HNI CORP (NYSE:HNI) Emerges as a Strong Value Stock with Solid Fundamentals

HNI CORP (NYSE:HNI) has appeared as a candidate through a systematic screening process made to find stocks with solid value characteristics. The method for this selection uses a balanced approach, giving priority to companies that show good fundamental health, profitability, and growth potential, while trading at prices that indicate they may be priced below their real worth. This plan fits with main ideas of value investing, which aim to find opportunities where the market price does not completely show a company’s basic financial strength or future possibilities.

Valuation Metrics

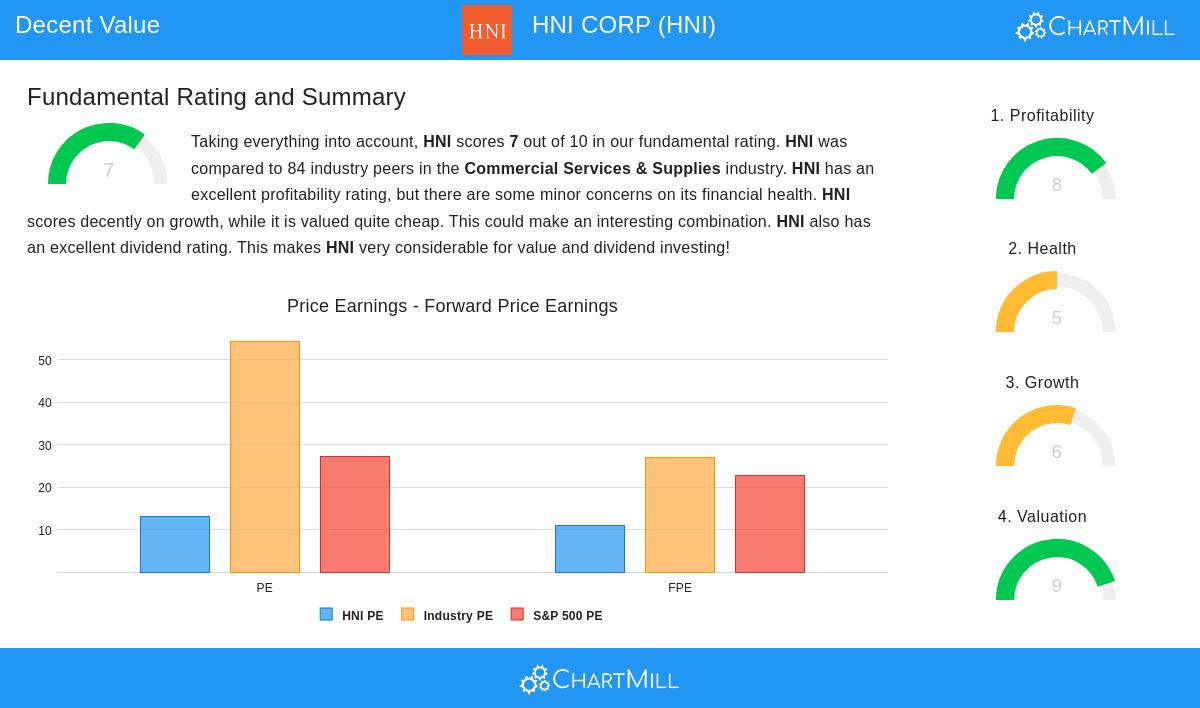

HNI’s most notable feature is its valuation, which appears as especially appealing. The company’s basic numbers indicate it is trading at a price lower than the wider market and also many of its industry competitors. Important numbers include:

- A Price/Earnings (P/E) ratio of 12.97, much lower than the industry average of 54.43 and the S&P 500 average of 27.20.

- A Forward P/E of 10.93, which is also below the S&P 500’s 22.70, showing expectations of continued earnings growth.

- An Enterprise Value to EBITDA ratio that makes it less expensive than 84.5% of companies in its sector.

These valuation numbers are important for value investors, as they give a numerical base for judging if a stock is priced under its real value. A lower P/E ratio, particularly when combined with solid fundamentals, frequently indicates that the market may be undervaluing the company’s earnings potential or stability.

Profitability and Efficiency

Even with its lower valuation, HNI shows notable profitability, a main point in confirming that the company is not just inexpensive but fundamentally healthy. The firm’s return on invested capital (ROIC) of 11.95% is better than 84.5% of industry rivals, while its return on equity (ROE) of 18.24% is in the top 15% of its peers. Profit margins have also gotten better over recent years, with operating margins growing to 9.04%. For value-focused plans, high profitability numbers help make sure that the company is using its resources well and creating lasting earnings, lowering the chance that low valuation by itself might point to basic operational problems.

Financial Health

HNI keeps a fair level of financial health, although there are small points of notice. The company’s Altman-Z score of 3.45 shows a low chance of bankruptcy, and it has effectively lowered its debt-to-assets ratio over the past year. However, liquidity measures like the quick ratio of 0.93 indicate some possible difficulties in meeting immediate obligations without counting on inventory sales. A good financial health profile is necessary in value investing, as it offers a safety buffer, making sure that the company can handle economic declines or industry challenges without risking its operational steadiness.

Growth Prospects

Growth is another area where HNI indicates promise, especially looking forward. While past revenue growth has been moderate, analysts forecast notable speeding up in the next few years, with earnings per share (EPS) expected to rise by 17.14% each year and revenue growth predicted at 35%. This future growth is significant for value investors because it implies that the present low pricing may be short-term, with possibility for market notice and price increase as these growth forecasts happen.

Dividend Sustainability

HNI also provides a dividend yield of 2.95%, which is higher than both the industry and S&P 500 averages. The company has kept or raised its dividend for more than ten years, showing a dedication to giving capital back to shareholders. For value investors, a consistent dividend can offer continuous income and an extra safety buffer, making the stock attractive even if price increase requires time to develop.

Conclusion

HNI Corp. offers a strong case as a stock priced below its value, mixing low valuation numbers with solid profitability, acceptable financial health, and positive growth forecasts. These traits fit well with the standards used in value investing, which looks for companies trading under their real value without losing fundamental quality. Investors curious about comparable possibilities might look into more results from the Decent Value Stocks screen for a wider group of candidates fitting this plan.

For a detailed examination of HNI’s fundamentals, you can see the full fundamental analysis report.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making any investment decisions.