Bitcoin Falls Below $110K As Fed Anxiety Grows, On Course To End ‘Uptober’ Streak

The apex cryptocurrency slipped 1.6% to $109,523.97 at the time of writing, while Ethereum stock fell 2.9% to $3,825.17, and BNB fell 2% to $1,095.67.

- According to SoSoValue data, spot Bitcoin ETFs have seen combined outflows of nearly $959 million over the past two days.

- Federal Chair Jerome Powell doused expectations of another rate cut this year on Wednesday.

- Strategy maintained its forecast for Bitcoin prices to hit $150,000 by the end of the year.

Bitcoin and other major cryptocurrencies declined on Friday as investors continued to assess Federal Reserve Chair Jerome Powell’s commentary on interest rates, amid large outflows from exchange-traded funds.

The apex cryptocurrency slipped 1.6% to $109,523.97 at the time of writing, while Ethereum fell 2.9% to $3,825.17, and BNB fell 2% to $1,095.67, according to CoinMarketCap data. Among other tokens, XRP was down 4.3% and Solana was down 5.4%.

According to SoSoValue data, spot Bitcoin ETFs have seen combined outflows of nearly $959 million over the past two days, while Ethereum ETFs have seen outflows of $265 million in the same period. Bitcoin prices were above $114,000 at the beginning of the month, indicating they remain on track for a monthly decline in October, marking the first time since 2018.

Powell’s Hawkish Tone Deals A Blow

The Federal Reserve lowered benchmark interest rates by 25 basis points on Wednesday. However, digital assets and equities declined after Federal Reserve Chair Jerome Powell dampened expectations of another rate cut this year.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it,” Powell said, before adding that there was “a growing chorus now of feeling like maybe this is where we should at least wait a cycle” before the next move.

While digital assets regained some ground earlier this week after U.S. President Donald Trump hailed his meeting with Chinese counterpart Xi Jinping as a success, it appeared that the two sides are still some distance away from a trade deal.

“Too much selling at this point. Retail, whales, and institutions are all selling Bitcoin,” investor Ted Pillows said.

What Is Retail Thinking?

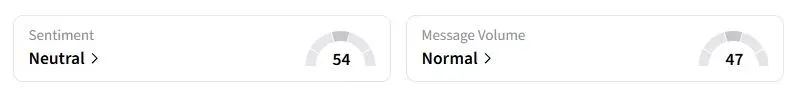

Retail sentiment on Stocktwits about Bitcoin was in the ‘neutral’ territory at the time of writing.

“As supply becomes scarcer, expect more volatility and swings,” one user said.

Strategy Reaffirms $150,000 Year-End Target For Bitcoin

Michael Saylor’s Strategy, which pioneered the concept of Bitcoin treasuries, reiterated its expectations to achieve $80 per share in earnings in 2025 and $34 billion in operating income. Its expectations are based on the fact that Bitcoin will hit $150,000 by the end of the year.

“Over time, our hope is [that] if Bitcoin was to be treated as a true capital on our balance sheet, that we would be considered an investment-grade rated company,” said CEO Phong Le in a call with analysts after noting that the company has already seen U.S. banks and mortgage companies consider using Bitcoin as collateral.

For updates and corrections, email newsroom[at]stocktwits[dot]com.