Pentair PLC (NYSE:PNR) Identified as a Quality Stock by Caviar Cruise Screen

Water solutions provider PENTAIR PLC (NYSE:PNR) has been identified by the Caviar Cruise stock screening method, a systematic process used to find good companies for long-term investment. This strategy, based on the ideas of quality investing, looks for businesses with strong financial traits, including steady revenue and profit increases, good returns on invested money, reasonable debt, and the ability to turn accounting profits into actual cash. The method is founded on the idea that holding good companies for a long time can be a successful strategy, and it uses numerical filters to find such candidates for more study.

Financial Health and Profitability

A main part of the Caviar Cruise screen is to find companies with solid and getting better profitability, which often shows pricing strength and effective management. Pentair’s financial numbers show a good match with this goal. The company’s business performance is marked by high margins and notable returns.

- Operating Margin: 22.33%, doing better than 94.62% of its industry competitors.

- Profit Margin: 15.84%, exceeding 90.77% of the machinery industry.

- Return on Invested Capital (ROIC): 13.90%, a number that puts it with the best in its field and shows effective use of money.

Also, Pentair’s EBIT has increased at a compound annual growth rate (CAGR) of 15.22% over the last five years. This major profit increase, which is much faster than its revenue growth, is a key screen filter as it shows the company is becoming more profitable over time, probably through cost savings or market strengths.

Debt and Cash Flow Analysis

Quality investing focuses on financial strength, looking for companies that are not weighed down by debt and produce strong, good cash flows. The Caviar Cruise method specifically checks the Debt-to-Free Cash Flow ratio to make sure a company can handle its debts without trouble. Pentair does well here, showing a careful financial setup.

- Debt-to-Free Cash Flow: 2.02, showing it would take just over two years of current cash flow to pay off all debt, a sign of good financial health.

- Profit Quality (5y average): 99.67%, indicating that almost all of its reported net income over the past five years has been changed into actual free cash flow.

This very good profit quality score points to established, effective operations that create plenty of cash without having to put all earnings back into the business, leaving room for shareholder payments or strategic purchases.

Return on Capital and Growth Path

The screen puts a lot of focus on Return on Invested Capital (ROIC) as a main sign of a good business. A high ROIC shows that a company can create strong profits from its investments, building value for shareholders. Pentair’s ROIC of 13.90% not only meets the screen’s 15% level for the main number (ROICexgc is figured at 78.17%) but is also well above the industry average. While past revenue growth has been slow, the company has successfully pushed for higher profitability from its sales. Analysts estimate future revenue growth of about 3.56% per year, showing expectations for ongoing, stable increase.

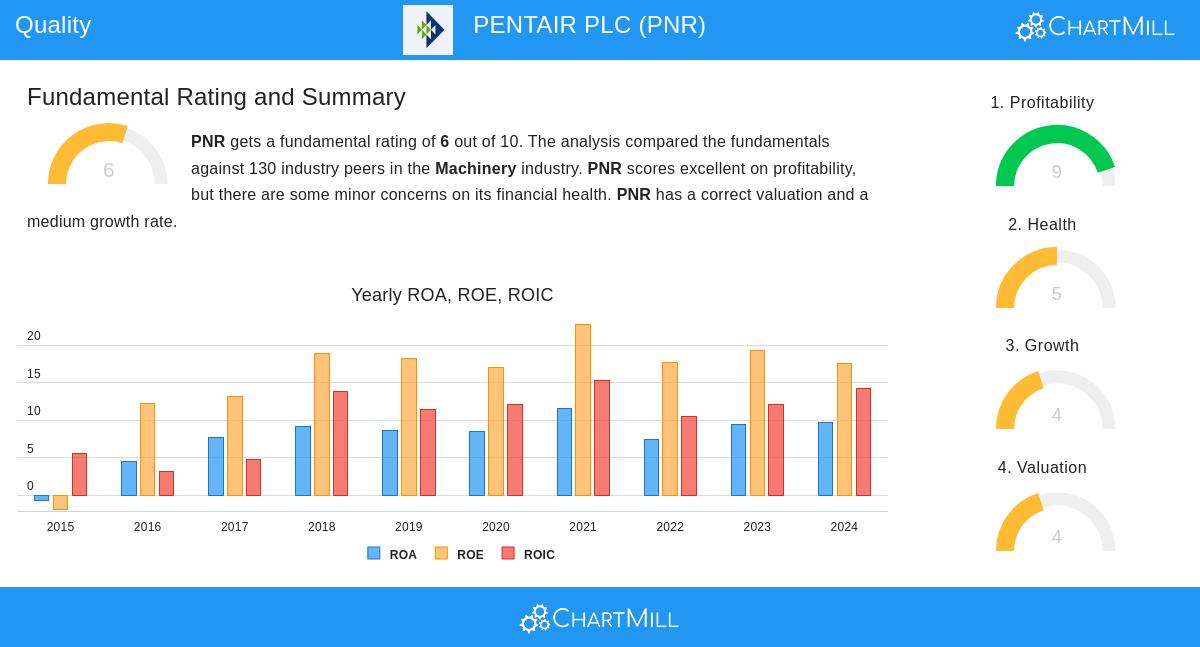

Fundamental Rating Overview

According to Chartmill’s detailed fundamental analysis report for PNR, the stock has an overall rating of 6 out of 10. The report confirms the company’s notable profitability, giving it a high score of 9 in that area, backed by very good margins and returns on capital. Its financial health is rated as medium, with a score of 5, noting good ability to pay debts but some small points about liquidity ratios. Valuation is seen as acceptable with a score of 4, trading at prices generally similar to the wider market and its industry, while growth is rated at 4, showing a solid past record that is thought to slow down soon.

A Candidate for Quality Portfolios

For investors using a quality-focused, buy-and-hold plan, Pentair makes a strong case. It shows the signs the Caviar Cruise screen looks for: high and improving profitability, very good returns on capital, a solid cash flow story, and a workable amount of debt. While its price is not very low, quality investors often accept reasonable prices for better businesses. The company’s focus on necessary water solutions for homes, businesses, and industrial uses also fits with the non-number part of quality investing, which prefers businesses with clear models and connection to long-term, stable trends.

To see other companies that pass the Caviar Cruise quality screen, you can look at the full list of results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.