Viking Therapeutics Stock Powers Toward Best Month Of The Year — Wall Street, Retail Bulls Fired Up On Obesity Drug Promise

Traders on Stocktwits linked Novo Nordisk’s renewed bid for Metsera to competition from Viking’s obesity drug VK2735, fueling further optimism.

- VKTX shares have surged about 45% in October, set for their strongest monthly gain of 2025.

- Traders on Stocktwits linked Novo Nordisk’s renewed bid for Metsera to competition from Viking’s obesity drug VK2735, fueling further optimism.

- Pfizer’s stalled Metsera deal and past struggles with its own obesity program added to speculation that Viking could become a future acquisition target.

Viking Therapeutics shares have climbed nearly 45% in October, putting the stock on track for its best monthly performance of 2025, as investor excitement builds over its experimental obesity treatment and renewed analyst optimism.

Canaccord Starts Coverage With ‘Buy’

Viking shares have rallied amid a slew of bullish analyst calls on Wall Street following quarterly earnings, with the latest coming from Canaccord Genuity’s initiation on Wednesday with a ‘Buy’ rating and $106 price target, representing an upside of 178% from the stock’s last close. The brokerage firm said Viking stands out as a leader in the obesity drug development space, citing its strong Phase 2 efficacy data from August for the oral version of VK2735.

Canaccord expects readouts from Viking’s two Phase 3 trials in 2027 and mid-2028, and believes VK2735 can differentiate on multiple fronts in a crowded obesity drug pipeline.

Pfizer And Novo Nordisk Fuel M&A Speculation

Investor chatter also intensified after Novo Nordisk submitted an unsolicited proposal to acquire Metsera, a company that Pfizer had already agreed to purchase in September.

Metsera has given Pfizer four business days to adjust its offer, fueling speculation among traders on Stocktwits that Pfizer might turn its attention to Viking if its Metsera deal falls through. Pfizer discontinued its own oral weight-loss candidate, Danuglipron, in April 2025, following safety issues, and has been seeking other ways to re-enter the obesity market.

Viking’s Obesity Drug Program

Viking is developing VK2735, a dual agonist of the GLP-1 and GIP receptors, both of which play key roles in regulating glucose, appetite, and body weight. The company is testing subcutaneous and oral versions of the therapy in clinical trials.

Early-stage data have shown positive safety and efficacy signals, reinforcing Wall Street’s belief that Viking could become a meaningful player in the weight-loss drug race dominated by Novo Nordisk and Eli Lilly.

Q3 Earnings And Outlook

Viking Therapeutics reported a net loss of $52.3 million for the third quarter, in line with expectations, as it continues to invest heavily in its obesity and metabolic disease pipeline. Viking said it plans to meet with the U.S. Food and Drug Administration (FDA) by year-end to discuss advancing the oral formulation into late-stage clinical trials.

The company noted that Phase III enrollment for its injectable version of VK2735 remains ahead of schedule, with completion expected in early 2026. A maintenance dosing study is currently underway to assess how best to sustain weight loss over time.

Viking also plans to file an Investigational New Drug (IND) application with the FDA in the first quarter of 2026 for its next program targeting the amylin receptor, a mechanism that could complement GLP-1 and GIP therapies by improving appetite control and weight regulation.

Stocktwits Users See Viking At Center Of Pfizer–Novo Rivalry

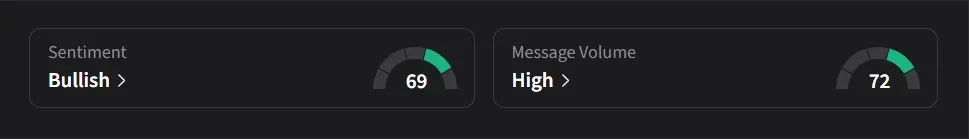

On Stocktwits, retail sentiment for Viking was ‘extremely bullish’ amid a 200% jump in 24-hour message volume.

Some traders speculated that Novo Nordisk’s renewed bid for Metsera may be tied to competitive pressure from Viking’s obesity program. One bullish user suggested Novo’s main interest in Metsera is its early-stage oral GLP-1/GIP agonist, adding that Novo knows Viking’s oral 2735 could be a long-term threat.

Another trader agreed, speculating Novo may have approached Viking before turning to Metsera, but “panicked” once Pfizer entered the picture. The user added that institutional investors may share the same view, noting Viking’s strong price reaction.

Viking’s stock has declined 5% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.