Although the market is mostly concerned with what’s going on in the short term, individual investors should be more focused on what’s going on over the long term. Being able to hold fantastic companies without needing to worry about quarter-to-quarter performance is an advantage individual investors have over larger institutions. So, investors should always be on the hunt for companies that will be long-term winners.

Two tech stocks that I think are fantastic buy-and-hold for the long term are Taiwan Semiconductor (TSM 0.95%) and Meta Platforms (META +0.50%). Both companies are dominant in their industries, and I think they make for great stocks to buy and hold today.

Image source: Getty Images.

Taiwan Semiconductor

Taiwan Semiconductor is the leading semiconductor manufacturing firm. Its chips are used in nearly every high-powered computing device, ranging from laptops to self-driving cars to cutting-edge artificial intelligence computing units. Although Nvidia (NVDA +0.04%) has been the leader in AI computing units so far, nothing is stopping Broadcom (AVGO 1.73%) or AMD (AMD 1.91%) from taking massive market share. However, these computer hardware manufacturers get their chips from one primary source: Taiwan Semiconductor.

Taiwan Semiconductor Manufacturing

Today’s Change

(-0.95%) $-2.74

Current Price

$286.50

Key Data Points

Market Cap

$1486B

Day’s Range

$277.13 – $287.88

52wk Range

$134.25 – $311.37

Volume

16M

Avg Vol

13M

Gross Margin

58.06%

Dividend Yield

0.01%

An investment in Taiwan Semiconductor is a bet that we’re going to use more advanced chips in greater quantities, which seems like a no-brainer bet. Furthermore, TSMC has some innovative technologies launching that will help solve part of the AI computing energy crisis. Taiwan Semiconductor’s 2nm (nanometer) chip nodes excel in energy usage reduction, as these chips consume 25% to 30% less power when configured to run at the same speed as previous generations. This is a big deal, as energy consumption is starting to become a bottleneck in building out the computing capacity that’s needed. This new chip generation isn’t going to come for free, giving Taiwan Semiconductor a revenue boost.

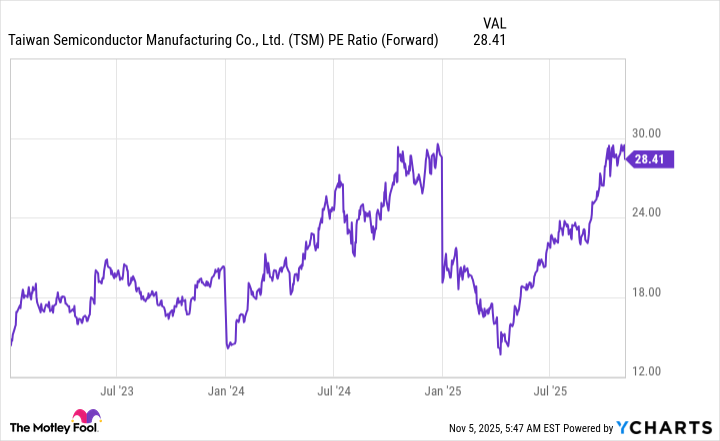

TSMC isn’t as cheap as it used to be, with the stock trading for 28 times forward earnings. However, that’s the same valuation it was trading at at the end of 2024, so this isn’t an unheard-of valuation level.

TSM PE Ratio (Forward) data by YCharts

Still, I think this premium price tag is worth paying because of TSMC’s position within the semiconductor space. It’s a great stock to buy and hold, as it is slated to capitalize on all of the computing trends that will emerge over the next few years.

Meta Platforms

Meta Platforms is the parent company of social media sites like Facebook and Instagram. Although Meta is actively trying to launch products that diversify its revenue stream and allow it to break into the hardware industry, it’s really just an advertising business at its core.

The problem is, the market doesn’t like how much Meta Platforms is spending on its other endeavors. During its Q3 earnings announcement, Meta Platforms noted that its capital expenditures dollar growth will be “notably larger” in 2026. Considering they expect to spend between $70 billion and $72 billion in 2025 after spending $39.2 billion in 2024, this is a concern for many investors.

Meta is going beyond just spending all of its free cash flow on AI data centers. However, even if they overbuild, I think there is a lot that Meta can do with this excess computing power, so it won’t be a big deal in the long run.

Furthermore, Meta expects these investments to continue to drive meaningful ad revenue growth. Considering that Meta grew revenue 26% year over year to $40.6 billion, that’s a notable statement being overshadowed by their spending plans.

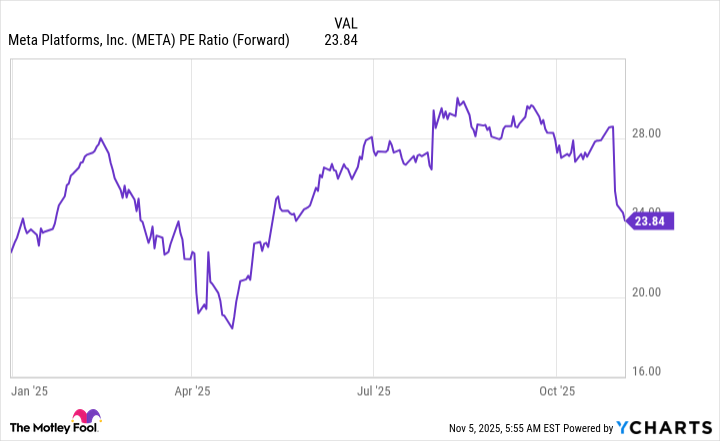

This is a classic case of the market being concerned over short-term effects versus long-term benefits, and I believe now is an excellent time to scoop up Meta shares while they’re cheap.

META PE Ratio (Forward) data by YCharts

I think Meta is a great buy right now, but investors will need to stay patient to reap the benefits of buying today.