Why Is Coinbase Stock Gaining Premarket Today?

The company reported quarterly revenue of $1.87 billion for the three months ended Sept. 30, while analysts expected it to post revenue of $1.81 billion.

- The cryptocurrency exchange said that its transaction revenue rose to $1 billion, a 37% jump over the previous quarter.

- The company projected fourth-quarter subscription and services revenue to be between $710 million and $790 million.

- The company expanded access to tradable assets from about 300 to over 40,000 in the U.S. in the third quarter.

Coinbase stock gained over 5% in premarket trading on Friday after the cryptocurrency exchange’s third-quarter revenue topped Wall Street’s estimates.

The company reported quarterly revenue of $1.87 billion for the three months ended Sept. 30, while analysts expected it to post revenue of $1.81 billion, according to Fiscal.ai data. Coinbase also reported a net income of $432.6 million, or $1.50 per share, compared with $75.5 million, or 0.28 cents per share, in the year-ago quarter.

What Drove Coinbase’s Earnings?

The cryptocurrency exchange reported that its transaction revenue increased to $1 billion, a 37% rise over the previous quarter, while subscription and services revenue rose 14% to $747 million. Global crypto market spot trading volumes at Coinbase’s platforms were up 38% sequentially, while U.S. crypto market spot volumes were up 29%.

The company benefited from the favorable policy changes adopted by the Trump administration during the quarter, which included a regulatory framework for stablecoins, which are pegged 1:1 with the U.S. dollar. Coinbase holds a stake in the USDC stablecoin issuer, Circle, and is one of the most important platforms for investing in these tokens.

“We are accelerating payments through stablecoin adoption, which we anticipate will continue given policy tailwinds, and ongoing adoption from financial institutions and corporates for payment and treasury needs,” the company said in a statement.

Coinbase earnings also benefited from higher institutional trading volumes following its acquisition of derivatives platform Deribit.

What Is Retail Thinking?

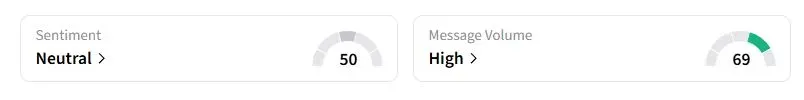

Retail sentiment on Stocktwits about Coinbase was in the ‘neutral’ territory at the time of writing, compared with ‘bearish’ a day ago.

“Bad day to report good earnings. This will rally as soon as Bitcoin resumes its uptrend. I think it’s time to load up,” one user said, noting the impact of the recent weakness in Bitcoin prices.

Another user said that the stock would now run up to over $400.

Coinbase Moves Ahead On ‘Everything Exchange’ Goals At Full Throttle

In the second quarter, Coinbase announced plans to expand beyond digital assets and become a one-stop platform for a range of other instruments, including equities, prediction markets, commodities, and more. The company expanded access to tradable assets from about 300 to over 40,000 in the U.S. in the third quarter.

“So the Everything Exchange is really central to the next chapter of what we’re building, and I’m really excited that we’ll have more to share on that on December 17 at our product showcase,” said CEO Brian Armstorng.

Also See: Bitcoin Falls Below $110K As Fed Anxiety Grows, On Course To End ‘Uptober’ Streak

For updates and corrections, email newsroom[at]stocktwits[dot]com.