Natural Grocers by Vitamin Cottage (NYSE:NGVC) Aligns with GARP Investment Strategy

Natural Grocers by Vitamin Cottage (NYSE:NGVC) operates as a specialty retailer of natural and organic groceries and dietary supplements. Headquartered in Lakewood, Colorado, the company has grown to more than 168 stores in 21 states, using a smaller-store format that offers a clean, convenient shopping environment. Its product selection includes organic produce, Natural Grocers brand items, dry and frozen groceries, meats, dairy, baked goods, and a large assortment of dietary supplements and body care products. The company serves various dietary preferences, including gluten-free, vegetarian, and non-dairy options, placing itself in the increasing health-conscious consumer market.

Investment Strategy Framework

The investment method referenced here uses principles famously stated by Peter Lynch, who supported finding companies with lasting growth, fair valuations, and good financial health for long-term portfolios. This strategy, often called Growth at a Reasonable Price (GARP), focuses on fundamental analysis instead of market timing. It looks for businesses that are increasing steadily but not extremely, are profitable, have acceptable debt, and are valued in a way that does not overvalue future potential. The method stays away from speculative high-growth stocks in favor of those with reliable expansion that can be continued over many years, matching a buy-and-hold philosophy.

Criteria Alignment

Natural Grocers displays several traits that match this disciplined investment method. The company’s financial numbers meet specific levels that show a balance between growth, profitability, and valuation steadiness.

- Sustainable Earnings Growth: The company has reached an EPS growth rate of 28.65% on average over the last five years. This number fits within the strategy’s goal range, being above the minimum 15% level yet below the 30% limit that indicates potentially unstable hyper-growth.

- Fair Valuation Relative to Growth: With a PEG ratio of 0.67, which is notably lower than the goal of 1, the stock seems fairly priced. This ratio shows that the market price is not overestimating the company’s past earnings growth, a main idea of the strategy to prevent overvalued investments.

- Strong Profitability: A Return on Equity (ROE) of 21.56% easily passes the 15% standard. This high ROE shows that management is effectively using shareholder equity to create profits, a central sign of a good business.

- Conservative Financial Structure: The company keeps a Debt-to-Equity ratio of 0.21, which is not only below the 0.6 screen filter but also under the stricter 0.25 level that Lynch himself liked. This low debt lowers financial risk and shows a careful method to funding its operations.

- Acceptable Short-Term Financial Health: A Current Ratio of 1.02 meets the minimum need, indicating the company has sufficient current assets to meet its short-term obligations. While this is a minimal pass, it satisfies the basic financial health check.

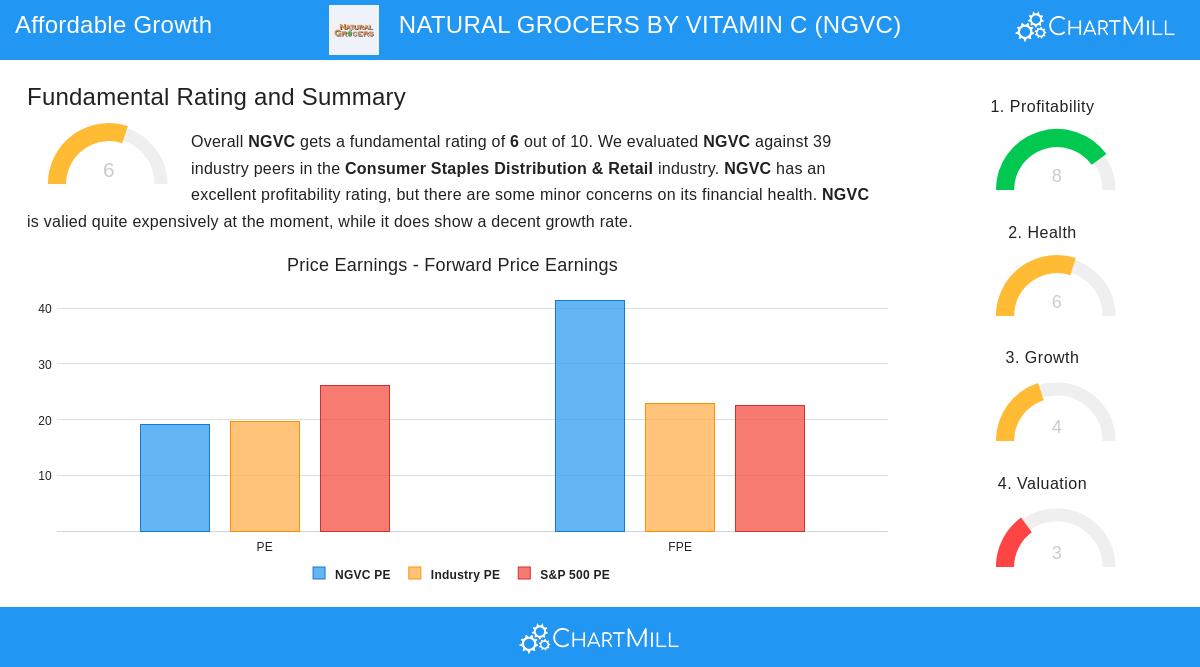

Fundamental Health Overview

A detailed fundamental analysis for Natural Grocers gives it a moderate total rating. The company’s main strength is in its profitability, where it rates highly because of very good profit margins and strong returns on equity and invested capital. Its financial health is acceptable, helped by a very small debt amount and good solvency numbers, though it displays some weakness in short-term liquidity measures. The main issue is its valuation; while some numbers like Enterprise Value to EBITDA seem fair, its Price-to-Earnings and Forward P/E ratios are viewed as high relative to the market and its own past context. The company also shows good past growth in earnings and revenue but has no available analyst estimates for future performance, making forward-looking estimates more difficult.

Suitability for GARP Investors

For investors looking for growth at a fair price, Natural Grocers offers a strong case based on the Lynch-inspired criteria. The company’s good past earnings growth, high profitability, and conservative balance sheet are the exact basic qualities this strategy looks for. The low PEG ratio is especially important, as it gives a numerical reason for the current stock price by connecting it directly to the company’s established growth path. While the P/E ratio alone might indicate a high valuation, the PEG ratio puts it in perspective, showing that investors are not paying a too high price for that growth. The company’s business model, focusing on the stable, non-discretionary natural grocery sector, also fits with the idea of investing in understandable, “ordinary” industries that have steady consumer demand.

Discover More Investment Ideas

The screen that found Natural Grocers is one part of a methodical way to find possible long-term investments. For investors wanting to see other companies that currently pass these same strict filters, the complete list of results is available using the Peter Lynch Strategy stock screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.