You Can Soon Trade NVDA, TSLA, META, GOOGL Futures As CME Expands Playbook

The move allows traders to own a stake in mega-cap firms like Nvidia, Tesla, Meta and Alphabet, without owning the underlying shares.

- CME Group plans to launch financially settled single-stock futures this summer, pending regulatory approval.

- The move allows traders to take positions in more than 50 major U.S. stocks, including Nvidia, Tesla, Meta Platforms and Alphabet.

- CME reported 2025 futures and options average daily volume of 7.4 million contracts and open interest of 9.8 million.

CME Group, Inc. (CME) plans to let traders take futures positions in Nvidia, Tesla, Meta Platforms and Alphabet, expanding its equity derivatives lineup beyond index-linked products and into individual megacap stocks.

CME Plans Single-Stock Futures

The exchange said it expects to launch financially settled single-stock futures beginning this summer, subject to regulatory approval. The contracts will cover more than 50 leading U.S. stocks from the S&P 500, Nasdaq-100 and Russell 1000.

Tim McCourt, CME’s Global Head of Equities, FX and Alternative Products, said the contracts would offer investors “an alternative way to gain exposure to individual leading U.S. stocks,” while also allowing them to hedge potential price movements without owning the underlying shares.

Equity Derivatives Demand Remains Strong

CME pointed to growth in equity derivatives trading as a key driver for the launch. In 2025, futures and options average daily volume reached 7.4 million contracts, while open interest climbed to 9.8 million contracts. Futures-only average daily volume rose 15% year over year to 6 million contracts, and average open interest increased 19% to a record 5.6 million contracts.

The exchange said demand has been growing across both institutional and retail participants.

Megacap Tech Still Drives S&P 500 Moves

The planned launch comes as U.S. equity markets grapple with heavy reliance on megacap technology stocks for index-level performance. Energy and materials stocks are up 22% and 17%, respectively, so far this year, while consumer staples are up 12%. Despite those advances, the S&P 500 has risen only about 1.7% over the same period.

The average valuation of the six largest U.S.-based technology companies, which are Nvidia, Apple, Alphabet, Microsoft, Amazon, and Meta Platforms, stands at $3.3 trillion.

The imbalance becomes clearer in day-to-day index moves. Despite Exxon’s roughly 25% gain so far this year, its contribution to the S&P 500 has been modest, adding only a few index points even on strong sessions. By contrast, a 1% move in Nvidia alone adds more than five points to the index, with Apple and Microsoft contributing several points each. Taken together, a 1% rise across the six largest technology stocks can lift the S&P 500 by nearly 20 points, according to a Barron’s report.

How Did Stocktwits Users React?

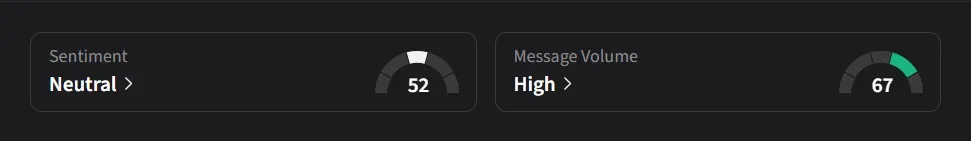

On Stocktwits, retail sentiment for CME was ‘neutral’ amid ‘high’ message volume.

One user said, “Always a sign of the end when a plethora of new ‘innovative’ financial products get spun out from the Wall Street greed machine.”

Another user noted that the move to launch single-stock futures aims to “effectively capture the retail ‘active trader’ market that’s tired of PDT [pattern day trader] rules and limited hours.”

CME stock has risen 29% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.