Brady Corporation (NYSE:BRC) Stands Out as a Quality Investment Candidate

The Caviar Cruise investment strategy represents a systematic way to find good companies suitable for long-term holding. This method, influenced by Belgian author Luc Kroeze’s writing, concentrates on businesses showing steady revenue and profit increases, high returns on capital put to work, acceptable debt, and good cash flow generation. Investors using this method look for companies with lasting competitive strengths and sound business frameworks that can build value over many years.

BRADY CORPORATION – CL A (NYSE:BRC) appears as a noteworthy candidate when viewed through this quality-oriented perspective. The Milwaukee-based maker of identification solutions and safety products displays several traits that match the Caviar Cruise method’s strict criteria.

Financial Performance and Growth Measures

Brady Corporation shows the kind of steady operational achievement that quality investors look for. The company’s financial numbers reveal a trend of maintainable growth and better profitability:

- EBIT growth of 10.54% CAGR over five years is much higher than the strategy’s 5% minimum level

- Profit quality averaging 93.76% over five years shows very good cash flow generation

- Debt-to-free cash flow ratio of 0.65 shows the company could settle all its debt in under one year

The EBIT growth number is especially notable as it goes beyond the strategy’s need and points to better operational efficiency. This measure, which centers on main business performance before interest and taxes, gives a clearer view of operational improvement than net income, which can be affected by single events or accounting changes.

Return on Invested Capital and Profitability

The company’s very good return on invested capital excluding cash, goodwill, and intangibles (ROICexgc) of 44.52% is well above the strategy’s 15% minimum. This measure is important to the Caviar Cruise method because it assesses how well a company creates returns from its operational assets. A high ROIC indicates lasting competitive strengths and effective capital use, both signs of good businesses.

Brady’s margin results further support its quality traits:

- Operating margin of 16.51% is better than 89% of similar companies

- Profit margin of 12.45% is in the top group within the commercial services sector

- Gross margin of 50.27% shows good pricing ability and cost management

Financial Health and Stability

The company’s balance sheet condition matches the quality investing focus on financial strength. With a debt-to-free cash flow ratio of 0.65, Brady shows very good financial adaptability. This measure, which indicates how many years of present cash flow would be required to pay off all debt, gives important understanding of a company’s capacity to handle economic slowdowns while still investing for growth.

Other financial health signs include:

- Altman-Z score of 6.70 showing very small bankruptcy chance

- Steady share count decrease over several years

- Current ratio of 1.88 giving adequate short-term cash availability

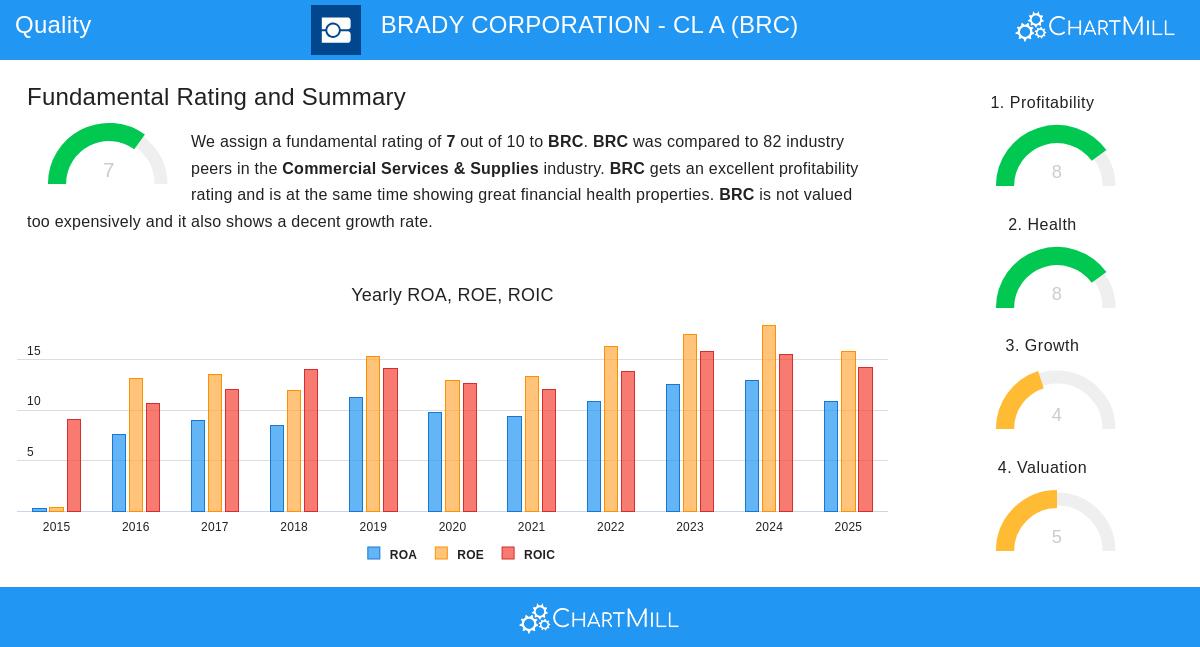

Fundamental Analysis Summary

According to Chartmill’s full evaluation, Brady Corporation gets a 7 out of 10 in fundamental rating, placing it well within the commercial services and supplies industry. The detailed fundamental analysis report points out the company’s very good profitability rating along with strong financial health attributes. While growth rates are called acceptable rather than outstanding, the company’s valuation seems fair considering its quality traits.

The analysis mentions that Brady’s profitability numbers usually do better than similar companies, with special ability in return measures and margin performance. The company’s dividend policy, while not very high, shows dependability with a maintainable payout ratio and a history of regular payments.

Quality Investment Points

Beyond the numerical data, Brady Corporation displays several non-numerical traits that quality investors often want. The company’s focus on safety and identification solutions meets lasting market demands that continue through different economic periods. Its worldwide operations give variety, while the business framework stays fairly simple to grasp, making products that help organizations keep safety compliance and operational effectiveness.

The company’s capability to keep and improve margins indicates pricing ability and competitive benefits in its specific markets. These traits, joined with the numerical strength shown through the Caviar Cruise filters, present a solid case for quality investors looking for lasting businesses for long-term investment portfolios.

For investors wanting to look at more companies that fit the Caviar Cruise quality requirements, the complete screen results offer a wider set of possible investments meeting these strict standards.

Disclaimer: This analysis is for information only and does not form investment guidance, a suggestion, or a backing of any security. Investors should do their own investigation and talk to financial advisors before making investment choices. Past results do not assure future outcomes.