Carnival (CCL +0.33%) (CUK +0.72%) has gone through its worst and best times in recent years. The world’s biggest cruise operator saw revenue plunge during early pandemic days as it was forced to halt sailings, and this led to annual losses and increasing debt. But as Carnival set sail once again, it made major moves to turn things around — from introducing more fuel-efficient ships to inspiring travelers to spend more on board — and those efforts have been paying off.

The company has returned to profitability and may be heading for its best days ever in the quarters and years to come. There are many reasons to buy Carnival like there’s no tomorrow, but let’s consider the three biggest.

Image source: Getty Images.

1. An impressive recovery and growth story

As mentioned, Carnival experienced turbulent times just a few years ago. But the company made efforts to turn things around, and the plan worked, as we can see through recent earnings reports. Carnival has reached many records, including the following in the latest reporting period: record adjusted net income of $3.1 billion for the full year 2025, record revenue of more than $26 billion, and record high operating income of $4.5 billion.

Carnival also expects adjusted net income for the coming year to surpass that of 2025. And there’s reason to be optimistic about Carnival reaching its goals as booking trends show travelers are flocking to the company’s cruises, even at higher price levels. For example, the 2026 cumulative advanced booked position is in line with that of this year, and in the latest quarter, the company reported record customer deposits.

Today’s Change

(0.33%) $0.10

Current Price

$30.82

Key Data Points

Market Cap

$40B

Day’s Range

$30.70 – $31.01

52wk Range

$15.07 – $32.89

Volume

9.3M

Avg Vol

21M

Gross Margin

29.62%

2. Solid work on paying down debt

As I noted earlier, Carnival built up a wall of debt to stay afloat (excuse the pun) during the early stages of the coronavirus crisis. But the company made paying down this debt and returning to investment grade credit ratings a priority. Carnival also wisely focused on paying down variable rate debt, making it less vulnerable to any potential higher interest rate environment.

CCL Total Long Term Debt (Quarterly) data by YCharts

The company said during the recent quarterly report that it’s cut its debt by more than $10 billion since the peak about three years ago. With a net debt to adjusted EBITDA ratio of 3.4x for the current year, Carnival reached investment grade with Fitch Ratings and is one step away from investment grade at S&P. (S&P recently lifted its view on Carnival to “positive” from “stable.”)

In fact, Carnival has improved its financial situation so much that it reinstated a dividend in the latest quarter. So investors have reason to be confident about the company’s financial health moving forward and may benefit from passive income too.

3. The stock is cheap

Carnival shares have rewarded investors this year, advancing 23% and slightly outperforming the S&P 500. But those gains haven’t pushed Carnival stock into expensive territory. The stock, trading at about 12x forward earnings estimates, down from more than 16x late last year, looks very reasonably priced right now considering its financial performance in recent quarters and its long-term prospects.

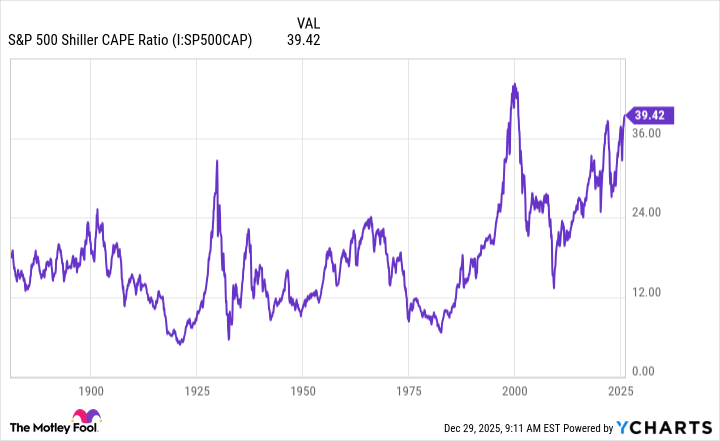

The shares look particularly interesting against today’s market backdrop. Overall, stocks in the S&P 500 are trading at one of their most expensive levels ever, as we can see through the S&P 500 Shiller CAPE ratio.

S&P 500 Shiller CAPE Ratio data by YCharts

This metric looks at earnings per share in relation to stock prices over a 10-year period — since this allows for shifts in economic growth, this measure offers us a clear picture of valuation.

The Shiller CAPE ratio reached beyond 39 recently, something it’s only done once before in the entire history of the S&P 500. So, in today’s market, Carnival stands out as a company that’s delivering growth but is not overvalued — and this, along with the other two points I mention here, makes it a stock to buy like there’s no tomorrow.