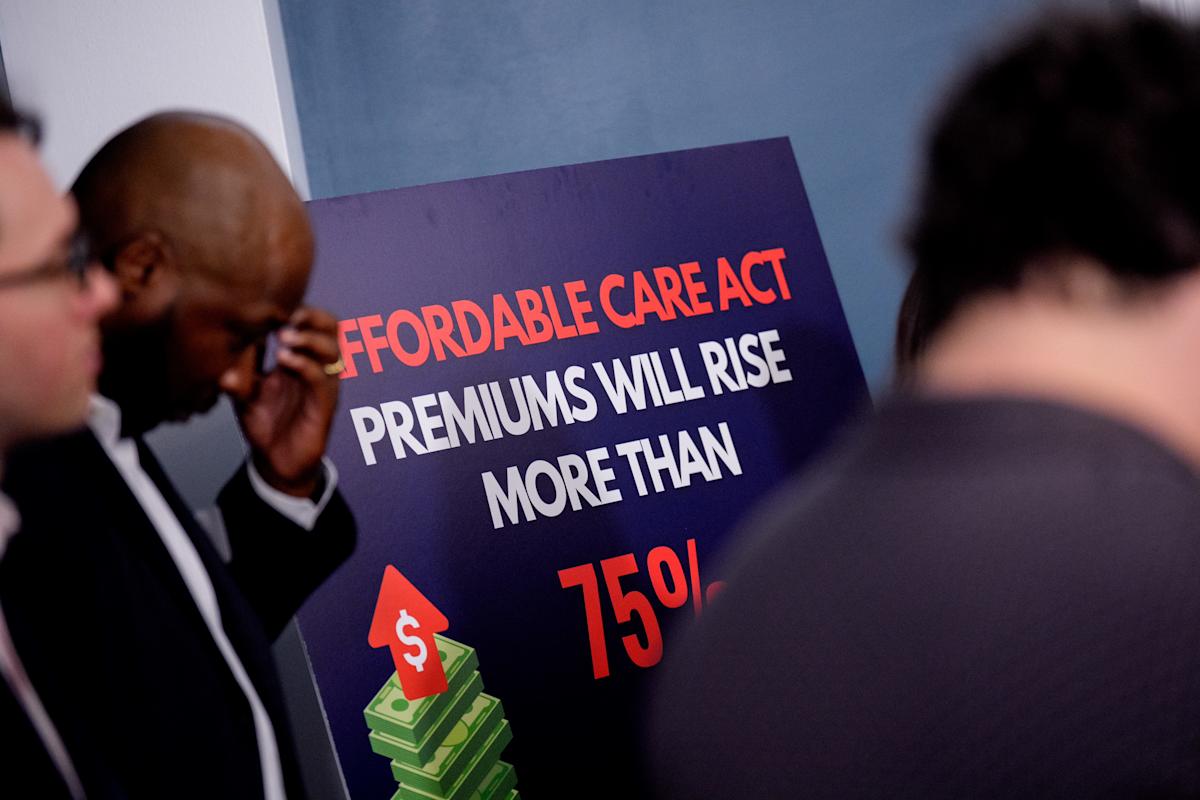

The Senate on Thursday rejected the Democrats proposal to maintain the subsidies. Because the Senate didn’t extend the enhanced premium tax credits set to expire at the end of 2025, Smith and others face sharply higher costs for ACA insurance beginning Jan. 1, 2026.

And House Republicans released a legislative proposal aimed at making healthcare more affordable but without extending premiums under Obamacare. A House vote could come in the next week.

Obamacare enrollees must choose a plan by Monday, Dec. 15, to get coverage beginning Jan. 1, 2026.

ACA experts say many consumers are likely scrutinizing their monthly costs due to the expiration of the enhanced tax credits. Consumers must pay the higher costs or downgrade to a less expensive Obamacare plan.

“People have to make these big financial and health decisions, and they are making them right now,” said Sabrina Corlette, co-director of Georgetown University’s Center on Health Insurance Reforms.

About 1 in 3 Affordable Care Act enrollees would “very likely” shop for a new 2026 insurance plan if their costs more than double, according to a recent survey by health policy nonprofit KFF.

“Many people are likely actively shopping and switching (plans) this year,” said Cynthia Cox, a KFF vice president and director of the program on the ACA.

Since she was diagnosed with diabetes in her 20s, Smith has prioritized affordable and robust health insurance. It influenced decisions when switching jobs. And when the Maricopa County, Arizona, woman retired five years ago, she knew she could purchase Affordable Care Act health insurance.

If Smith does nothing, she’ll be reenrolled in a 2026 plan that will cost her $948 a month – a monthly increase of $368. She’s strongly considering downgrading her coverage to a less expensive plan until she’s eligible for Medicare in mid-2026.

If she chooses a plan with a lower monthly premium, she’ll likely pay more for deductibles and other cost-sharing requirements that come with less robust insurance coverage. That means she might need to postpone plans for a costly knee-replacement operation.

“It’s very frustrating to me,” said Smith. “You do things the right way, and quite frankly, you get screwed.”

Republicans initially balked at including the enhanced premium tax credits in the federal budget. That omission prompted Democrats to force a federal government shutdown for a record 43 days. The shutdown ended when Senate Republicans promised to vote on whether to extend the enhanced tax credits.

Even though four Republicans sided with Democrats, it fell short of the 60-vote minimum to extend the subsidies. That’s left the majority of ACA enrollees with just days to switch plans before the higher premiums take effect.

“It’s left everyone scrambling,” Smith said.

Consumers should have some idea how much their insurance premiums will increase next year. Many states that operate their own health insurance marketplaces “are really trying to spread the word that folks need to meet the (Dec. 15) deadline,” said Corlette, of Georgetown.

Corlette recommends consumers sign in to their ACA accounts and assess options. For those who are now enrolled in a gold- or silver-level Obamacare plan, they might want to look at coverage options for less expensive bronze plans, Corlette said.

With the expiration of the enhanced premium tax credits, KFF projects that monthly premium payments for 22 million Americans will rise an average of 114%.

A KFF survey found 1 in 4 ACA consumers will likely drop coverage of their insurance if costs more that double.

Those who expect higher health care costs next year anticipate taking other steps to pay for coverage. Among ACA enrollees who anticipate their health cost will increase more than $1,000 in 2026, 2 in 3 will likely cut spending on daily household needs and 1 in 3 said they would take out a loan or increase credit card borrowing, the KFF survey said.

Affordable Care Act customers aren’t the only ones who face health insurance sticker shock next year. Most working-age Americans get their health insurance through their employer, and surveys show workers in 2026 will face the largest health insurance rate increases since 2010.

Advocacy groups said some consumers will likely drop coverage because they won’t be able to afford rising health insurance bills.

Erica Li, a health policy analyst for Florida Policy Institute, warned the expiration of the enhanced tax credits “will increase the population of uninsured people in Florida to levels we haven’t seen since before the Affordable Care Act.”

More than 4 million Florida residents rely on the subsidies to afford health insuarnce, and without them, families “will face skyrocketing premiums – and in the worse case, many will be forced to go without coverage,” Li said.

Reach Ken Alltucker at alltuck@usatoday.com

This article originally appeared on USA TODAY: Obamacare costs are about to increase, but there’s still time to save

Leave a Comment

Your email address will not be published. Required fields are marked *