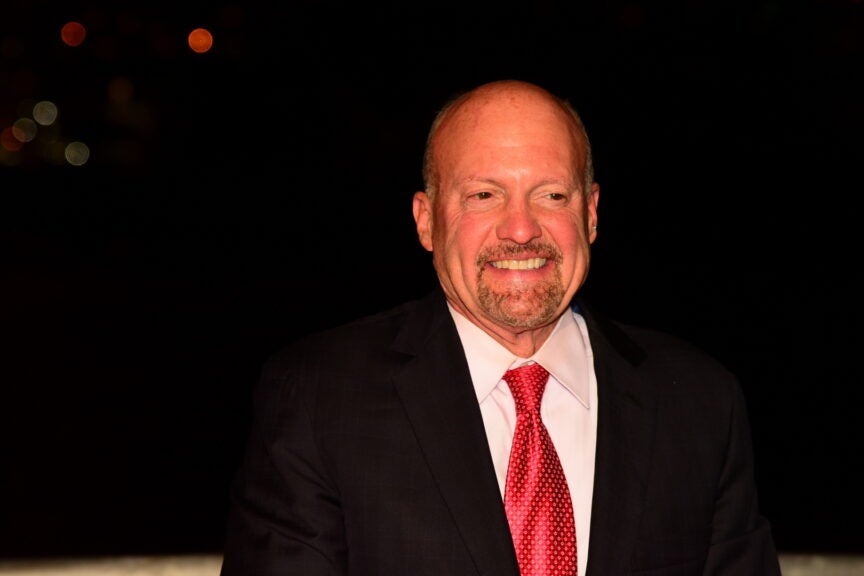

Jim Cramer Backs Elon Musk’s $1 Trillion Package: ‘Hate Him Or Like Him’ He’s ‘Really Smart’ And ‘Actually Worth It’ – Tesla (NASDAQ:TSLA)

Renowned TV host Jim Cramer weighed in on Tesla Inc.‘s (NASDAQ:TSLA) self-driving, robotics and AI push while also defending CEO Elon Musk‘s $1 trillion pay package.

Check out the current price of TSLA here.

Tesla Has The Best Self-Driving Alternative, Says Cramer

In a post shared on the social media platform X on Sunday by influencer Sawyer Merritt, which had an excerpt from Cramer from the Mad Money show, Cramer said that Musk’s EV giant had the “best self-driving alternative on a price basis.”

However, Cramer said that Tesla’s energy storage business could be a key driver for growth. “Musk has put AI to the test, and he recognized that if you could develop better and bigger, and stronger batteries, that might be the answer for our energy-starved country,” Cramer said. He also hailed Tesla’s Optimus robot, calling it “the most exciting part of Musk’s investible empire.”

“Hate him or like him, man, this guy’s real smart,” Cramer said, while also weighing in on Musk’s pay package, urging the company to give him the package “he wants” despite opposition from proxy advisors International Shareholder Services (ISS) and Glass Lewis. “Unlike so many other CEOs, he’s actually worth it,” Cramer said.

It’s worth noting that Cramer had earlier defended Musk’s pay packet in a post on the social media platform X, urging investors to “not be small-minded” and reiterated Tesla’s future roadmap, which involves robotics and autonomous vehicles.

Elon Musk Calls Proxy Advisors Corporate Terrorists

The comments came when Musk had criticized the proxy advisors on their opposition to his CEO compensation award, calling the firms “corporate terrorists,” in a post on social media. “ISS and Glass Lewis have no actual ownership themselves and often vote along random political lines unrelated to shareholder interests!” He said.

Musk had also defended his position as the CEO of the automaker, sharing that the EV company was worth more than all of its competitors in the auto industry. Tesla’s current market capitalization is over $1.4 trillion and the EV giant is the largest automaker in the world by market capitalization today.

Elon Musk Backtracks On Major Robotaxi Goal

During Tesla’s third-quarter earnings conference last week, the CEO shared that Tesla would be removing onboard safety operators from its Robotaxis in Austin by the end of 2025.

However, Musk backtracked on the promise of Robotaxis serving half the population of the U.S. by the end of the year, now saying that Tesla aims to offer Robotaxis across 8-10 major cities across the U.S. Tesla reported a revenue of $28.095 billion, beating the Wall Street estimates of $26.239 billion during its earnings call.

Robyn Denholm Defends Musk’s Pay Package

Tesla Board of Directors Chair, Robyn Denholm, defended Musk’s pay packet in a letter she wrote to Tesla investors. Denholm criticized the firms’ “one-size-fits-all” approach towards Tesla, saying that the approach doesn’t fit the automaker, which challenges the status quo.

Tesla scores well on Momentum, Quality and Growth metrics, but offers poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Photo courtesy: katz / Shutterstock.com

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: