Nifty Holds Above 24,400; Sensex Scales 83,000 Led By Pharma, Tech

Biocon and Glenmark surged on regulatory approvals, while Poonawalla Fincorp rallied 12% on promoter fund infusion.

Indian equity markets gained ground to end higher, with the Nifty holding above the 24,400 mark and Sensex scaling the 83,000 levels. India’s Chief Economic Advisor (CEA) V Anantha Nageswaran expressed optimism regarding the swift resolution of India-US trade deal discussions.

On Thursday, the Sensex closed 320 points higher at 83,013, while the Nifty 50 ended up 93 points at 25,423. Broader markets mirrored the optimism, with the Nifty Midcap and the Smallcap index gaining 0.3%.

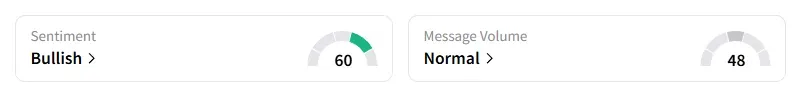

The retail investor sentiment surrounding the Nifty 50 moved to ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, pharmaceuticals (+1.5%) and technology (+0.8%) led the gains. On the other hand, media and PSU banks faced some selling pressure.

Eternal was the top Nifty gainer, rising 3% after global brokerage firm Goldman Sachs raised its target price to ₹360 per share from ₹340 earlier.

Biocon shares ended 4% higher after its subsidiary received US FDA approval for two biosimilars, Bosaya and Aukelso, along with a provisional interchangeability designation, boosting investor confidence.

Glenmark Pharma rose 3% after the Indian drug regulator approved the initiation of Phase 3 clinical trials of Envafolimab, a drug used for the treatment of lung cancer.

Another lower circuit for Dreamfolks that ended 5% lower. Cohance ended 6% lower following a block deal.

And Poonawala Fincorp ended 12% higher on promoter fund infusion. Financial Sarthis spotted a massive volume-backed breakout attempt toward long-term resistance at ₹514.50 (multi-year high) after a steady uptrend. They identified support at ₹425.65. A weekly close above ₹514 could open the room for fresh all-time highs.

Stock Calls

Mayank Singh Chandel is bullish on Deepak Fertilisers following a breakout from a flag and pole pattern. This setup typically indicates a short-term pause before the next leg higher. He recommended entering around ₹1,490, with a stop loss at ₹1,365 and target price of ₹1,770. Chandel added that the risk-to-reward ratio looked favorable, with the stop placed just below the pattern support. He advised traders to watch for sustained volumes to confirm the move.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a strong start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

The most relevant Indian markets intel delivered to you everyday.