QUALCOMM INC (NASDAQ:QCOM): A High-Quality Dividend Stock with Strong Profitability

In the search for reliable dividend-paying stocks, many investors use systematic screening methods to find companies that offer both attractive income potential and fundamental stability. One effective method involves filtering for securities with strong dividend ratings while keeping minimum standards for profitability and financial condition. This process helps find companies able to maintain their dividend payments through different market environments, balancing yield with business strength and balance sheet soundness.

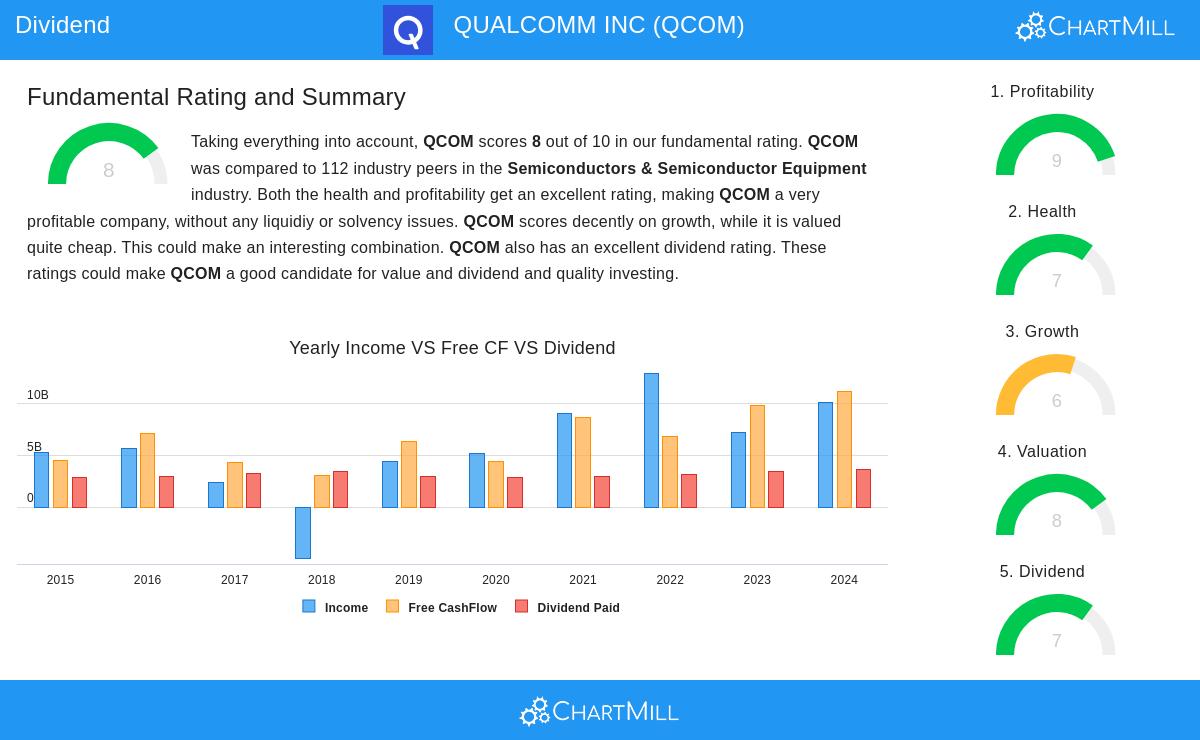

QUALCOMM INC (NASDAQ:QCOM) appears as a notable candidate from this screening process, showing features that dividend investors frequently look for. The semiconductor and wireless technology company gets a ChartMill Dividend Rating of 7, placing it in the group of high-quality dividend-paying stocks while holding excellent profitability and health scores of 9 and 7 in that order.

Dividend Profile Analysis

QUALCOMM’s dividend offering mixes acceptable yield with dependable payment history and manageable payout ratios. The company’s present yearly dividend yield is 2.17%, placing it well compared to both industry competitors and wider market measures. More significantly, the sustainability measures give assurance for income-focused investors.

- Current dividend yield of 2.17% is higher than 91% of semiconductor industry competitors

- Ten-year history of steady dividend payments with no cuts

- Payout ratio of 32.79% shows significant earnings coverage

- Five-year dividend growth rate of 5.69% shows a dedication to raising shareholder returns

The acceptable payout ratio is especially important as it shows QUALCOMM keeps a large part of its earnings for reinvestment while holding enough room for future dividend growth. This mix of giving capital back to shareholders and funding growth projects shows careful capital management.

Profitability and Financial Health

QUALCOMM’s excellent profitability forms the base for its dividend continuity. The company receives a ChartMill Profitability Rating of 9, reflecting superior operational efficiency and earnings ability. Return measures are much better than industry averages, with Return on Assets at 21.10%, Return on Equity at 42.55%, and Return on Invested Capital at 20.40% – each one doing better than about 93% of semiconductor industry competitors.

The company’s financial health rating of 7 shows a sound balance sheet able to handle economic variations. QUALCOMM keeps good liquidity with current and quick ratios of 3.19 and 2.38 in that order, making sure short-term responsibilities can be easily met. While the debt-to-equity ratio of 0.54 seems higher compared to some industry competitors, this is balanced by good free cash flow production that could pay off all existing debt in about 1.27 years.

Valuation Considerations

QUALCOMM shows an appealing valuation profile that might interest value-aware dividend investors. The stock trades at a price-to-earnings ratio of 14.41 and forward P/E of 13.71, representing large discounts to both the S&P 500 averages and the wider semiconductor industry. This valuation situation suggests investors are getting dividend income at acceptable prices relative to earnings ability.

Growth Trajectory

While future growth projections have become more modest from past levels, QUALCOMM still forecasts respectable expansion with EPS growth expected at 8.66% and revenue growth at 5.10% each year. This growth outline, combined with the company’s good market position in wireless technologies and growing Internet of Things applications, gives an acceptable foundation for ongoing dividend growth.

The complete fundamental analysis available through QUALCOMM’s detailed report shows a company with good dividend characteristics backed by excellent profitability and acceptable financial health. These qualities match well with dividend investment approaches looking for companies with sustainable payment abilities.

For investors looking for more dividend stock ideas filtered using similar methods, the Best Dividend Stocks screen gives regularly updated results filtering for high dividend ratings together with minimum profitability and health standards.

Disclaimer: This analysis is based on fundamental data and ratings available at the time of writing and is meant for informational purposes only. It does not form investment advice, and investors should do their own research and think about their personal financial situations before making investment choices. Past performance and current ratings do not ensure future outcomes.