DR HORTON INC (NYSE:DHI): A Strong Dividend Stock for Long-Term Investors

Investors looking for dependable dividend income frequently use methodical screening processes to find companies with the ability to sustain their payouts. One useful method includes selecting for stocks with good dividend ratings while also meeting acceptable profitability and financial condition measures. This tactic helps steer clear of high-yield situations where unmaintainable dividends are frequently linked with fundamental business issues. By concentrating on companies with sound basic qualities, investors can establish holdings in businesses able to continue and increase their payments over the long term.

Dividend Profile Analysis

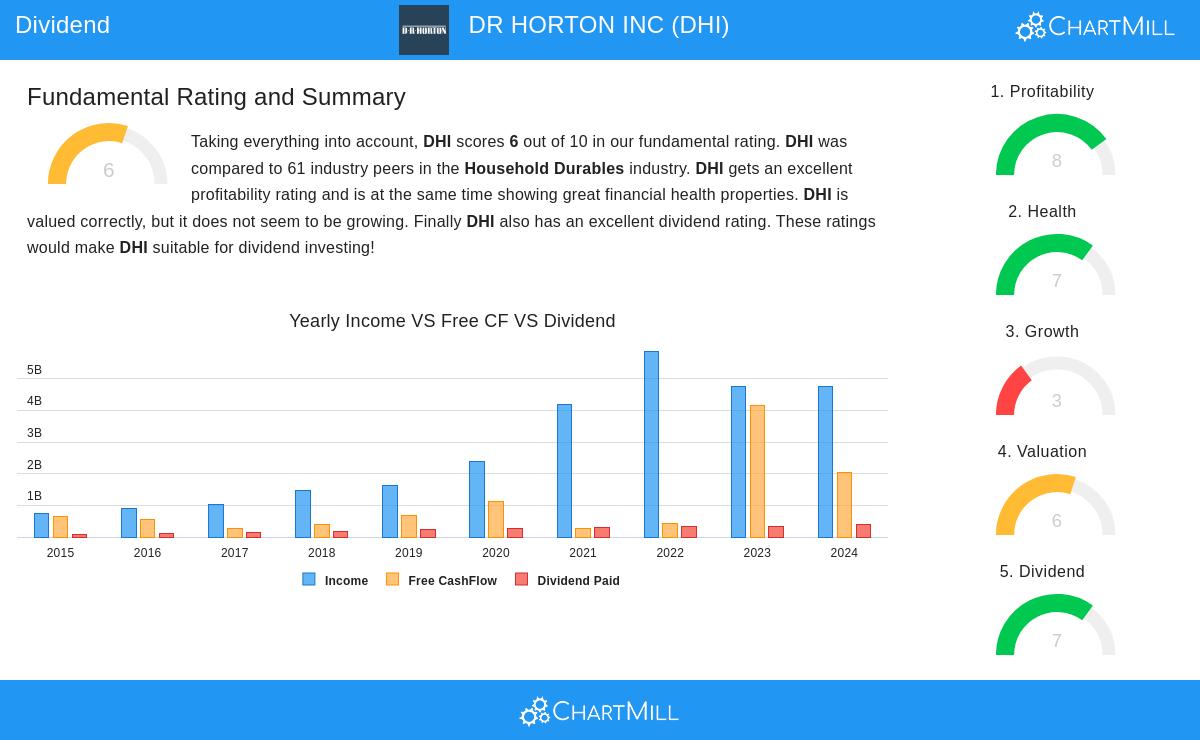

DR HORTON INC (NYSE:DHI) offers a strong argument for dividend-oriented investors, receiving a ChartMill Dividend Rating of 7 out of 10. The company displays a number of traits that dividend investors usually look for:

- Dividend Growth: The company has raised its dividend at a notable yearly rate of 14.84% over recent years, greatly exceeding inflation and delivering real income growth

- Payment Consistency: Having at least 10 years of continuous dividend payments and no decreases in that time, DHI has built a dependable history of giving capital back to shareholders

- Sustainable Payout: Just 11.96% of earnings are used for dividend payments, providing significant capacity for continuing distributions in economic declines

The mix of good dividend growth and a low payout ratio speaks to main considerations for dividend investors, as it shows both income growth possibility and lessened chance of dividend reductions in difficult times.

Profitability Foundations

The company’s good dividend traits are backed by strong business performance, receiving a ChartMill Profitability Rating of 8. A few measures are particularly notable:

- Margin Strength: Operating margin of 15.48% is better than 88.52% of industry counterparts, while profit margin of 11.46% is higher than 90.16% of competitors

- Efficient Capital Use: Return on invested capital of 12.73% is above 80.33% of industry participants, showing productive use of shareholder capital

- Historical Performance: The company has reported positive earnings in four of the last five years with steady operational cash flow production

These profitability measures are important for dividend continuity, as they show the company’s capacity to produce enough earnings to finance both business activities and shareholder returns without weakening financial soundness.

Financial Health Assessment

DHI holds a ChartMill Health Rating of 7, indicating a stable financial condition that backs continued dividend obligations:

- Debt Management: A debt-to-equity ratio of 0.30 shows careful borrowing, while having no outstanding debt places the company well within its industry

- Solvency Strength: An Altman-Z score of 5.54 points to low bankruptcy chance and is better than 81.97% of industry rivals

- Liquidity Position: Although quick ratio measures indicate some softness, the company’s good solvency and profitability offer balancing elements for handling immediate liabilities

For dividend investors, this financial condition summary lowers the chance that economic declines or short-term difficulties would lead to dividend decreases, as the company keeps suitable reserves to endure business cycles.

Valuation Context

With a price-to-earnings ratio of 12.88, DHI seems fairly priced relative to industry norms and much lower than S&P 500 multiples. The forward P/E of 11.89 implies the market could be underestimating the company’s earnings growth possibility of about 20.46% per year. This valuation picture gives dividend investors a chance to obtain a quality income producer without paying high multiples.

Growth Prospects

Even though the last year’s earnings displayed a decline, the company keeps a positive long-term EPS growth of 12.86% per year. More significantly, analysts forecast faster EPS growth of 18.90% per year going forward, supported by anticipated revenue growth of 7.34%. This growth path supports future dividend raises while keeping the careful payout ratio.

The detailed fundamental analysis report gives more information on these measures and their consequences for dividend continuity.

For investors looking for comparable dividend chances, the Best Dividend Stocks screen provides a methodical way to find companies with good dividend traits supported by healthy basic qualities.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial analysis, or recommendation to buy or sell any securities. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and dividend payments are subject to company discretion and market conditions.