INTERPUBLIC GROUP OF COS INC (NYSE:IPG): A Value Investing Case Study with Strong Valuation and Profitability

In value investing, finding stocks trading below their intrinsic value while having good fundamentals is a key strategy. This method, started by Benjamin Graham and later improved by investors like Warren Buffett, aims to find chances where the market might have mispriced a security, giving a margin of safety for long-term investors. One way to search for these stocks is by filtering for solid valuation numbers along with good profitability, financial condition, and growth, criteria that help lower risks linked to undervalued stocks, like value traps. INTERPUBLIC GROUP OF COS INC (NYSE:IPG) appears as a strong example from this kind of search, deserving more attention for those looking into value-focused chances.

Valuation Metrics

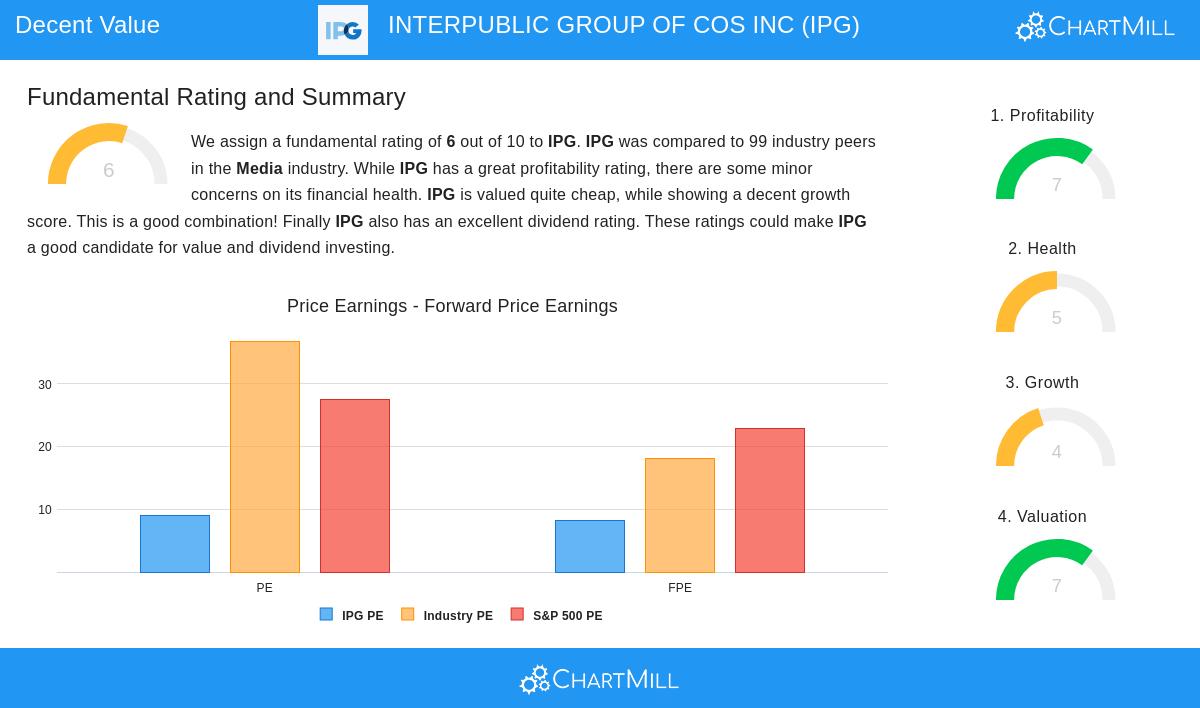

IPG’s valuation profile is very appealing, getting a 7 out of 10 in ChartMill’s fundamental rating system. Important metrics show this strength:

- P/E Ratio: At 9.00, it is much lower than the industry average of 36.77 and the S&P 500’s 27.41, showing a sensible price compared to earnings.

- Forward P/E Ratio: 8.17 adds to the case for undervaluation, trading below both industry and wider market comparisons.

- Enterprise Value to EBITDA and Price/Free Cash Flow: Both ratios indicate IPG is priced lower than most similar companies, matching value investing ideas that focus on buying at a discount to intrinsic value.

These valuation numbers are important for value investors, as they give a number-based start for judging if a stock is undervalued, a necessary condition for reaching long-term capital growth as the market fixes its pricing over time.

Profitability Assessment

Even with its low valuation, IPG keeps good profitability, with a rating of 7 out of 10. The company shows:

- Return on Invested Capital (ROIC): At 12.79%, it does better than 92.93% of industry peers, showing efficient use of capital.

- Profit and Operating Margins: Both metrics put IPG in the top half of its sector, showing solid operational efficiency.

- Consistent Earnings: IPG has been profitable over the last five years, with positive cash flows, highlighting financial stability.

For value investors, good profitability is key, it not only confirms the business’s basic health but also lowers the chance that low valuation comes from a fundamental drop, so supporting the idea that the stock is undervalued and not in trouble.

Financial Health

IPG’s financial health rating of 5 out of 10 shows some points of strength with small worries:

- Debt Management: The debt-to-FCF ratio of 3.52 is positive, showing the company can pay off debt in a sensible period, and it does better than 78.79% of peers in this metric.

- Liquidity: Current and quick ratios near 1.07 suggest enough short-term financial flexibility, though they are only normal for the industry.

- Risk Note: The Altman-Z score of 1.71 puts IPG in a careful area, pointing to some bankruptcy risk, though it still is better than 63.64% of competitors.

A satisfactory financial health score is important in value investing, as it makes sure the company can handle economic slumps and keep operating while the market sees its intrinsic value, avoiding value traps where poor balance sheets cause permanent capital loss.

Growth Prospects

With a growth rating of 4 out of 10, IPG has modest but stable expansion potential:

- Historical Growth: EPS has grown at a yearly rate of 7.46% over recent years, with revenue growth near 0.90%.

- Future Expectations: Analysts expect EPS growth of 6.58% and revenue growth of 1.76% each year, showing steady, if not amazing, forward movement.

- Dividend Growth: The dividend has risen at 7.02% per year, including a total return part for investors.

While not a high-growth stock, this stability fits with value investing’s focus on lasting businesses trading at discounts, making sure that growth, even if modest, adds to intrinsic value over time without depending on too much optimism.

Conclusion

INTERPUBLIC GROUP OF COS INC offers a detailed case for value investors: it mixes strong valuation numbers with good profitability and a nice dividend, balanced by average growth and some financial health notes. This profile suggests it could be undervalued compared to its intrinsic worth, especially for investors wanting exposure to the advertising and marketing sector with a margin of safety. As with any investment, complete due diligence is suggested, including checking IPG’s full fundamental report for more details.

For those wanting to look into similar chances, our Decent Value Stocks screen provides a selected list of stocks meeting these standards.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research or consult a financial advisor before making investment decisions.