Dexcom Stock Plunges 13% After-Hours As Q3 Margin Pressures Eclipse Record Profit — Retail Sees ‘Buy The Dip’ Setup

- Investors focused on Dexcom’s lower gross margin of 61.3%, down about 170 basis points year-over-year, despite record revenue and earnings.

- The company said elevated scrap and freight costs would continue to pressure margins in the near term, even as efficiency improvements are underway.

- Some retail traders viewed the decline as a buying opportunity, calling the after-hours drop “uncalled for.”

Dexcom shares slid 13% in after-hours trading on Thursday, as investors looked past a record third-quarter (Q3) profit and focused instead on rising costs and a cautious outlook for next year.

The glucose monitoring company reported $1.21 billion in revenue for Q3, up 22% year over year, driven by strong demand across the U.S. and international markets. Net income jumped to $242.5 million, or $0.61 per share, its highest ever.

Dexcom also raised its full-year revenue forecast to $4.63-$4.65 billion, representing around 15% growth. However, the company’s upbeat sales weren’t enough to offset concerns about profitability, as it said gross margins will remain near 61%, down about 170 basis points year over year.

Margin Pressure And Outlook

The company acknowledged that elevated scrap rates and freight costs continued to eat into profits. Management said the hit was “roughly half and half” between manufacturing waste and shipping expenses, though both are expected to ease gradually in the coming quarters.

Looking ahead, Dexcom projected double-digit revenue growth in 2026, but slightly below Wall Street’s expectations. The forecast does not yet include potential benefits from broader insurance coverage for type 2 diabetes patients, which the company said could provide upside later on.

Dexcom added that its new 15-day G7 sensor, currently rolling out to users, will have a limited impact this year but should meaningfully boost margins and growth in 2026 once it gains wider reimbursement.

Growth Drivers Remain Intact

Despite the market reaction, Dexcom’s underlying growth story remains strong. The company continues to expand its reach in the type 2 diabetes market, now covering nearly 6 million non-insulin patients in the U.S.

International revenue grew 22%, led by strong momentum in France and Canada following new reimbursement coverage. Its consumer-focused continuous glucose monitor, Stelo, topped $100 million in sales within its first year, with plans to launch in more markets in 2026. Dexcom ended the quarter with over $3.3 billion in cash.

Stocktwits Traders Stay Bullish Despite Selloff

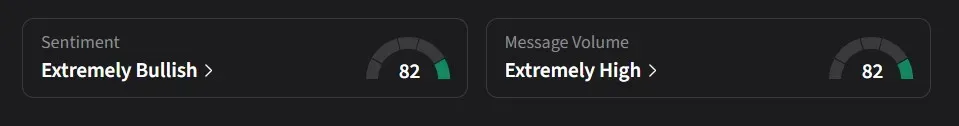

On Stocktwits, retail sentiment for Dexcom was ‘extremely bullish’ amid a 921% surge in 24-hour message volume.

One user said the market reaction reflected disappointment that the company’s longtime executive, now CEO, had signaled that Wall Street’s expectations for 2026 growth were too high, while also acknowledging a slowdown in new patient starts.

Another user said they hoped analysts would issue more bullish reports and raise price targets, describing the selloff as “uncalled for.”

A third user took the opposite stance, calling the pullback a buying opportunity.

Dexcom’s stock has declined 12% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.