NIKE INC -CL B (NYSE:NKE) Presents a Compelling Case for Dividend Investors

In the search for reliable dividend-paying stocks, many investors use systematic screening methods that prioritize both income generation and fundamental strength. One effective method involves filtering for companies with strong dividend characteristics while keeping good profitability and financial health metrics. This strategy helps identify businesses able to maintain and possibly grow their dividend payments over time, rather than just seeking the highest current yields. By focusing on these combined factors, investors can build a portfolio of dividend stocks with a lower risk of payout reductions during economic downturns.

Dividend Profile Assessment

NIKE INC -CL B (NYSE:NKE) presents several positive characteristics for dividend-focused investors. The company’s dividend profile shows a balanced combination of yield, growth, and reliability that fits well with long-term income strategies.

- Current dividend yield of 2.30%, slightly above the S&P 500 average

- Strong 10.70% annual dividend growth rate over recent years

- Record of maintaining or increasing dividends for more than a decade

- Steady payment history showing management’s commitment to shareholders

The company’s dividend growth path is especially notable, as it greatly exceeds inflation and provides real income growth for investors. This steady annual increase pattern shows the company’s confidence in its future cash flow generation and commitment to returning capital to shareholders. For dividend investors looking for both current income and future income growth, this mix of yield and growth represents an appealing profile.

Profitability and Financial Health

Beyond the dividend details, NIKE shows the fundamental strength needed to support ongoing dividend payments. The company keeps good profitability metrics and financial health indicators that point to continued ability to fund shareholder returns.

- Return on Equity of 21.50%, doing better than 77% of industry peers

- Profit Margin of 6.23% ranking in the top quartile of the industry

- Current Ratio of 2.19 indicating strong short-term liquidity

- Altman-Z score of 4.37 showing very low bankruptcy risk

These metrics are important for dividend investors because profitable companies with strong balance sheets are in a better position to maintain payouts during economic challenges. The company’s above-average returns on capital point to efficient operations, while the healthy liquidity position ensures it can meet both operational needs and dividend obligations without difficulty. This financial strength lowers the risk of dividend cuts that often happen when companies face profitability or liquidity pressures.

Valuation and Growth Considerations

While the dividend characteristics and fundamental strength present a positive case, investors should consider the stock’s current valuation and growth prospects within their overall assessment. The company trades at premium valuation multiples compared to both the broader market and some industry peers, though this may be reasonable by several factors.

- P/E ratio of 33.51 above the S&P 500 average of 26.76

- Expected earnings growth of 17.01% annually in coming years

- Revenue growth projection of 4.91% moving forward

- Payout ratio of 80.59% needing monitoring for sustainability

The high payout ratio deserves attention, as it nears levels that may restrict future dividend growth if earnings stagnate. However, the company’s expected earnings growth could help bring this ratio to a more normal level over time. For dividend investors with longer time horizons, the combination of strong brand positioning, global scale, and expected earnings expansion may make accepting a higher valuation for this quality company reasonable.

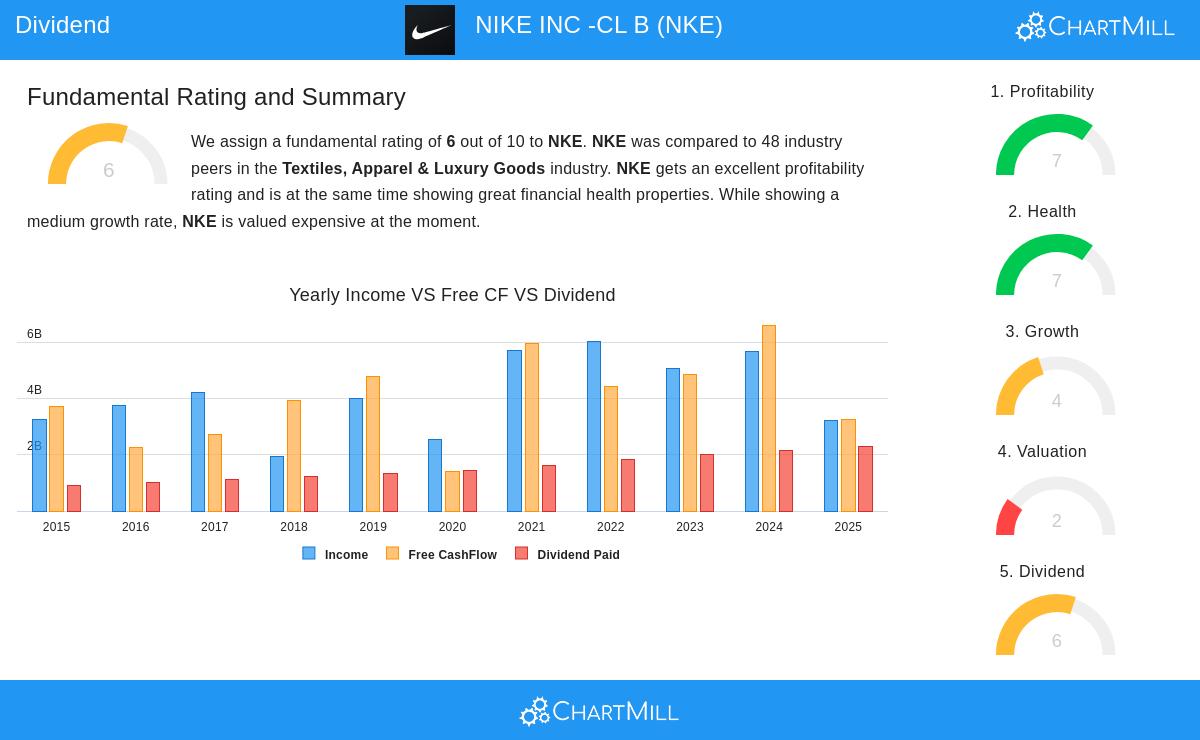

Detailed Fundamental Analysis

The detailed fundamental report provides extra context for evaluating NIKE’s suitability for dividend portfolios. The report assesses five critical dimensions of the company’s fundamentals, offering a complete view beyond dividend metrics alone. This detailed analysis helps investors understand how the dividend fits within the wider business context and whether current payment levels appear sustainable given the company’s overall financial position and market standing.

For investors looking for more dividend stock ideas screened using a similar method, the Best Dividend Stocks screener provides regularly updated results based on dividend quality, profitability, and financial health criteria.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial guidance, or recommendation to buy or sell any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results, and dividend payments are subject to change based on company decisions and financial conditions.