Gold Holds Near Record as Rate-Cut Hopes Draw Investor Demand

(Bloomberg) — Gold held near its latest record reached earlier Tuesday, with traders waiting for a speech from Federal Reserve Chair Jerome Powell for fresh insight into the central bank’s monetary policy path.

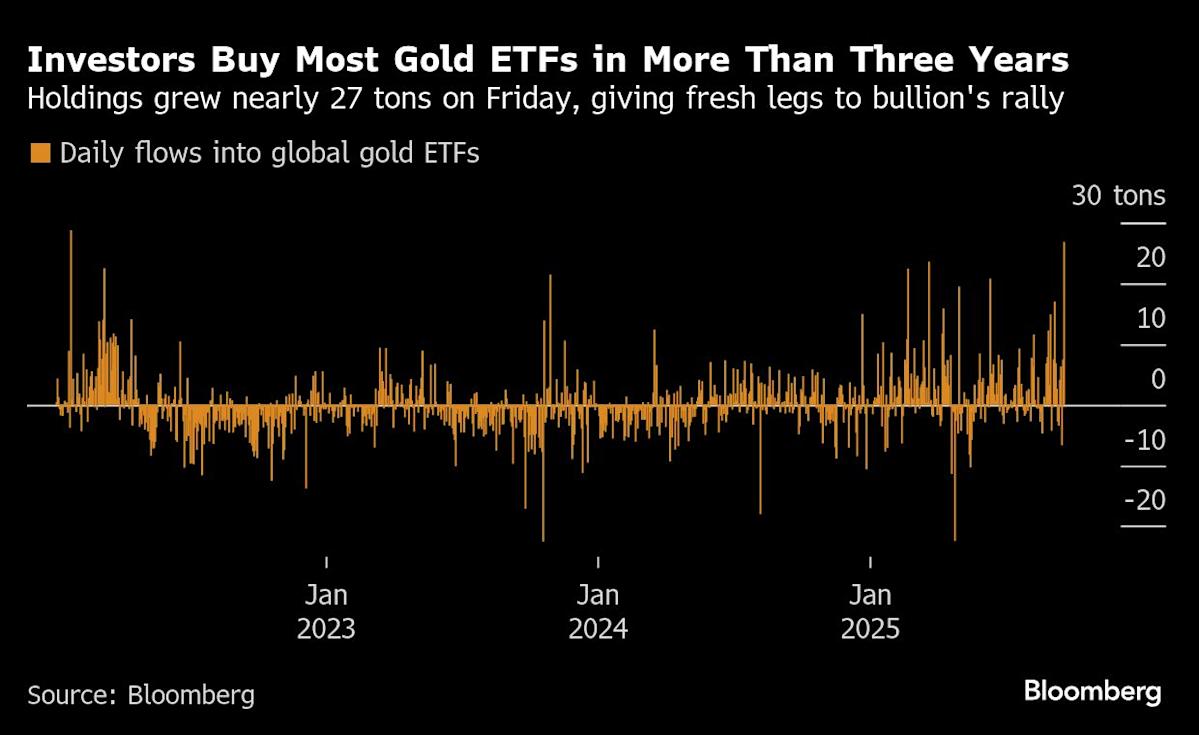

Bullion traded around $10 dollar shy of $3,759.23 an ounce, which marked the third consecutive trading day it’s reached the all—time high milestone. Investors have piled into exchange-traded funds — with holdings expanding at the fastest pace in more than three years on Friday — following a brief dip in prices last week as Powell curbed expectations for rapid easing. Lower rates benefit typically benefit non-interest bearing precious metals.

Invest in Gold

Most Read from Bloomberg

“After pulling back the day after the Fed’s 25 basis-point rate cut — potentially on some perceived caution in Powell’s FOMC comments — new upward momentum has taken root with ETF inflows still the driving force,” BMO Capital Markets analysts including Helen Amos and George Heppel said in a note late Monday. “With a rate-cutting cycle firmly on the table we think risk-reward remains positive for prices into” the fourth quarter.

Powell is due to give a highly anticipated speech on the economic outlook later on Tuesday, after the quarterly rate forecasts that accompanied last week’s rate decision — known as the dot plot — showed a wide dispersion of views. Meanwhile, several Fed officials on Monday reiterated the need for taking a cautious approach to rate decisions moving forward, including St. Louis Fed President Alberto Musalem who said that he sees limited room for more reductions amid elevated price pressures.

Silver, meanwhile, held a three-day rally near $44 an ounce. The cheaper precious metal has seen possible support from bullish options trades, with the daily volume of IShares Silver Trust options surging to 1.2 million on Friday — the highest since April 2024, with call options also spiking.

Gold and silver have been among the year’s best-performing major commodities on a broad confluence of supportive factors, as the Fed eases monetary policy, central banks bolster their reserve holdings, and lingering geopolitical tensions sustain a bid for havens. Major banks including Goldman Sachs Group Inc. have flagged their expectations for further gains.

Traders will also parse incoming data this week, including Friday’s US personal consumption expenditures price index. The Fed’s preferred measure of underlying inflation likely grew at a slower pace last month, which would boost the argument for rate cuts.

Leave a Comment

Your email address will not be published. Required fields are marked *