Natural Grocers by Vitamin Cottage (NYSE:NGVC) Screens as a Peter Lynch-Style GARP Investment

Natural Grocers by Vitamin Cottage (NYSE:NGVC) has appeared through a screening process based on the investment philosophy of legendary fund manager Peter Lynch, who emphasized identifying companies with lasting growth, fair valuations, and good financial condition. Lynch’s approach, detailed in his book One Up on Wall Street, focuses on long-term holdings in businesses that are easy to understand, financially solid, and trading at prices that do not overstate their future potential. This strategy mixes parts of both growth and value investing, looking for firms that can provide steady returns without high risk or inflated expectations.

Growth and Valuation Metrics

A main part of Lynch’s method is looking at growth compared to price, mainly through the PEG ratio, which changes the P/E ratio for earnings growth. Natural Grocers is notable with a PEG ratio of 0.68, much lower than Lynch’s threshold of 1, showing the stock may be fairly priced given its past growth. Supporting this, the company has shown a strong five-year EPS growth rate of 28.65%, well within Lynch’s target range of 15–30% for lasting expansion.

Key metrics include:

- PEG Ratio: 0.68 (below 1, suggesting undervaluation relative to growth)

- EPS Growth (5Y): 28.65%

- P/E Ratio: 19.43

These numbers indicate that Natural Grocers has not only increased at a good speed but also trades at a valuation that Lynch would probably find acceptable, avoiding the mistake of paying too much for fast growth.

Profitability and Financial Health

Lynch favored companies with high returns on equity and low debt, making sure they were both profitable and strong. Natural Grocers does very well in profitability, with an ROE of 21.56%, much higher than the 15% minimum Lynch supported. This shows efficient use of shareholder money and an ability to produce earnings without too much borrowing. The company’s debt-to-equity ratio of 0.21 is not only below the screener’s limit of 0.6 but also matches Lynch’s personal choice for ratios under 0.25, showing a careful balance sheet with little need for loans.

Additional financial strengths:

- Return on Equity (ROE): 21.56%

- Debt-to-Equity: 0.21

- Current Ratio: 1.02 (meeting Lynch’s liquidity requirement)

While the current ratio is only a bit above 1, showing enough short-term liquidity, the company’s overall ability to pay debts, shown by a good Altman-Z score, gives confidence that it is financially secure.

Fundamental Summary

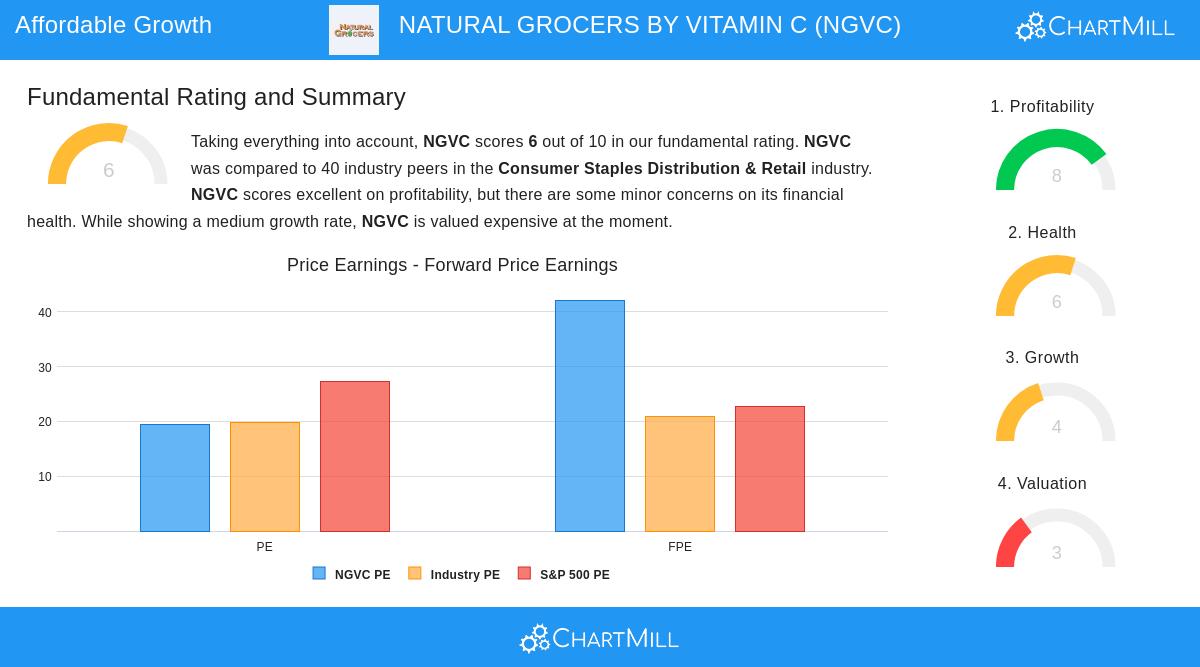

A full fundamental analysis rates Natural Grocers at 6 out of 10, showing a varied but mostly good profile. The company scores well in profitability, doing better than most industry competitors in measures like operating margin and return on invested capital. However, it has some issues with liquidity ratios and current valuation levels. Growth has been good in the past, though a lack of future estimates makes upcoming predictions less certain. Overall, the fundamental view supports the idea of a company with solid operations and managed growth, fitting nicely within Lynch’s model.

Suitability for GARP Investors

For investors looking for growth at a fair price, Natural Grocers is a strong case. Its good past earnings growth, combined with a PEG ratio showing undervaluation, matches the GARP approach. The company’s focus on natural and organic retail places it in a consistently growing market, while its careful financial management, low debt, high profitability, lowers downside risk. Lynch’s strategy stresses keeping such companies for the long term, letting compounding growth overcome short-term market changes.

Natural Grocers may not be a widely followed or exciting name, but that is frequently where Lynch discovered his top opportunities: in well-managed businesses increasing steadily without too much debt or high valuations.

For readers wanting to look into other companies that fit this strategy, more screening results are available here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research or consult a financial advisor before making investment decisions.