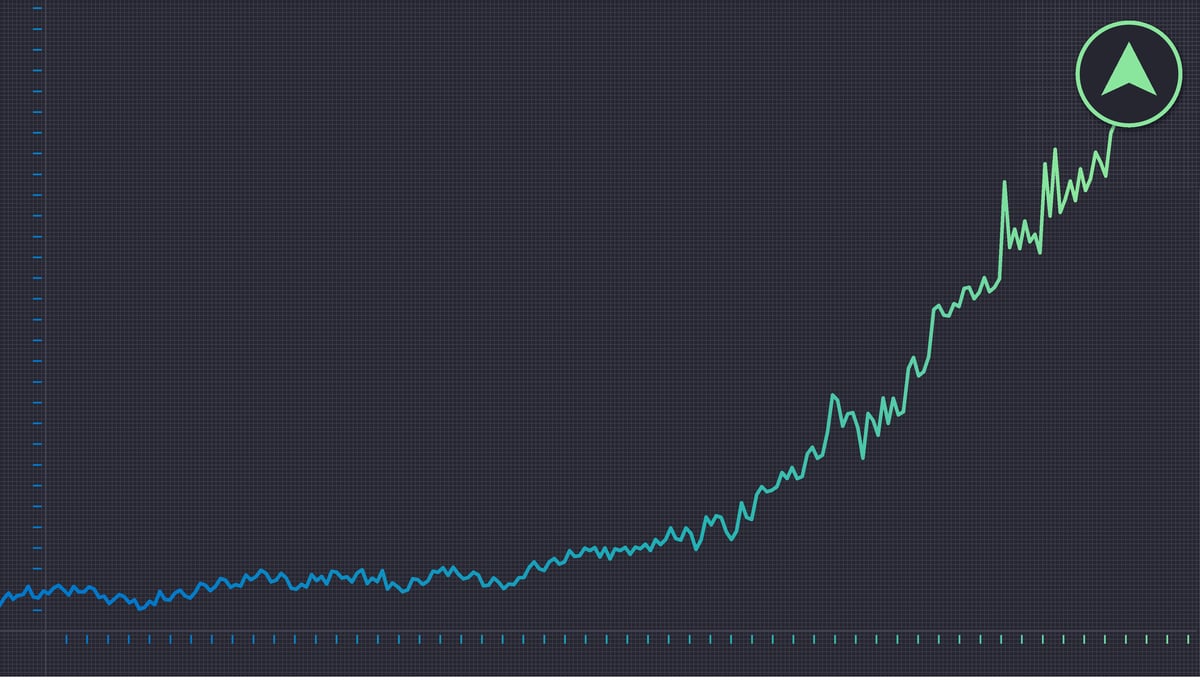

AppLovin (APP 1.82%) has been one of the market’s biggest winners in 2025, with the tech stock up 120% year to date as of this writing. The move comes as the advertising technology company has not only delivered impressive top-line growth but soaring profits.

Why should investors care?

Because the same set of facts can lead to two different conclusions for investors: The business looks meaningfully stronger than it did a year ago, but the price investors are being asked to pay now is much less forgiving.

AppLovin is a classic example of a great business with an unattractive stock.

Image source: Getty Images.

What powered AppLovin’s 2025 run

AppLovin’s growth has been hard to ignore.

The company, which provides software and AI (artificial intelligence) solutions for businesses to reach, monetize, and grow their audiences, saw its third-quarter revenue rise 68% year over year to more than $1.4 billion. And adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rose 79% year over year to $1.12 billion.

Results are even more impressive when looking at AppLovin’s year-to-date quarterly results in aggregate. Trailng-9-month revenue as of Sept. 30 was about $3.8 billion, up 72% year over year. And the company earned over $2.2 billion of net income (up 128% year over year) on these sales. Adjusted EBITDA for the period rose 90% year over year to $3.1 billion.

With this being said, one detail investors should not gloss over is the direction of growth. Third-quarter revenue growth of 68% was still fast, but it was lower than the 77% year-over-year growth AppLovin posted in the second quarter.

Still, the broader takeaway is clear: in 2025, AppLovin has looked less like a niche ad-tech name and more like a scaled platform with unusual profitability.

An unforgiving valuation

When a stock more than doubles, the question is rarely whether the company is doing well. In this case, AppLovin is firing on all cylinders. The harder part is whether the current price leaves any room for error.

With a price-to-sales ratio of about 40 and a price-to-earnings ratio of 50 as of this writing, investors clearly expect strong growth to persist.

While there’s no indication that growth will come down substantially anytime soon, it is worth noting that management expects a further deceleration in Q4. AppLovin guided to revenue of $1.57 billion to $1.60 billion and adjusted EBITDA of $1.29 billion to $1.32 billion. That guidance implies 57% to 60% year-over-year revenue growth — impressive but a marked deceleration from 68% growth in Q3.

AppLovin’s bulls would likely point out that the company’s initiatives to ramp up capabilities for self-service advertisers could help the company keep its growth rates high. But it may take time for these efforts to move the needle.

“We’re already seeing spend from these self-service advertisers grow around roughly 50% week-over-week,” said AppLovin CEO Adam Foroughi in the company’s third-quarter earnings call. Though he also noted that it’s “too soon for this to be significant…” and proceeded to acknowledge that it does show promise for the platform’s potential success in “being an open platform to any type of advertiser.”

Given the stock’s high valuation, investors should proceed carefully. The valuation leaves very little room for error. Adding in the risks facing any advertising platform business, such as how an uncertain macroeconomic environment could reduce advertiser budgets, or how technological changes can impact ad tracking and measurement, narrows the margin for error further.

Even so, there’s a lot to like. AppLovin is executing, and the guidance suggests this momentum will continue. But given the stock’s big run-up, staying on the sidelines and hoping for a better price is probably wise.