Retail diesel prices stable; futures point to surge

After weeks of up and down movement in the weekly diesel benchmark price, the numbers at the pump are right back where they were July 11.

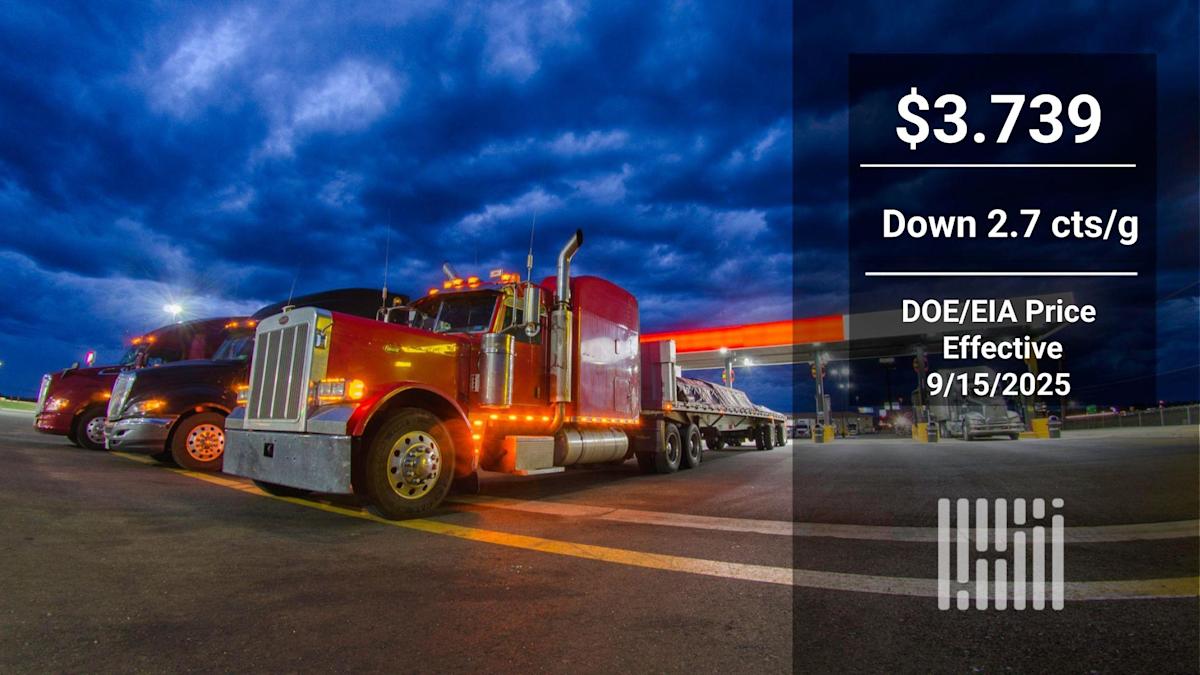

The weekly Department of Energy/Energy Information Administration average weekly retail diesel price effective Monday, published Tuesday, was down 2.7 cents/gallon to $3.739/g. That is the same level it was at July 7.

Including that day, the weekly price used for most fuel surcharges has risen five times. It has fallen six times. The move with the largest magnitude during that time was an increase of 5.4 cts/g on July 21.

In short, it’s been a period of tremendous stability in what is supposed to be a market or perpetual volatility.

But the futures market in oil in general and diesel in particular have exhibited a bullish trend in recent days that on Tuesday took ultra low sulfur diesel (ULSD) to its highest settlement since the end of July.

ULSD on the CME commodity exchange settled Tuesday at $2.3935, up 6.24 cts/g on the day and up more than 10 cts/g in just two days. The end result of the increases is that the Tuesday settlement was the highest on CME since a $2.3995/g price on July 31.

Given the lag between futures price movement and retail prices, there has been no sign of that yet in the DOE/EIA price, which declined in the past week. But that sort of movement, barring a sharp reversal, is likely to show up in next week’s number.

The increase in recent days is being attributed to Trump administration pressure on countries that buy Russian oil to stop doing so until Moscow moves toward some sort of cease-fire with Ukraine, according to various media reports.

But beyond that are th attacks Ukraine is continuing to launch against Russian oil infrastructure.

Bloomberg reported that Ukraine has increased those attacks, most recently targeting a Russian oil refinery.

The news agency also reported that Russia’s Transneft pipeline, which it said transports more than 80% of Russian crude output, had started to restrict companies from storing too much oil with it, presumably because that oil sitting in storage is a rich target for Ukrainian drone attacks.

On the bearish side, multiple news reports suggested that an increase in oil tanker prices could be a sign of increasing oil production looking for a means of transport to bring it to market. Bloomberg reported charter rates for a VLCC of crude from Saudi Arabia to China is now $87,000 per day, the highest in 2 1/2 years.

Questions about Russia’s ability to produce or export inevitably have a larger impact on diesel than crude, given Russia’s role as a significant diesel producer.

Leave a Comment

Your email address will not be published. Required fields are marked *