BEIJING (Reuters) -In a landmark interpretation, China’s top court recently reinforced that workarounds between employers and workers to evade social insurance contributions are invalid, a move that both promises to fund depleted pension plans and threatens jobs and businesses.

The response from some small business owners has been to offer new contracts without paying the company’s required social insurance contributions, highlighting how Beijing’s limited attempts toward boosting consumer demand remain beset by hard economic trade-offs.

Of 18 employees across China whom Reuters talked to, only three said their employers have been paying the company’s contributions. The rest said no contributions were being made. All requested not to be identified, fearing they could be fired or disciplined.

That suggests the Supreme Court ruling may fail to generate funding needed for more generous welfare to help China transition to a growth model that relies more on consumer demand and less on debt-driven infrastructure and industrial investment.

A 2019 Chinese Academy of Social Sciences (CASS) report warned that the national pension fund could run out by 2035 as the worker-to-retiree ratio declines. A 2024 update said that delaying retirement could push depletion back 8-9 years, easing but not solving the funding challenge.

China has signalled it is addressing industrial overcapacity at a time when factory margins are being squeezed by deflationary pressures and U.S.-China trade frictions. The policy mix leaves officials balancing near-term employment against longer-term reforms.

Falling home prices and weak household confidence have curbed spending, but financing a broader safety net means higher labour costs, which smaller firms say are impossible to absorb.

In some cases, employers are asking workers to sign contracts relabelling part of their salary as “social insurance subsidies” without increasing pay, workers told Reuters.

A survey of 6,689 firms in late August by human resources firm Zhonghe Group found only 34.1% of them were “fully compliant” with social insurance rules. Over the past year, 29.3% of the firms reported disputes with employees due to social insurance.

The Ministry of Human Resources and Social Security did not reply to a Reuters inquiry on whether there have been changes in the number of people enrolled in the social insurance system since early September.

‘THE COMPANY DOESN’T PAY’

China’s social insurance contributions typically equal about 10% of gross income for employees and roughly 25% for employers – covering pension, unemployment, medical, work injury and maternity benefits.

Some lower paid workers are not keen on contributing their personal shares, either, given concerns over weak wages, job security and the rising cost of living.

In the southwestern Guangxi region, a supermarket clerk said she was told to sign a new contract in late August that required her to “voluntarily” give up company-funded social insurance contributions and waive arbitration and the right to sue.

The document re-labelled 1,000 yuan ($140) of her existing pay as a “social insurance subsidy”, though it is not deducted from her paycheques. While she earns the same amount as before, no contributions are paid into her pension account.

“Since the company doesn’t pay for my social insurance, I don’t have any,” she said.

A real estate agent in Zhaoqing, in Guangdong province, described an identical change: 1,000 yuan of her 3,050-yuan monthly pay was rebranded as a “social-insurance subsidy” with no enrollment in the system.

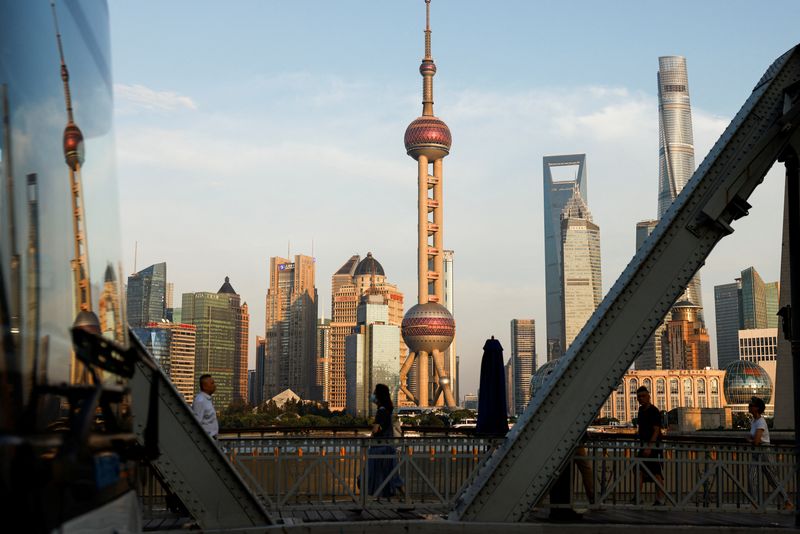

“This is illegal,” said Peng Shugang, a senior partner at China Commercial Law Firm’s Shanghai office.

He added China’s latest tax system enables real-time data sharing, including social insurance contributions, and can spot mismatches between wage declarations and contribution bases.

“Social insurance compliance will shift from ‘special inspections’ to ‘routine monitoring’, with violations detectable in real time,” he added.

Three exporters who wanted to attend the autumn Canton Fair this year told Reuters that exhibitors at the huge trade exhibition need to submit proof of social insurance contributions – a requirement the firms said was unprecedented.

The fair’s organisers confirmed the new rule but said exhibitors could provide alternative documentation, such as salary payment records for the past year, in lieu of contribution payments. They did not comment on the reasons behind the change.

A factory owner surnamed Ren in the manufacturing hub of Zhejiang province, employing 80 workers, told Reuters he is taking a wait-and-see approach. He pays social insurance for long-term permanent employees who want it but not for part-time or seasonal workers.

“We are waiting to see now what other companies do,” said the business owner, who asked to be identified only by his surname, Ren.

If authorities crack down hard, he said, “many businesses will go bankrupt. At the same time the country wants to reduce production capacity, so maybe that’s okay.”

Not all employers are ignoring the court ruling.

Wang Hu, owner of an outdoor wedding photography firm called Zhe Film in Yunnan province, decided to pay social insurance for his 70 employees starting from September. He estimated the cost at about one million yuan a year, or 20% of revenue.

“I worked for other people for 16 years. None of the bosses ever paid for my social insurance,” Wang said. “As orders boomed since last year, I now want to show gratitude and do something.”

($1 = 7.1247 Chinese yuan renminbi)

(Reporting by Ellen Zhang and Liangping Gao in Beijing and Casey Hall in Shanghai; Additional reporting by David Kirton in Shenzhen; Editing by Kim Coghill)

Leave a Comment

Your email address will not be published. Required fields are marked *