Bitcoin Moves Above $111,000 After Trump Says Trade Deal With China ‘Pretty Soon’ After Summit With Xi

- The apex cryptocurrency was still down 2% at around $110,000, but regained ground from earlier lows, according to CoinMarketCap data.

- “I guess on the scale from 0 to 10, with ten being the best, I would say the meeting was a 12.” — Trump.

- Digital assets and equities declined after Federal Chair Jerome Powell doused expectations of another rate cut this year.

Bitcoin trimmed some of its earlier losses after President Donald Trump lowered tariffs on China by 10% and hinted at an impending trade deal, but remained down 2% at around $111,200. Ethereum also fell 2%, and XRP was down nearly 2%, while Solana edged slightly higher.

“I guess on the scale from 0 to 10, with ten being the best, I would say the meeting was a 12,” Trump said, according to an AP News report. “I think it was a 12.” The U.S also agreed to lower the 20% tariffs imposed on China over fentanyl flows to 10%, effectively reducing the U.S. tariff rate on Chinese goods to 47% from 57%.

Trump stated he could sign a trade deal with China “pretty soon” as the two sides do not have major “stumbling blocks.” Trump also said he would visit China in April, and that Xi would come to the U.S. “some time after that.” The U.S. and China also agreed to a one-year deal on rare earths, which would be renegotiated each time it is renewed.

Fed’s Hawkish Stance Weighs On Digital Assets

The Federal Reserve lowered benchmark interest rates by 25 basis points on Wednesday. But digital assets and equities declined after Federal Chair Jerome Powell doused expectations of another rate cut this year.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it,” Powell said, before adding that there was “a growing chorus now of feeling like maybe this is where we should at least wait a cycle” before the next move.

“Powell said inflation is still making people unhappy; it’s a clear sign the Fed’s still concerned about inflation,” said investor Ted Pillows.

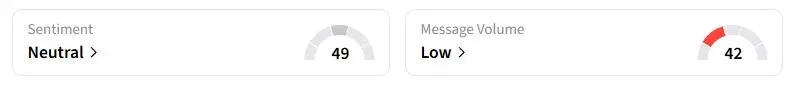

Retail sentiment on Stocktwits about Bitcoin was in the ‘neutral’ territory at the time of writing.

One trader said Bitcoin would soon return to $114,000.

Fidelity’s Solana ETF On The Way

Fidelity amended its S-1 filing for its spot Solana ETF by removing the “delaying amendment”, following the likes of Bitwise and Canary Capital. The rule allows securities to go live 20 days after an amended filing, even without the Securities and Exchange Commission’s approval, especially during a federal shutdown.

Also See: Rare Earth Stocks In Spotlight After Trump-Xi Agree To Critical Minerals Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.