Check Out The New Levels

Canaccord termed the Waymo-Lyft partnership a long-anticipated collaboration for Lyft investors after raising the price target to $18.

Lyft (LYFT) stock witnessed a slew of price target hikes from analysts on Thursday after the company announced a partnership with Alphabet’s Waymo to bring the latter’s fully autonomous ride-hailing service to Nashville in 2026.

Jefferies analyst John Colantuoni raised the firm’s price target on Lyft to $22 from $15 while keeping a ‘Hold’ rating on the shares. The firm considers the news a reflection of Waymo’s desire to diversify its partnerships to avoid reliance on any single player, namely Lyft rival Uber Technologies (UBER). The analyst added that Waymo’s partnerships with both firms support its view that rideshare platforms will become the eventual aggregators of AV demand.

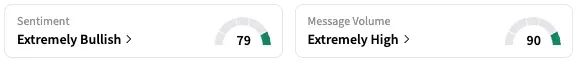

Shares of LYFT traded 2% lower on Thursday morning at the time of writing. On Stocktwits, retail sentiment around LYFT stock stayed within the ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

Lyft announced on Wednesday that it will provide end-to-end fleet management, including vehicle maintenance, infrastructure, and depot operations, for the Nashville Waymo fleet through its Flexdrive unit. While riders can initially use Waymo robotaxis through the Waymo app in Nashville, they will also be able to match with a Waymo vehicle using the Lyft app later in 2026, the companies said.

Canaccord raised its price target on Lyft to $18 from $11 and kept a ‘Hold’ rating on the shares. The firm described the Waymo-Lyft partnership as a long-anticipated collaboration for Lyft investors, as the company sets its best foot forward to navigate the autonomous robots that are set to disrupt its business potentially.

BofA raised the price target on Lyft to $14 from $12 and kept an ‘Underperform’ rating on the shares. Waymo is a high-profile partner for Lyft, noted the analyst. However, the firm expects a limited impact on Lyft’s volume growth, as Waymo’s supply is expected to be limited initially, the analyst said.

Lyft shares closed at $22.84 on Wednesday, following a rally driven by the partnership. According to data from Koyfin, the average price target on the stock is $18.08, implying a potential downside of about 19% from current levels.

A Stocktwits user opined that the price targets are “low-balled.”

LYFT stock is up by 74% this year and by about 84% over the past 12 months.

Read also: Replimune Stock Plunged 42% Today – Here’s Why

For updates and corrections, email newsroom[at]stocktwits[dot]com.

The best trade ideas and analysis from the Stocktwits community. Delivered daily by 8 pm ET.