2025 is shaping up to be the third consecutive year where the simplest way to produce market-beating returns is through megacap growth stocks — especially those with exposure to artificial intelligence (AI).

But the stock market cares more about where companies are headed than where they have been. And many investors are probably wondering how long the AI rally can last and if tech stocks have run up too far, and too fast.

Instead of chasing high-flying, unproven names, a better approach could be to turn to industry-leading companies like Dow Jones Industrial Average component Microsoft (MSFT +1.55%). Microsoft is up 21.9% year to date at the time of this writing compared to an 8.6% gain for the Dow. It has beaten the index over the last three-, five-, and 10-year periods.

With 16 consecutive years of dividend raises and plenty of levers to pull to reward shareholders, here’s why Microsoft has what it takes to continue outperforming the Dow and the S&P 500 for years to come.

An earnings-driven stock

A common investing mistake is assuming that a soaring stock is overvalued just because the price has run up over a short period. But stocks aren’t commodities, like a gallon of gas, where a lower price is always better for the consumer. Rather, they are dynamic assets because they represent a piece of ownership in something that is always changing.

Therefore, a better way to look at stock prices and valuation is by examining the relationship between financial results and expectations.

When great companies are inexpensive, the results can be decent and still fetch a favorable reaction. But when a stock is expensive, the results and forecast have to be excellent to justify further market-beating returns.

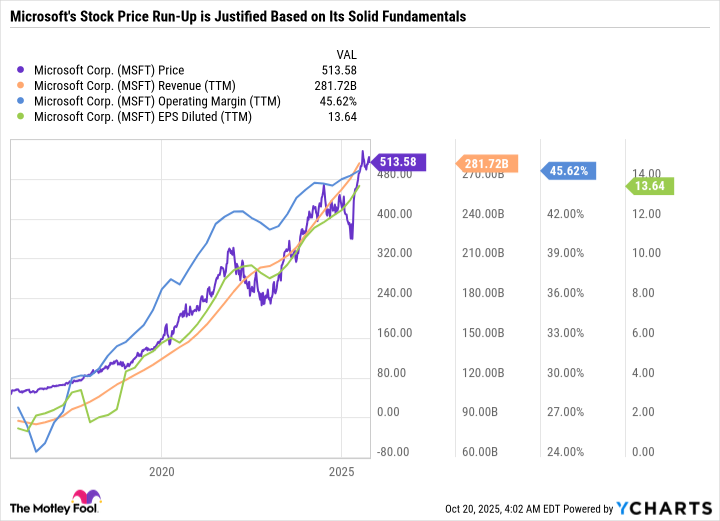

Over the last decade, Microsoft’s stock price has soared 826%, but its diluted earnings per share are also up 847%. The stock price is following earnings growth, not going up based on hype alone.

Microsoft is leveraging AI to expand its operating margin — allowing it to grow earnings faster than sales. That’s an incredible accomplishment considering Microsoft’s diversification. Too often, companies will expand outward at the expense of efficiency. But not Microsoft. It is a rare example of a tech company that has continued to innovate, tap into new markets, and make savvy acquisitions.

Microsoft is a good value

With the Nasdaq Composite up 110% in the last three years, investors won’t find a lot of dirt cheap high-quality growth stocks hiding in plain sight. When buying stocks near all-time highs, the best approach is to accept that the price may be high, but it could still be worth it in the long run if the underlying business is sound.

In fiscal 2025, which ended June 30, 2025, Microsoft grew revenue by 15%, net income and diluted earnings per share by 16%, and operating income by 17%. At 33 times forward earnings, Microsoft is a good value because its results are solid and they are repeatable. In other words, Microsoft’s future results aren’t based on one big idea paying off, but rather several different ideas working in concert.

In addition to the growth of the business, Microsoft returns a ton of capital to shareholders through its dividend and stock buybacks. The low dividend yield of 0.8% is more so a reflection of Microsoft’s outperforming stock price than a lack of raises — as Microsoft has increased its dividend by at least 9% per year for eight consecutive years.

A company you can count on, no matter what 2026 brings

Microsoft stands out as one of the best growth stocks to buy in 2026, especially for investors who are looking for a company they can be confident will persevere in the event of an economic or AI-specific slowdown. Its rock-solid balance sheet and globally diversified business segments should allow it to hold up relatively well during a downturn.

At the same time, Microsoft generates a ton of free cash flow that it can pour into its best ideas without taking on debt. It has the cushion needed to take risks and fail, which is especially important in the ever-changing tech sector.

All told, Microsoft makes a lot of sense for investors looking to invest in themes like AI and cloud computing without paying a price that depends on everything going right at once.