ADOBE INC (NASDAQ:ADBE) Stands as a Peter Lynch-Style GARP Investment

The investment philosophy created by Peter Lynch has long been a foundation for investors looking for growing companies at sensible prices. His method, explained in his book One Up on Wall Street, stresses fundamental analysis and a long-term buy-and-hold method. The plan centers on finding companies with lasting earnings growth, high profitability, and sound balance sheets, all while trading at prices that do not exaggerate their future potential. This “growth at a reasonable price” (GARP) structure steers clear of the extremes of speculative growth investing by demanding financial discipline and established operational quality.

ADOBE INC (NASDAQ:ADBE) appears as a noteworthy candidate when assessed using Lynch’s particular screening rules. The company, a global technology frontrunner providing digital marketing and media solutions through its Creative Cloud, Document Cloud, and Experience Cloud platforms, shows the kind of clear, widely-used business that Lynch liked. Its products have become essential tools for creative professionals and businesses globally, matching his idea of investing in what you understand.

Earnings Growth and Valuation

A main part of the Lynch method is finding companies with high, but not extreme, earnings growth. He thought growth rates over 30% were frequently not maintainable, while those under 15% might not give sufficient returns. The price must also be sensible compared to that growth, which is calculated by the PEG ratio.

- Maintainable EPS Growth: ADBE’s earnings per share have increased at an average yearly rate of 18.69% over the last five years. This sits directly within Lynch’s preferred span of 15% to 30%, pointing to a strong and possibly maintainable growth path.

- Sensible PEG Ratio: The company’s PEG ratio, which contrasts its Price-to-Earnings ratio to its growth rate, is 0.94. Lynch viewed a PEG ratio of 1.0 or lower as a mark of an appealing price. A number under 1 implies that investors are not paying too much for the company’s growth potential, a main need for a GARP investment.

Financial Health and Profitability

Lynch put a high importance on a company’s financial position, choosing businesses that were not over-burdened with debt and were very profitable. This lowers risk and shows efficient management.

- Controlled Debt Levels: ADBE’s Debt-to-Equity ratio is 0.53. While Lynch had a personal liking for a ratio under 0.25, the screen’s rule permits a more flexible limit below 0.6. ADBE’s level shows a moderate amount of debt that is not seen as too high, and the company’s high cash flow gives a good cushion for its debts.

- Sufficient Short-Term Liquidity: With a Current Ratio of 1.02, ADBE satisfies Lynch’s need for a ratio greater than or equal to 1. This means the company has enough current assets to meet its short-term debts, ensuring operational steadiness.

- Outstanding Profitability: The company’s Return on Equity (ROE) is a notable 59.11%, well above the screen’s 15% minimum. A high ROE is a sign of a good company, showing management’s skill at creating high profits from shareholder equity.

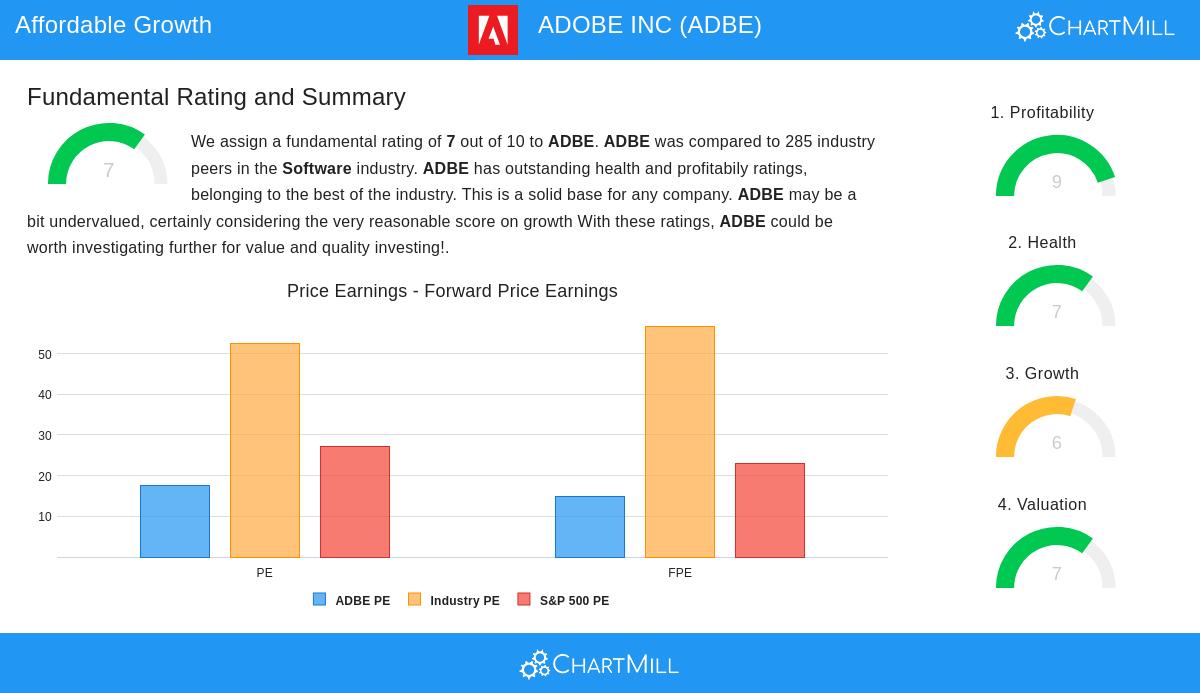

Fundamental Analysis Overview

A wider view of the detailed fundamental report for ADBE supports the results from the Lynch screen. The company gets a good overall fundamental score of 7 out of 10. Its health and profitability grades are excellent, putting it in the group of top performers in the competitive software field. The price is seen as being very inexpensive compared to industry rivals, forming a noteworthy mix of high quality and sensible cost. The report points out exceptional numbers for Return on Invested Capital (34.45%) and operating margins (36.25%), further highlighting the company’s operational effectiveness and market strength. While future growth is predicted to slow a bit from previous highs, it stays firmly positive.

The combination of maintainable historical growth, a sensible price as measured by the PEG ratio, a sound balance sheet, and high profitability makes ADOBE INC a stock that deserves further examination for investors following the Peter Lynch method. It represents the kind of company that can build the base of a long-term, varied portfolio designed to benefit from growth without taking on too much price risk.

For investors wanting to find other companies that match this disciplined plan, you can see all present results using the Peter Lynch Stock Screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. All investment involves risk, and past performance is no guarantee of future results. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.