SEBI RA Financial Sarthis Picks These 4 Stocks With Bullish Setups

Fedbank Financial, Arvind Fashions, and Flair Writing’s shares have been boosted by a strong Q1 earnings report. MCX board is considering a stock split.

While the broader markets are choppy on Wednesday, struggling to hold above key support, several midcap and smallcap names are showing powerful breakout signals, backed by volume, structure, and momentum.

SEBI-registered Financial Sarthis has picked four such stocks with bullish setups.

Fedbank Financial Services

The stock has finally broken out of a long consolidation base at ₹133.14 after months of sideways movement. The breakout candle gained 7.18% on strong volume, signaling the start of a potential sustained uptrend, the analyst said.

With momentum now building, this stock is worth tracking for follow-through above the breakout level.

Fedbank Financial shares closed 7.2% higher on Tuesday after posting strong quarterly results. The stock is currently trading 1.5% lower at ₹129.99, potentially due to profit booking.

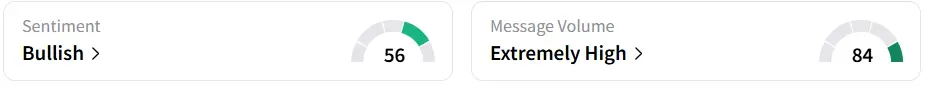

Retail sentiment on Stocktwits turned ‘bullish’, amid ‘extremely high’ message volumes. It was ‘neutral’ a day earlier.

Year-to-date, the stock has gained over 26%.

Arvind Fashions

Another stock that rallied on strong Q1 earnings. Arvind Fashions shares surged 12% intra-day after posting a 20% growth in core earnings driven by new store additions and a focus on premium product lines. Revenue rose to ₹1,107 crore, while profit after tax came in at ₹13 crore.

The price movement was accompanied by a surge in volume, Financial Sarthis noted. With Fibonacci levels aligned and momentum reignited, a move above today’s high could lead to continued upside in the near term, they added.

Arvind Fashions’ stock extended Tuesday’s gains and was up 3.16% at ₹555, having gained 8% YTD.

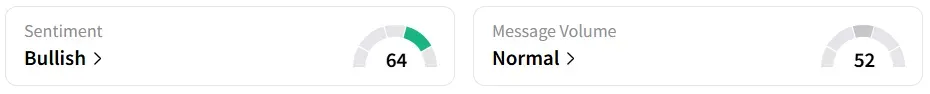

Retail sentiment on Stocktwits remained ‘bullish’. It was ‘neutral’ a month earlier.

Flair Writing Industries

The stock hit a 52-week high on Wednesday, extending Tuesday’s 7.6% gains, after the company posted a 9.2% increase in net sales and a 5.7% growth in net profit for the quarter ended June 30.

Flair Writing shares broke through its major resistance zone at ₹335.95, supported by strong volume action. This marks a classic base breakout and positions the stock well for trend-following strategies, especially for momentum traders eyeing higher levels, the analyst said.

YTD, the stock has gained nearly 24%.

Multi Commodity Exchange of India (MCX)

The stock is holding firm above its rising trendline, anchored volume weighted average price (AVWAP) support, and 50-day exponential moving average (EMA), the analyst said.

VWAP is a trading indicator that shows the average price of a security, weighted by volume, over a set period. AVWAP is a variation of the indictor.

After a healthy pullback in an ongoing uptrend, the stock appears to be setting up for a potential reversal. A bullish confirmation could make this a strong re-entry opportunity for positional traders, they added.

The company announced that the board will consider a stock split during a meeting on August 1.

At the time of writing, the shares were trading marginally higher at ₹7,847, having gained more than 25% YTD.

The most relevant Indian markets intel delivered to you everyday.

For updates and corrections, email newsroom[at]stocktwits[dot]com