Medtronic PLC (NYSE:MDT): A Dividend Stock Analysis for Sustainable Income

For investors looking for dependable income, dividend investing is a key method for creating lasting wealth. One organized process involves searching for companies that provide appealing dividends and also have sound basic conditions. This system favors stocks with good profit measures, firm financial status, and maintainable dividend plans, making sure that income payments are supported by a workable business instead of a short-term yield lure. By concentrating on these linked elements, investors can find companies able to continue and possibly raise their dividends over the years.

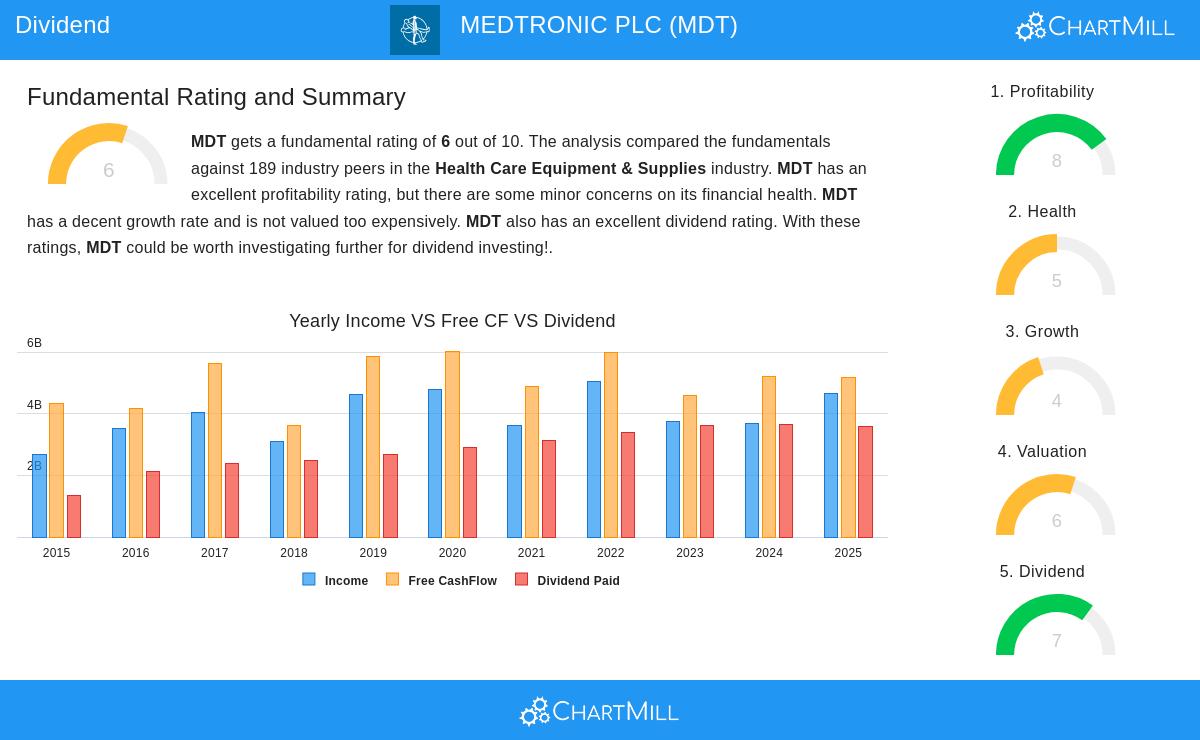

Dividend Sustainability and Yield

Medtronic PLC (NYSE:MDT) offers a strong example for dividend-oriented investors, reaching a ChartMill Dividend Rating of 7. This rating shows good dividend qualities while noting points for review. The company’s present yield and past regularity build the base of its attraction, while the payout ratio needs regular checking to judge long-term viability.

- Appealing Yield: MDT gives a dividend yield of 3.01%, which is higher than the industry average of 1.79% and the S&P 500 average of about 2.30%. This puts the company in a leading group of its field for income creation.

- Dependable History: The company has built a reliable record of payments, having not cut its dividend for at least ten years. This history gives trust in management’s dedication to giving capital back to shareholders.

- Maintainable Growth: With a five-year yearly dividend growth rate of 5.10%, MDT shows a habit of regularly rising payouts. This growth is aided by the fact that earnings are expected to grow quicker than the dividend, improving the viability of future raises.

- Payout Ratio Review: The present payout ratio is 77.27%, which is on the higher side and indicates that a large part of income is used for dividends. While this is not a direct warning, it is a measure that deserves continuous attention to make sure it does not limit the company’s financial options.

Profitability Supporting Dividend Payments

A company’s skill to produce steady profits is basic to its ability to pay dividends. Medtronic’s ChartMill Profitability Rating of 8 shows a good operational result that gives a firm base for its dividend plan. This high degree of profitability is key as it creates the extra cash required to pay for dividend payments without hurting the business’s condition.

- Good Return Measures: The company shows efficient use of capital with a Return on Equity of 9.73% and a Return on Invested Capital of 6.74%, both numbers doing better than a large part of industry competitors.

- Sound Margins: MDT keeps a solid Profit Margin of 13.63% and an Operating Margin of 19.57%, putting it in the top group of its industry. These good margins give a buffer against economic drops and aid steady earnings.

- Cash Flow Creation: A past of positive cash flow from operations verifies that the company’s profits are being turned into actual cash, which is what finally pays for dividend payments to shareholders.

Financial Health and Stability

For dividend investors, a company’s financial health is essential, as it makes sure the business can survive economic changes without risking its dividend. Medtronic gets a ChartMill Health Rating of 5, showing a sufficient but varied financial state. This middle score points out the value of a balanced screening method that steers clear of companies with serious financial problems while still permitting those with acceptable debt levels.

- Sufficient Liquidity: The company shows a Current Ratio of 2.01 and a Quick Ratio of 1.50, indicating it has enough short-term assets to meet its quick liabilities.

- Acceptable Debt Level: With a Debt-to-Equity ratio of 0.55, MDT uses a middle amount of debt financing. While this is more than some competitors, it is not seen as too high for a big, steady company.

- Solvency State: An Altman-Z score of 2.94 puts the company in a steady, though observant, place regarding bankruptcy risk, and it does better than many in its industry on this measure.

A more detailed breakdown of these basic factors is available in the full Medtronic Fundamental Analysis Report.

Medtronic PLC is a clear model of the kind of company a strict dividend screening process tries to find. It joins an appealing and rising yield with the profitability required to back it and a financial health picture that, while not ideal, is enough for a large, well-set company. The company’s good market place in the medical technology field adds a level of defensive steadiness to its income offer.

For investors wanting to do their own study and find other companies that fit similar standards for profitability, health, and dividend quality, the Best Dividend Stocks screen gives a good beginning point for more review.

,

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an offer to provide investment advisory services. All investment decisions involve risk, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.