AutoZone Inc (NYSE:AZO) Fits the Caviar Cruise Stock Screening Strategy for Quality Investing

The Caviar Cruise stock screening strategy is designed to find high-quality companies suitable for long-term, buy-and-hold investing. Inspired by quality investing principles, this method focuses on businesses with solid revenue and profit growth, strong returns on invested capital, reasonable debt levels, and steady cash flow generation. The strategy looks for companies that show not only past performance but also lasting competitive strengths and efficient operations.

AutoZone Inc (NYSE:AZO) appears as a candidate that fits these criteria well. Below, we review how the company meets the main requirements of the Caviar Cruise screen.

Revenue and Profit Growth

A key aspect of quality investing is steady growth in revenue and earnings. AutoZone’s 5-year revenue CAGR of 5.75% is above the screen’s minimum threshold of 5%, showing stable demand for its automotive parts and services. More notably, its EBIT growth (5Y CAGR of 11.32%) is higher than revenue growth, a sign of better operational efficiency and pricing strength. This is important because it indicates the company is growing profitably, likely due to economies of scale or a strong brand.

High Return on Invested Capital (ROIC)

ROIC shows how well a company generates profits from its capital investments. AutoZone’s ROIC (excluding cash, goodwill, and intangibles) is 36.24%, far above the 15% minimum required by the Caviar Cruise screen. This strong return suggests the company uses capital effectively, a trait of high-quality businesses. A consistently high ROIC often points to lasting competitive advantages, such as brand power or operational skill.

Strong Free Cash Flow and Debt Management

Quality investors favor companies that turn earnings into cash efficiently. AutoZone’s 5-year average profit quality (FCF/Net Income) of 105.17% means it produces more free cash flow than reported net income—a rare and positive feature. Also, its Debt/FCF ratio of 4.5 is within the screen’s acceptable range (below 5), meaning the company could repay its debt in under five years using current cash flows. While its liquidity ratios (current and quick ratios) are lower, the strong FCF generation reduces short-term solvency risks.

Profitability and Margins

AutoZone’s profitability metrics support its quality profile. The company has an operating margin of 20.06%, much higher than most peers in the specialty retail sector. Its gross margin of 53.13% is also among the best in the industry, reflecting pricing strength and cost control. These margins, along with stable or improving trends over time, suggest resilience against competition.

Valuation Considerations

While the Caviar Cruise screen does not set strict valuation rules, AutoZone trades at a P/E of 26.22, close to the S&P 500 average. Given its better profitability and growth potential, the premium may be reasonable for investors who prioritize quality over deep value.

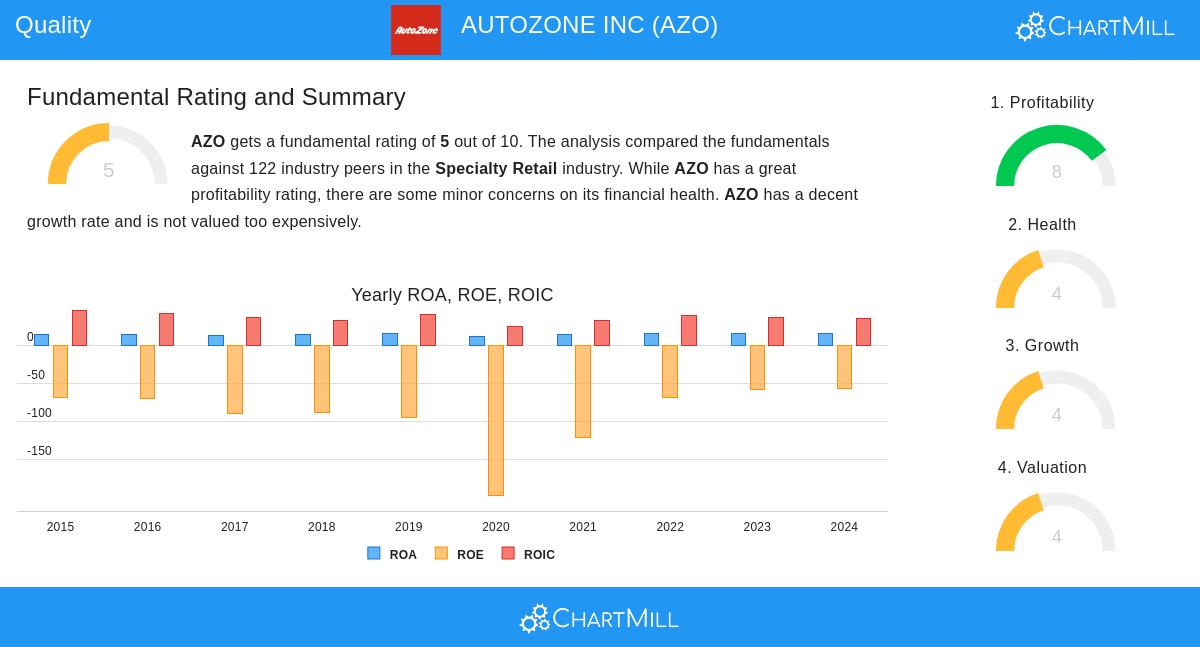

Fundamental Analysis Summary

AutoZone’s fundamental analysis report highlights its strong profitability (8/10 rating) but notes some liquidity concerns (4/10 health score). The company’s high ROIC, steady earnings growth, and solid cash flow generation outweigh its weaker short-term liquidity metrics, making it an attractive option for quality-focused investors.

Finding More Quality Stocks

For investors looking to identify other companies that meet the Caviar Cruise criteria, the full screen results can be found here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a financial advisor before making decisions.