Royal Gold Inc (NASDAQ:RGLD): A Prime Candidate for Growth at a Reasonable Price (GARP)

Investors looking for companies with good growth potential at fair prices often use an “Affordable Growth” or “Growth at a Reasonable Price” (GARP) method. This method tries to find businesses that are growing quickly but are not valued too highly, aiming to capture upside while limiting valuation risk. A main part of this method involves searching for stocks that show good growth traits, solid basic profitability, sound finances, and a price that does not seem too high. Royal Gold Inc (NASDAQ:RGLD) recently appeared from this type of search, leading to a more detailed examination of its fundamental qualities.

Growth Path

A main need for an affordable growth stock is a shown ability to grow, and Royal Gold’s results here are strong. The company’s growth score of 8 out of 10 is backed by good historical and expected operational gains.

- Earnings Per Share (EPS) increased by a notable 65.89% over the last year, with an average yearly growth rate of 29.76% over recent years.

- Revenue has also shown good growth, rising 30.15% in the last year and keeping an 11.20% average yearly growth rate over a longer time.

- Looking ahead, Revenue is expected to grow by an average of 21.28% each year, showing the company’s growth narrative is not finished, even as short-term EPS growth is expected to slow.

This steady and good growth is necessary for a GARP method, as it supplies the basic “growth” engine that investors want to benefit from.

Valuation Check

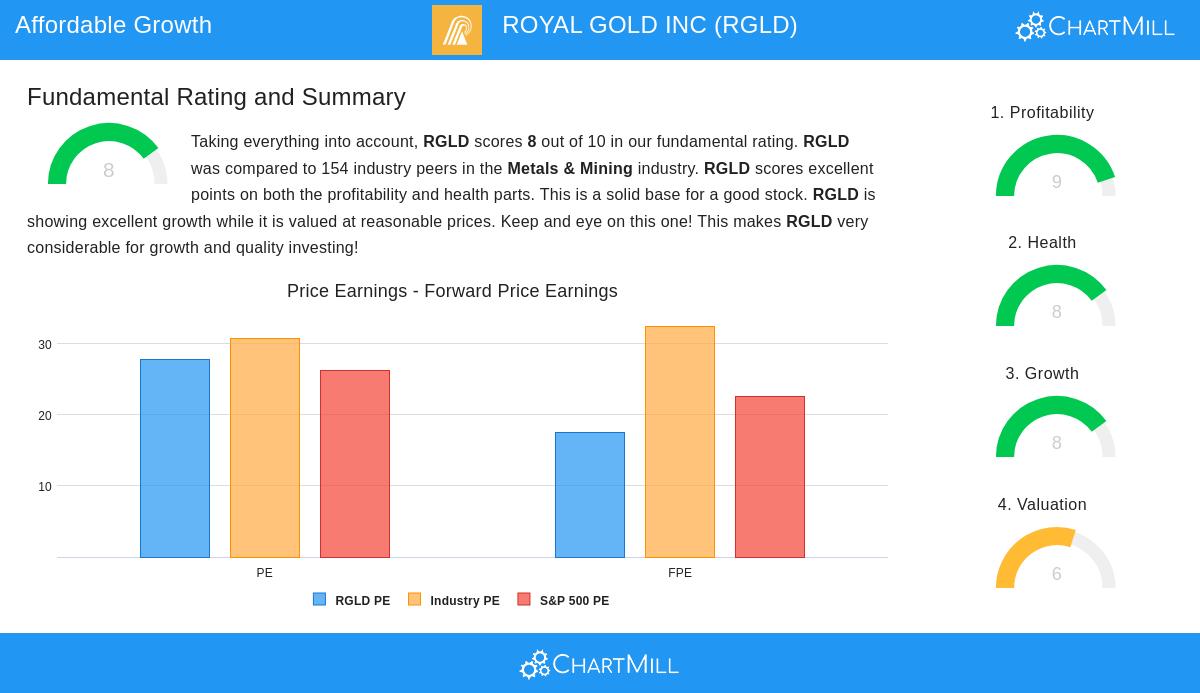

The “affordable” or “reasonable price” part is important to avoid paying too much for growth. Royal Gold’s valuation score of 6 indicates it is fairly placed in its market, showing a possible chance relative to its growth outlook.

- The stock’s Price/Earnings (P/E) ratio of 27.70 is about the same as the wider S&P 500 index and is valued lower than most of its industry counterparts.

- More importantly, its Price/Forward Earnings ratio of 17.55 is lower than the current S&P 500 average, hinting the market may not be completely valuing its future earnings potential.

- The low PEG ratio, which changes the P/E ratio for growth, shows the company’s price seems rather low when its growth path is considered.

For investors, this valuation picture means they are not required to pay a large extra amount for Royal Gold’s better-than-average growth, which fits well with the main idea of looking for growth at a fair price.

Profitability and Financial Condition

A good growth and valuation narrative must be built on a stable base, which is where profitability and financial condition are important. These elements lower investment risk and indicate the company’s growth can continue. Royal Gold does very well here, with a profitability score of 9 and a condition score of 8.

The company’s profitability is excellent, with margins that are some of the best in its field. Its Profit Margin of 56.22% and Operating Margin of 64.70% do better than over 98% of industry rivals. Also, returns on assets, equity, and invested capital are all much higher than industry averages, showing very efficient use of money.

From a financial condition view, the company is on very firm footing. A key point is that Royal Gold has no debt, removing interest cost and default worry. This is supported by good liquidity, with a Current Ratio of 4.49, showing more than sufficient short-term assets to meet its needs. An Altman-Z score of 27.67 clearly shows no bankruptcy concern.

These high scores in condition and profitability give the safety element that makes the growth and valuation story more believable and less risky for investors using a structured GARP method.

A more detailed breakdown of these fundamental numbers is available in the full fundamental analysis report for Royal Gold.

Summary

Royal Gold presents a strong case for review within an affordable growth structure. The company combines a good, proven growth history in both earnings and revenue with a price that seems fair, particularly when considered alongside its future earnings and growth rate. This appealing mix is further supported by first-class profitability and a very strong balance sheet with no debt, which supports the lasting nature of its business model. While the dividend payment is small, the company’s main attraction is in its growth and quality features.

This review of Royal Gold was found using a particular filtering method. Investors wanting to find other companies that match similar standards of good growth, fair price, and sound basics can see more results through this Affordable Growth stock screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The content should not be relied upon for making investment decisions. All investments involve risk, including the possible loss of capital. Always conduct your own research and consider your individual circumstances before investing.