Victory Capital Holding – A (NASDAQ:VCTR) Presents a Compelling Case for Value Investors

The search for undervalued companies with sound basic business foundations is a key part of value investing. This method involves finding stocks trading for less than their real value, often using numerical measures to check financial condition, earnings ability, and growth potential. A systematic method requires that a company is not just inexpensive on the surface but also shows the financial durability and profit capacity to support a better price over a long period. Filtering for stocks with good valuation numbers together with firm scores for condition, earnings, and growth can help find these possible chances.

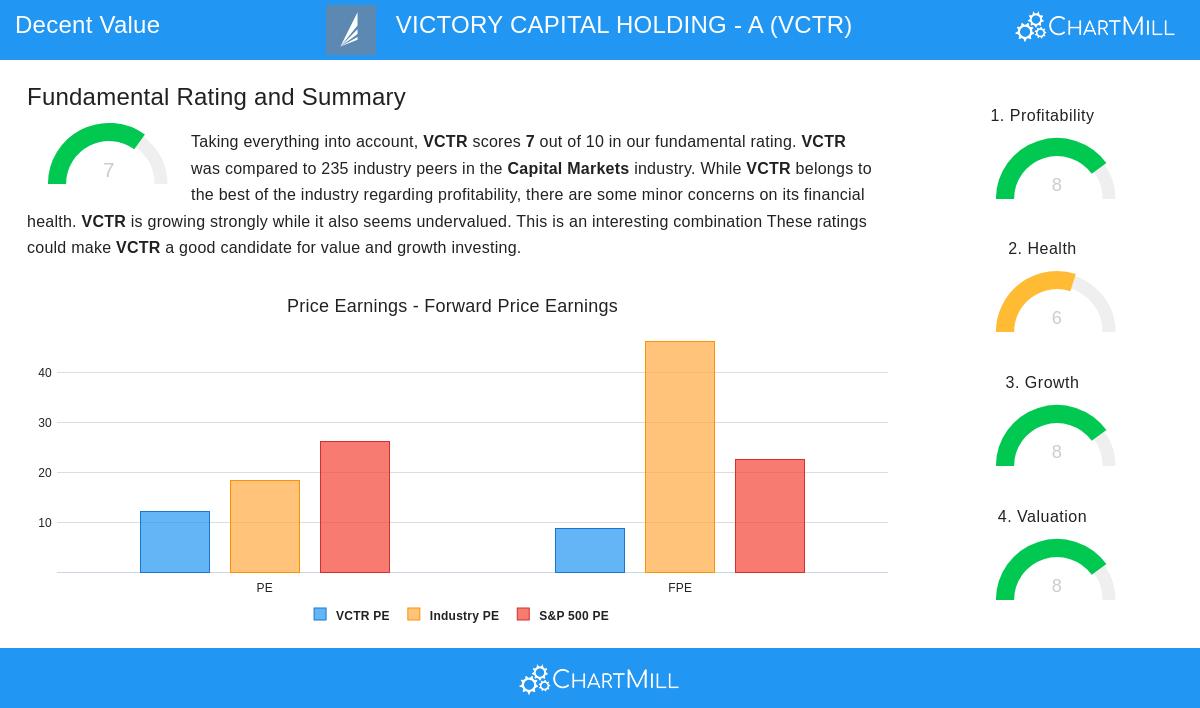

Victory Capital Holding – A (NASDAQ:VCTR) presents a strong case for this kind of review. The company, a provider of specialized investment strategies, gets an overall basic rating of 7 out of 10, putting it in a good position compared to others in its field. Its profile indicates it may be a candidate that fits with the ideas of value investing, where the aim is to find good businesses available at a sensible price.

Valuation Measures

A main idea of value investing is buying assets for less than their actual value. Victory Capital’s valuation numbers indicate it is priced well next to both the wider market and its direct rivals. For value investors, these numbers represent a possible safety buffer.

- Price-to-Earnings (P/E) Ratio: VCTR’s P/E ratio of 12.04 is much lower than the S&P 500 average of 26.19, showing a more inexpensive price. It is also more appealing than 60% of its industry counterparts.

- Forward P/E Ratio: The forward P/E of 8.82 further supports its value, being less expensive than 78% of the industry and notably under the S&P 500 average.

- Enterprise Value to EBITDA: Using this measure, VCTR is valued more cheaply than 87% of the companies in its field.

- PEG Ratio: The stock’s low PEG ratio, which includes earnings growth, suggests its current price may not completely account for its future growth path.

Financial Condition

A company’s financial condition is important for value investors, as it shows stability during economic declines and the ability to pay for future activities without too much risk. Victory Capital shows a firm, though not outstanding, financial standing.

- Solvency: The company shows good solvency with a Debt-to-Equity ratio of 0.39, indicating low use of debt funding and doing better than 68% of its industry. Its Debt-to-Free-Cash-Flow ratio of 3.67 is also good, suggesting it could repay its debt in a practical time.

- Liquidity: With Current and Quick Ratios both at 1.14, VCTR should have no big problems meeting immediate bills, placing it in the average range for its industry.

- Altman-Z Score: The score of 2.33 puts the company in a steady, though careful, area for bankruptcy risk, and it is still higher than 70% of its peers.

Earnings Ability

Steady earnings ability is a main sign of a good business and a force behind real value. Victory Capital does very well in this part, which helps support a better price as time passes.

- Margins: The company has strong margins, with an Operating Margin of 46.16% (higher than 80% of peers) and a Gross Margin of 83.35% (higher than 89% of peers). Both have gotten better in recent years.

- Returns on Capital: VCTR produces good returns, with a Return on Invested Capital of 9.26%, doing better than 84% of the industry. Its Return on Equity and Return on Assets are also above the industry midpoint.

Growth Path

For a value investment to reach its potential, the company must show growth that can drive a new price for its stock. Victory Capital displays positive growth patterns.

- Past Performance: In the last year, Revenue increased by a firm 20.90%, while Earnings Per Share went up by 15.51%. The 5-year average EPS growth is a good 12.55%.

- Future Expectations: Analysts predict a speed-up, with EPS expected to grow 16.54% each year and Revenue predicted to grow over 21% per year. This quickening growth pattern is a good sign for future cash generation and real value.

The mix of a good price, firm financial condition, high earnings ability, and a quickening growth pattern makes Victory Capital Holding – A a stock worth more study for value-focused portfolios. Its basic report gives a full breakdown of these positive points. For investors looking for more chances that match this description, the Decent Value Stocks screen can be used to find other companies with good valuation numbers and acceptable basics.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.