Dorman Products Inc (NASDAQ:DORM) Stands Out as a Peter Lynch-Style GARP Investment

In the field of long-term investing, few methods have shown the lasting performance of Peter Lynch’s system, which centers on finding companies with maintainable growth paths and fair prices. This framework, frequently grouped as Growth at a Reasonable Price (GARP), highlights basic financial soundness and earnings while steering clear of speculative entry and exit points. The method aims at businesses with steady profit growth, solid financial statements, and prices that do not exaggerate future prospects. By using these ideas in an organized filtering process, investors can find companies that merge growth features with value principles.

Evaluating Peter Lynch Criteria

Dorman Products Inc (NASDAQ:DORM) appears as a noteworthy option when assessed using Lynch’s main investment measures. The automotive parts company shows a number of traits that fit the GARP thinking, especially via its measured growth outline and monetary control. The company’s basic financial numbers show a business expanding at a maintainable speed while keeping high operational standards and monetary soundness.

- Maintainable Profit Growth: Dorman’s 5-year EPS growth of 21.83% sits well inside Lynch’s favored 15-30% band, showing steady increase without signs of overheating

- Fair Price: With a PEG ratio of 0.88, the company is valued under Lynch’s limit of 1.0, implying the market has not overvalued its growth outlook

- Cautious Financial Setup: A debt-to-equity ratio of 0.31 is much better than Lynch’s preferred upper limit of 0.6, showing little dependence on debt

- Good Cash Position: The current ratio of 2.74 is much higher than the least needed 1.0, showing very good short-term monetary condition

- High Earnings Ability: A return on equity of 16.14% is above Lynch’s 15% limit, showing effective use of owner money

Basic Financial Condition Review

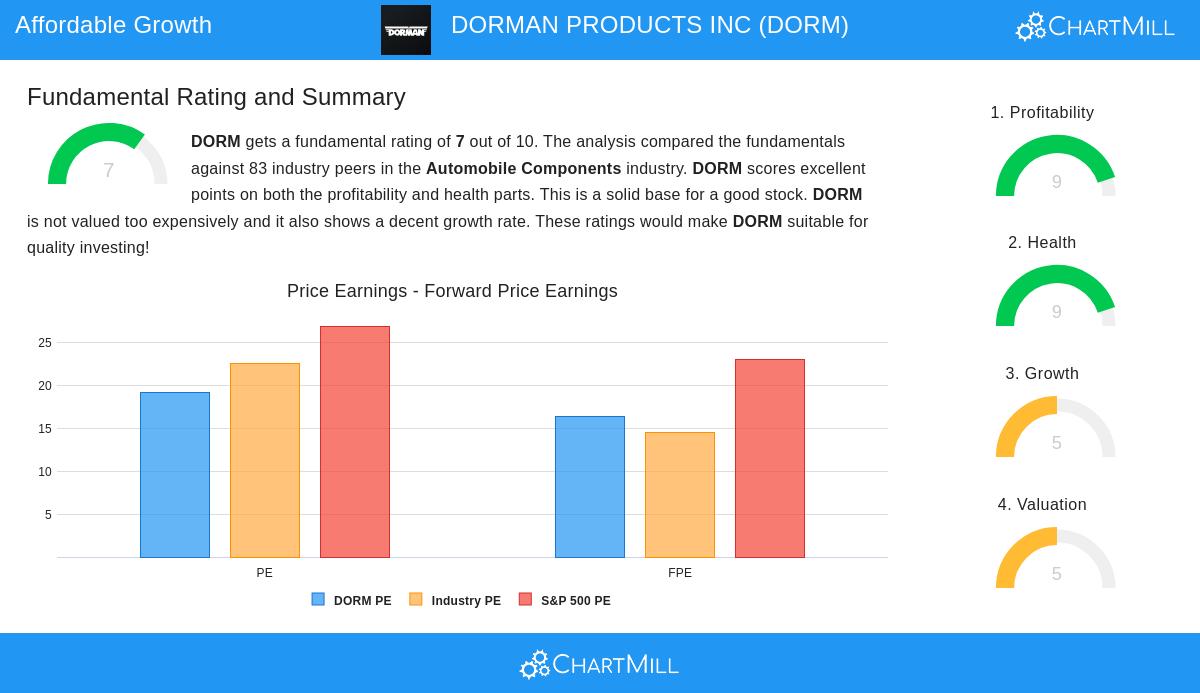

The company’s full basic financial review shows a business working from a point of advantage in several areas. Dorman gets an overall basic financial score of 7 out of 10, putting it much above normal within the rival automobile components field. This review shows especially high performance in earnings and monetary condition, with both groups getting very good scores of 9 out of 10.

Earnings ability is a main advantage, with the company showing better profit margins and returns compared to others in the field. The 10.83% profit margin is higher than 97.59% of rivals, while operating margin of 15.75% beats 98.80% of the industry. Return measures are similarly notable, with ROE of 16.14% and return on invested capital of 12.70% both placed in the top 6% of the sector. Monetary condition signs give more assurance, including an Altman-Z score of 5.15 showing low failure risk and a current ratio of 2.74 showing plenty of cash availability.

View the full basic financial review report for detailed numbers and field comparisons.

Investment Logic and Company Operation

Dorman’s company operation fits well with Lynch’s liking for easy-to-grasp businesses working in needed but possibly missed fields. As a provider of automotive replacement parts for light duty, heavy duty, and specialty vehicle areas, the company meets a stable aftermarket need that is not tied to economic swings or tech changes. This “ordinary but essential” quality often interested Lynch, who saw that such companies could provide steady returns without drawing too much market notice.

The company’s monetary control goes beyond the filtering standards, with other good signs including a record of stock repurchases and getting better debt handling. These points support the main filtering numbers and indicate management’s focus on owner benefits. While future growth estimates show some slowing compared to past results, this actually fits with Lynch’s choice for maintainable rather than sudden expansion that could be hard to keep.

Find Other Investment Options

For investors wanting to use the Peter Lynch system on other possible choices, our often-refreshed filter gives more companies meeting these controlled growth and value standards. The filtering tool allows for more adjustment based on personal study choices and risk comfort.

Review current Peter Lynch filter outcomes and other investment options

Disclaimer: This review is given for information only and does not form investment guidance, suggestion, or backing of any security. Investors should do their own study and talk with a qualified financial consultant before making investment choices. Past results do not ensure future outcomes, and all investments have risk including possible loss of original money.