Garden Reach Shipbuilders Surges On New Contracts; Technicals Flash Buy Signal

The analyst sees more upside with target prices up to ₹3,400.

Shares of Garden Reach Shipbuilders rose as much as 6% on Monday after the company signed five memoranda of understanding (MoUs) with partners in the shipbuilding, port, and infrastructure sectors.

Garden Reach Shipbuilders signed contracts with Deendayal Port Authority, Kandla, Syama Prasad Mookerjee Port Authority, Indian Port Rail & Ropeway Corporation, Shipping Corporation of India, and Modest Infrastructure.

The company also received an international order from Germany-based Carsten Rehder Schiffsmakler and Reederei for the design, construction, and delivery of four 7,500 deadweight tonnage (DWT) multi-purpose vessels.

The contract is valued at $62.44 million and is scheduled for completion within 33 to 42 months.

Technical Take

GRSE stock is attracting attention after a notable correction in the past three months, sliding from highs of ₹3,538 to around ₹2,300 before stabilizing, noted SEBI-registered analyst Prabhat Mittal.

Currently, the stock is trading around ₹2,719, holding above its 20, 50, and 100-day moving averages. The moving average convergence/divergence MACD indicator is also flashing a buy signal, suggesting momentum is turning favorable, Mittal noted.

He recommends taking up positions with upside targets of ₹3,200 and ₹3,400 in the short to medium term, with a stop loss below ₹2,400.

Retail Watch

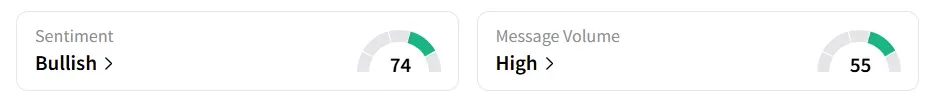

Retail sentiment for GRSE on Stocktwits has been ‘bullish’ for a month, prior to which, it was ‘neutral.’ GRSE was also among the top six trending stocks on the platform.

The stock has seen significant buying interest this year, gaining nearly 70%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

The most relevant Indian markets intel delivered to you everyday.