China’s Magnet Exports to EU Surge as Bloc Bears Brunt of Crunch

(Bloomberg) — China’s exports of rare-earth magnets to the European Union surged in August, underscoring the bloc’s heavier reliance on Chinese supply compared with the US and its exposure to trade tensions between Washington and Beijing.

Shipments to the EU rose 21% from July to 2,582 tons, according to Chinese customs data on Saturday, taking year-to-date volumes to more than three times those of the US. In contrast, exports to the US fell 5% on-month to 590 tons.

Most Read from Bloomberg

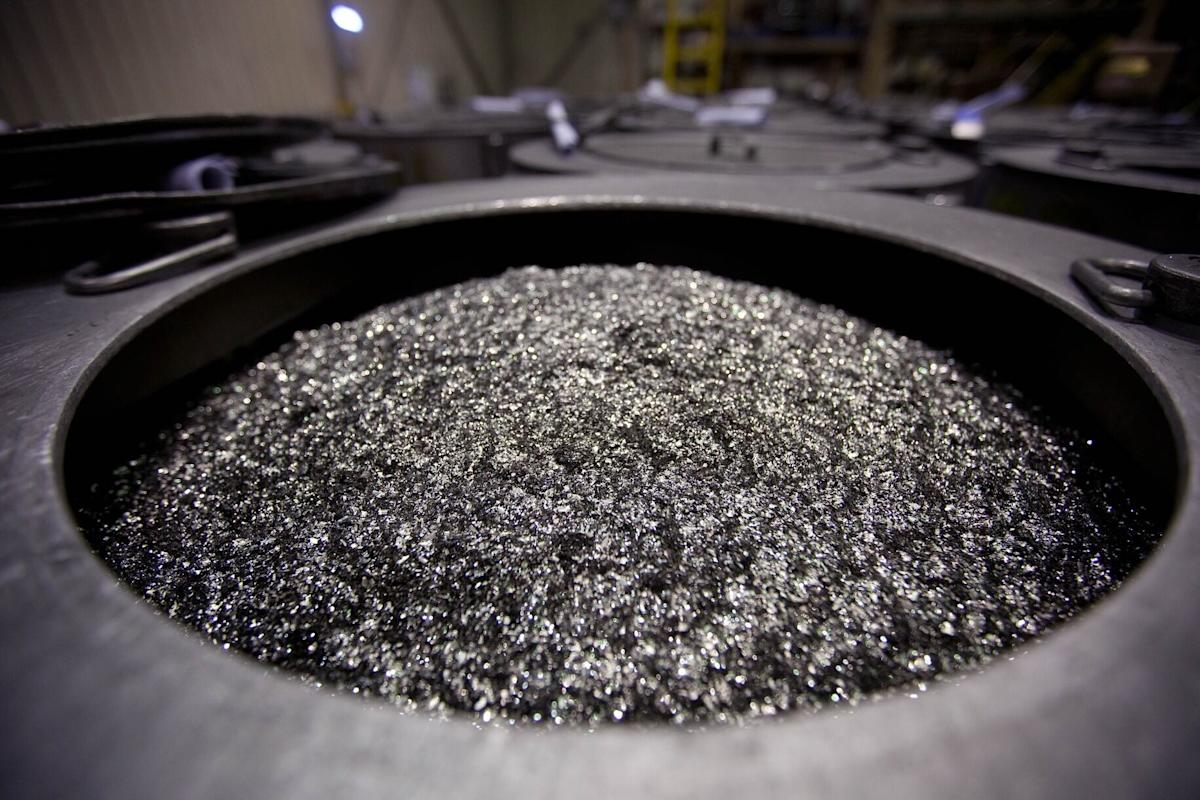

Rare-earth magnets that are essential for electric vehicles, wind turbines, and military hardware became Beijing’s most potent weapon in the standoff with Washington earlier this year. While a call between President Donald Trump and Chinese leader Xi Jinping on Friday signaled that tensions continue to ease, concerns remain over China’s dominance of about 90% of global magnet output.

The EU’s outsized dependence has left its industries particularly exposed. Even with the recent rebound, the earlier supply crunch continues to ripple through the bloc. EU companies incurred seven production stoppages in August and an additional 46 are expected this month, the EU Chamber of Commerce in China said on Thursday.

China’s dominance has prompted Europe to accelerate plans to secure alternatives. The EU’s Critical Raw Materials Act entered into force last year and includes proposals to recycle more rare-earth elements from used electronics. Europe’s electric-vehicle industry is also seeking supplies in other places such as Estonia.

In the US, MP Materials Corp., the sole US rare earths miner, plans to start commercial production of magnets later this year.

China’s customs data offers only a partial guide to the ongoing effects of export controls, which apply just to those magnets that contain specific heavy rare earths. The data isn’t broken down by type, and will also include products that don’t contain the heavy rare earths.

On the Wire

Venture capitalists in clean tech are starting to say out loud what they’ve suspected for a while: China’s dominance has left key sectors in the West uninvestable.

The Democratic Republic of Congo will allow some cobalt exports to resume from next month, as the world’s biggest producer of the metal said quotas would replace a months-long ban on shipments.

China’s shipments of rare-earth magnets to the US dropped in August, even as overall exports continued to rebound following a recent easing of Beijing’s restrictions.

Leave a Comment

Your email address will not be published. Required fields are marked *