DONNELLEY FINANCIAL SOLUTION (NYSE:DFIN): A Peter Lynch-Style GARP Investment

In the world of long-term investing, few strategies have shown as much staying power as the approach supported by Peter Lynch. His methodology, detailed in One Up on Wall Street, stresses identifying companies with sustainable growth paths trading at fair valuations, a philosophy now often called Growth at a Reasonable Price (GARP). Lynch’s framework joins careful fundamental study with a focus on financial health, profitability, and controlled debt, avoiding speculative trends. This method has been effective not only in theory but in practice, as shown by Lynch’s notable record managing the Magellan Fund.

Company Overview

DONNELLEY FINANCIAL SOLUTION (NYSE:DFIN) provides software and technology-enabled financial regulatory and compliance solutions, serving capital markets and investment companies through segments focused on software, compliance management, and communications. Headquartered in Pennsylvania, the company supports public and private entities in handling intricate financial rules, placing it in a stable, required niche instead of a flashy high-growth sector, exactly the kind of “dull” but necessary business Lynch often liked.

Alignment with Lynch’s Criteria

The screening process based on Lynch’s strategy points out several key metrics where DFIN does well, matching the main ideas of GARP investing.

- Earnings Growth and Sustainability: Lynch stressed EPS growth between 15% and 30% to avoid unsustainably high growth. DFIN’s 5-year EPS growth of 24.57% fits directly within this range, showing solid but controlled increase.

- Reasonable Valuation via PEG Ratio: The PEG ratio, which changes the P/E ratio for growth, is a key part of Lynch’s valuation method. A PEG below 1 indicates a stock may be undervalued relative to its growth potential. DFIN’s PEG of 0.60 shows good valuation for its past growth.

- Strong Profitability with ROE: Return on equity checks how well a company creates profits from shareholder equity. Lynch wanted ROE above 15%, and DFIN’s 19.00% shows effective use of capital and sound profitability.

- Conservative Debt Management: A low debt-to-equity ratio was important to Lynch, who liked companies funded more by equity than debt. DFIN’s ratio of 0.43 is much below the screen’s upper limit of 0.60, showing a good balance sheet with little financial risk.

- Adequate Liquidity: The current ratio checks short-term financial health, and Lynch preferred companies with a ratio of at least 1. DFIN’s current ratio of 1.29 shows enough liquidity to meet near-term duties easily.

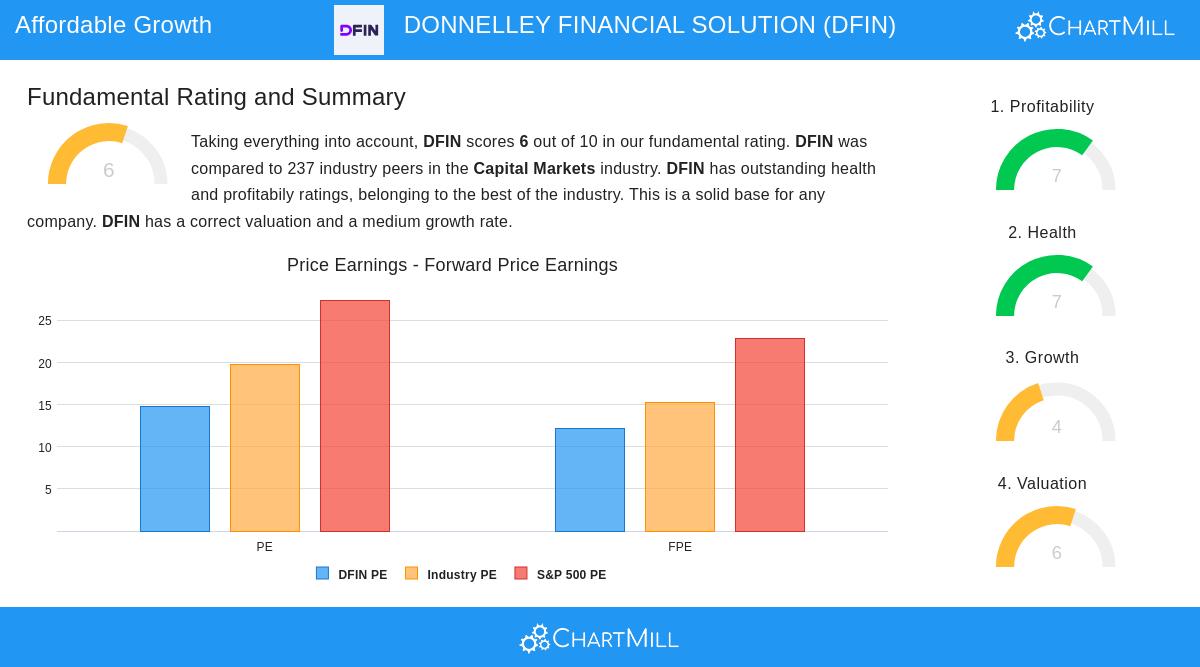

Fundamental Health and Performance

Beyond the specific Lynch criteria, DFIN’s wider fundamental picture supports its appeal for long-term investors. The company gets a good fundamental rating of 6 out of 10, with special strong points in profitability and financial health. Its return on invested capital (ROIC) of 16.03% is near the top in the capital markets industry, highlighting efficient capital use. While revenue growth has been slow lately, the company’s margins have gotten better, and analysts expect a return to EPS growth of almost 14% each year in the coming years. Valuation numbers also seem fair, with a P/E ratio below both the industry and S&P 500 averages. For a detailed breakdown, readers can see the full fundamental analysis report.

Investment Considerations

While DFIN matches many Lynch ideas, investors should know some mixed signs. Revenue has decreased a bit over the past year, and the company does not pay a dividend, which may put off income-focused shareholders. However, these are often lesser worries for GARP investors, who put earnings growth, valuation, and financial steadiness over short-term revenue changes or dividend income. The company’s niche in regulatory technology also gives a defensive trait, as financial compliance stays a constant need no matter the economic cycles.

Conclusion

For investors looking for growth at a fair price, DFIN offers a strong case based on the proven criteria of Peter Lynch. Its solid past earnings growth, good valuation, healthy balance sheet, and high profitability measures make it a notable candidate for more study and possible addition in a diversified long-term portfolio. As with any investment, complete due diligence is needed, but DFIN’s profile indicates it deserves notice from those following a disciplined, fundamental-based method.

For those interested in finding other companies that meet similar criteria, more results from the Peter Lynch screen can be found here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research or consult a financial advisor before making any investment decisions.