CEO Says ‘Confident In Our Long-Term Outlooks’

GSK now expects turnover growth to be toward the top end of 3% to 5% and core earnings per share growth to be closer to 8% at constant exchange rate.

British drugmaker GSK Plc (GSK) on Wednesday announced that it now expects full-year earnings and turnover to be toward the top end of its guidance after its second-quarter earnings surpassed Wall Street expectations on strong sales of its specialty medicines.

The company now expects turnover growth to be toward the top end of 3% to 5% and for core earnings per share growth to be closer to 8% at constant exchange rate.

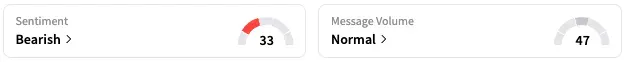

On Stocktwits, retail sentiment around GSK trended in the ‘bearish’ territory over the past 24 hours, while message volume dropped from ‘high’ to ‘normal’ levels.

CEO Emma Walmsley pegged the increase in guidance to another quarter of excellent performance, driven by the company’s specialty medicines segment.

“We also continue to make very good progress in research and development, with 3 major FDA approvals achieved so far this year, 16 assets now in late-stage development, and 4 more promising medicines to treat cancer, liver disease and HIV expected to enter Phase III and pivotal development by the end of the year. With all this, we now expect to be towards the top end of our financial guidance for 2025 and remain confident in our long-term outlooks,” the CEO said.

GSK is eyeing annual sales of over £40 billion ($53.28 billion) by 2031.

The company on Wednesday noted that its guidance is inclusive of tariffs enacted by the U.S. thus far and European tariffs indicated this week.

“We are positioned to respond to the potential financial impact of tariffs, with mitigation options identified. Given the uncertain external environment, we will continue to monitor developments,” the firm said.

For the second quarter, the company reported sales of about £8.00 billion, marking a growth of 6% at constant exchange rate and above an analyst estimate of £7.81 billion, according to data from Fiscal AI.

Specialty medicines sales rose 15% to £3.3 billion, thanks to double-digit sales growth in Respiratory, Immunology & Inflammation, Oncology, and HIV drugs at constant exchange rate.

Vaccine sales, meanwhile, rose 9% to £2.1 billion while general medicines sales fell 6%.

Core earnings per share came in at 46.5 pence in the three months through the end of June, up from an analyst estimate of 42 pence.

NYSE-listed shares of GSK are up by over 11% this year but down by over 5% over the past 12 months.

Read also: Humana Stock Gains On Upbeat Earnings And Raised Guidance, Draws Retail Praise

For updates and corrections, email newsroom[at]stocktwits[dot]com.

High Relative Strength, Low Social Following

(Exchange Rate: £1= $1.33)